October 13, 2014

Grain prices could soon stabilise

Commentary by Alessandro Gelli, Commodity Analyst

“Farmers like Pat Solon, who grows corn and soybeans on a 1,500-acre Illinois farm, […] say corn would need to rise to at least $4.25 a bushel from below $3.50 now for growers to feel confident enough to start buying new equipment again. As recently as 2012, corn fetched $8 a bushel.”

James B. Kelleher, As U.S. farm cycle turns, tractor makers may suffer longer than farmers, Reuters, September 16th 2014,

This year’s bumper crop was not very welcomed by farmers. They are indeed not benefiting from the increase in output due to the significant slide in grain prices -- the DCI® Grains Index is down by about 29% since its April high. According to the USDA, US farm income should fall this year to $113 billion down 13.8% y/y from a record high income reached last year. This year’s income would also be the lowest since 2010.

The sharp downward move in grain prices was triggered by improving crop conditions for wheat, corn and soybean, and a significant US Dollar upward move, which was the most important rise over a 3-month period since June 2010. The DCI® Grains Index is now down 36% since August 2012. However, grain prices — as well as sentiment — are reaching extremely low levels, which should trigger a physical response, especially from the supply side. This could prevent further significant downside in grain prices.

Global wheat and coarse grain production (wheat, corn, barley, oats and sorghum) for 2014/15 is expected to reach 1.98 billion metric tonnes, an upward revision of 8 million metric tonnes, and only 10 million metric tonnes lower than last year’s record. According to the USDA, global corn ending stocks could reach 189.9 million metric tonnes, the largest level since 2000, while global soybean stocks could experience their greatest year-on-year increase on record. Moreover, the current corn and soybean harvest in the US could lead to further downside pressure as concerns are rising as to whether North American storage capacity would be sufficient for the crop. These elements have contributed to the recent weakness in grain prices, which have fallen to low levels, especially relative to other commodities. Corn prices, for instance, fell in gold terms to the lowest level since at least 1975.

The sentiment on grains has deteriorated sharply. At the end of September 2014, the share of positive sentiment on soybean and on wheat fell to 20%, the lowest level since 1998 for soybean and since 2009 for wheat. On corn, the positive sentiment declined to 19%, the lowest level since 2004. Net long speculative positions — classified as Managed Money by the CFTC — have indeed fallen on corn and soybean by 79% and 84% respectively since early April 2014. In September 2014, the amount of short positions on soybean reached the highest level since at least 2006. On wheat, speculative positions became net short and reached on the third week of September the lowest level since at least 2006. These levels are implying that the grain markets are experiencing important oversold conditions.

The large decline in grain prices not only negatively affected investors’ sentiment but also that of producers. This is suggesting significantly reduced planting for some crops next year. Because of the price-inelasticity of supply in the short run, demand can outpace — or lag — supply during a certain time. Commodities have different cycle length. It could indeed take up to 10 years to build a new mine, 3 to 8 years to develop a giant oilfield, 3 to 5 years for a coffee tree to produce beans. But commodities with the shortest supply response are grains as it takes only between 6 months to one year to grow a crop of wheat, corn or soybeans. On the other hand, demand for grains is relatively inelastic to prices in the short run.

In the US, low corn prices, which dwindled below farm’s cash-cost –- estimated at $3.75 per bushel –- are expected to lead to a reduction in the planted area to 37.1 million hectares, down 4% y/y and at the lowest level since the 2010/11 season. The corn planted area has already declined last year by 2%, due to elevated soybean prices which encouraged to plant soybeans at the expense of corn. The soybean planted area is also likely to decline during the next season. Lower wheat prices could contribute to a rebound in demand, which declined last season due to elevated prices relative to other substitutes. Moreover, elevated yields estimate for grains may soon lead to disappointments. Indeed, when weather is good, farmers tend to exaggerate yields as they do not want to admit that they did not manage their farm as well as other farmers. We also expect the US dollar to weaken by year-end due to increasing scare around global growth, which could further delay the reduction in liquidity by the US Fed. Indeed, Fed Vice Chairman Fischer has said at the IMF’s annual meeting on October 11th 2014: “And if foreign growth is weaker than anticipated, the consequences for the U.S. economy could lead the Fed to remove accommodation more slowly than otherwise.” The change in Fed’s stance could therefore lead to a lower US Dollar and add upside pressure on grain prices. These factors and the extremely negative sentiment on grains, may allow a stabilisation in grain prices.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Surprising OPEC price cuts are increasing fears of a price war

Last week, Saudi Arabia and Iran announced a cut in their official selling prices (OSP) without consulting with the other OPEC members. On Monday, Iraq followed, resulting in a negative impact on international oil prices as it occurred at the peak of the refining maintenance season when crude oil demand is typically low. Moreover, the IMF revised lower global economic growth, implying weaker oil demand growth. The cuts in OSPs also contrasted with Saudi Arabia’s reduction in oil output in August by 400’000 b/d, which was widely seen as the Kingdom’s will to prevent a sharp decline in oil prices. The cut in OSPs is implying that these OPEC members may prefer to maintain market share and risk a price war instead of cutting output to prevent a slide in oil prices.

Nonetheless, while these