October 20, 2014

Lower oil prices are triggering supply adjustments

Commentary by Alessandro Gelli, Commodity Analyst

“As prices drop, the higher-cost producers [of US tight oil] are going to slow their drilling activity. We may see slower production growth at current prices.”

James Williams, WTRG Economics, October 15th, 2014 — WTI Spot price at $81.8 a barrel

Oil producers are under pressure. Lower oil prices are threatening the economic viability of new projects. This could have an impact over global supply growth in the coming years. On the other hand, the supply side of the oil market could adjust in the short run due to OPEC and US tight oil fields, which will prevent oil prices from falling significantly from current low levels.

The recent reduction in oil prices have reduced oil producing companies’ margins further, which were already at a low level due to elevated costs. Net profit margins at the largest integrated oil companies fell last year to 5.7%, the lowest level since 1998 and below the 1998-2013 average of 8.0%. Several international oil companies have already announced at the end of 2013 and in early 2014 plans to postpone or cancel some projects when oil prices stood above $100 per barrel. In September 2013, BP cancelled its plans to build a $10bn extension to its Mad Dog oil field in the Gulf of Mexico. In November 2013, Chevron announced that the development of its North Sea Rosebank project, estimated at $8bn, was not currently economically attractive. In September 2014, Statoil decided to postpone the development of an oil-sands project in Canada, due to high costs and shipping bottlenecks, following Total's announcement in May 2014 to put its Joslyn North project in Alberta on hold. The recent decline in oil prices should discourage further investments in the most expensive projects, located in Canada, Brazil, the North Sea and Angola. Investments in these high-cost countries were encouraged by the rise in oil prices since 2001 and resource nationalism in low-cost countries. Countries with easily available oil have an important supply growth potential, which cannot be developed due to investment restrictions towards international oil companies.

While low oil prices could delay investments and negatively affect oil supply growth in the coming years, it may have a limited impact on the short run over global oil supply growth as these projects would only be operational in 3 to 8 years. In commodity markets, supply — and often demand — is typically inelastic to prices in the short term. These announcements hence reflect a more negative investment environment, but failed to have an impact on the current supply/demand balance. However, historically OPEC — and especially Saudi Arabia — acted like a central bank, balancing the oil market in the short term by adjusting its production level. At the end of 2008, OPEC reduced its crude oil production target by 4.2 million b/d in response to the global recession and the sharp downward move in oil prices. Strategic Petroleum Reserves (SPR) are also used to ease market conditions in case of a major supply disruption, like during the 2011 Libyan civil war. However, the SPR can only be used to prevent prices from spiking. Chinese purchase of crude oil for its own SPR — which are typically occurring when prices are low as suggested by the recent surge in the number of large oil tankers sailing to China — may not be sufficient to balance the oil market this time. A reduction in OPEC production is therefore necessary. That’s why Saudi Arabia is increasing pressure on other OPEC members ahead of the next OPEC meeting on November 27th in order to coordinate a cut in output.

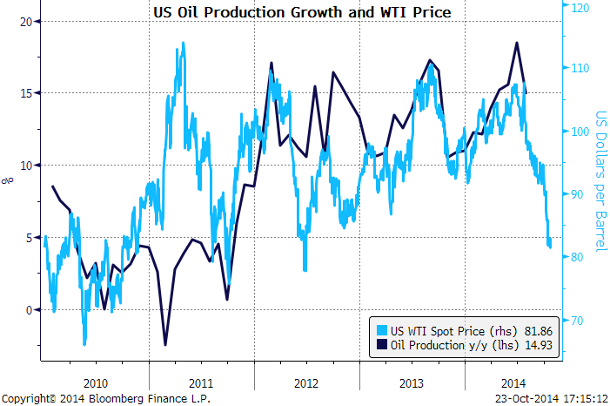

Nonetheless, OPEC is not the only mechanism, which can stabilise the oil market in the short run. US tight oil wells may indeed contribute to prevent further downside move in oil prices in the coming weeks. The rapid growth in US oil output contributed to this year’s decline in oil prices. Between January and July 2014, US oil production (crude oil and NGLs) rose by 1.4 million b/d y/y, twice as big as the global oil demand growth estimate by the International Energy Agency (IEA) — but the IEA may have underestimated the Chinese economic recovery which we expect to occur in the last part of the year. US oil prices are close to the median cost in key plays (Eagle Ford, Bakken) at $75 per barrel — but below the marginal cost of tight oil plays estimated at $90 per barrel. Because of the high decline rate of such fields — up to 60% in the first year, new wells must therefore be constantly drilled to replace falling output. Lower oil prices could therefore rapidly discourage drilling and then negatively affect supply growth; tight oil production is significantly more price-elastic than conventional crude oil. This is why US oil production started to follow WTI price more closely since 2011 as tight oil became an important share of US oil supply (see chart of the week).

WTI prices close to $80 a barrel could therefore soon lead to lower drilling activity. It then can be only a matter of months before oil production growth starts to weaken. The combination of a cut in OPEC production and weaker oil production growth from the US, while Chinese oil demand is likely to grow at a more rapid pace could lead to a tighter supply/demand balance next year. Developments in this direction could trigger a short-covering rally as prices clearly reached oversold conditions at current levels, reflected by the large amount of short positions on oil futures and the extremely weak positive sentiment, which fell to the lowest level since 2008.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Political and social impact of lower oil prices

Oil prices fell sharply these past few weeks due to increasing fears of a price war between OPEC members and the significant reduction of this year’s global oil demand growth estimate by the International Energy Agency to 650’000 b/d, down 250’000 b/d from the previous estimate. These negative factors also occurred when the oil market is seasonally weak due to the refining maintenance season and weak demand for petroleum products, amplifying the downward move in prices.

Brent price dwindled to the lowest level since the end of 2010, this has an important impact on the political situation and social conditions of several oil exporting countries which are heavily reliant on oil income. While Kuwait and Qatar require a price at around $60 to meet their budget needs, all the other OPEC members need a price above $90 per barrel. Lower oil prices may have a limited impact on Gulf monarchies due to massive cash reserves built during the past few years despite increasing military and social expenses — which helped these countries to avoid and Arab Spring within.

However, lower oil prices could soon start to have a major impact on countries that are most dependent on oil income and have little cash reserves. Venezuela for instance, which requires an oil barrel at about $120 to balance its budget, may soon be forced to reduce social expenditures such as subsidies on petroleum products prices — a gallon of gasoline cost about 6 cents. The fall in oil income is occurring in an already difficult period as the country is facing an economic slow down, high inflation and currency restrictions that have led to crucial shortages in retail products. In turn, reduced social expenditures could trigger critical social unrest. Previous fuel price hikes in Venezuela triggered riots. Moreover, the Maduro government may have limited scope to manoeuvre due to the parliamentary elections at the end of 2015. Nigeria, Algeria, Angola and Iran, all of which also need elevated oil prices to balance their budgets, could also face social unrest. Domestic concerns may encourage these countries to side with Saudi Arabia during the next OPEC meeting in November by agreeing on a common reduction in crude oil production in order to restore oil prices to more comfortable price level.

Copper underperformance within base metals is over

Copper has been one of the worst performers among the base metals sector since the financial probe on metals inventories used as financial collateral in China in June 2014. This contributed to reduced Chinese imports of copper and the underperformance of copper prices relative to other base metals. Chinese copper imports fell from 450’000 metric tonnes in April 2014 to 335’000 metric tonnes in August 2014, the lowest level since April 2013. Between July and September 2014, LME copper price fell by 5.0%, underperforming aluminium, zinc and lead prices — only nickel and tin prices underperformed copper prices. However, copper fundamentals are improving, which could mark the end of the copper underperformance.

Copper premiums have slightly increased in the US and in Europe. In Shanghai, copper premiums are stable since the end of September and still up by 10.6% from August lows, following the slight decline in mid-September. The backwardation in copper also increased and at the beginning of last week reached the highest level since May 2014, implying a tighter supply/demand balance.

Moreover, the price spread between the SHFE and the LME has recently increased to the highest level since the end of June 2014. This should boost Chinese copper imports, which already increased last month. In September 2014, Chinese copper imports rebounded to 390’000 metric tonnes, up 16.1% m/m. Copper price may also benefit from the acceleration of the Chinese economy which we expect but is underestimated by the market.

The end of the sugar bear market?

Following four years of surplus, the sugar market could move into a deficit during the 2014/15 season according to Platts. Sugar prices indeed declined from $35 per pound in February 2011, the highest level since 1980, to $13.5 per pound in mid-September 2014, the lowest level since April 2009. This 61.8% decline in price may be over. More supportive fundamentals have already allowed a recovery in price by 23.5% since the third week of September to $16.7 per pound.

Rising demand for sugar and lower production in Brazil, the world’s largest producer, should contribute to the deficit. Sugar production in Brazil’s Centre South region, which accounts for 90% of the Brazilian sugar output, is expected to decline due to the worst drought in decades in early 2014, which also negatively affected coffee production. Low sugar prices also discouraged output mills to process sugar cane. According to Unica, Brazil’s sugar-cane-industry association, the crop at Centre South region is likely to reach 545.9 million metric tonnes this year down from 597.1 million metric tonnes last year. Since 2009, 44 sugar mills have closed in Brazil as current prices at 16.5 cents a pound are below production cost estimated at 21.0 cents a pound.

The likely decline in Brazilian sugar production could be mitigated by stronger supply in Thailand, which is the world’s fifth largest sugar producer. However, this may not be sufficient to weaken sugar prices, which are showing signs of oversold conditions, with short speculative positions close to the record high levels made in June 2013. Net long speculative positions are also at low levels, while the positive sentiment on sugar reached in mid-September 2014 the same level since June 2012; 17% of surveyed fund managers only had a bullish view on sugar prices, which was the lowest level since October 2001, when sugar prices fell to 6.2 cents a pound. Current prices below the cost of production and the likely deficit next year may prevent further downside move and on the other hand marks the end of the bear market which started in 2011.

Chart of the week: US oil production growth is following oil prices more closely

|

US tight oil has contributed to a significant increase in US crude oil production, which rose from 5.6 million b/d in 2011 to 7.4 million b/d in 2013 and 8.8 million b/d at the end of September 2014. The fact that tight oil supply is significantly more price-elastic than conventional crude oil, and the growing share of tight oil over total US crude oil production, both, have increased the short term sensitivity of US oil production growth towards US oil price, especially since the end of 2011 as implied by the chart below. The major downward move in oil prices is therefore suggesting that US oil production growth could weaken in the coming months. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com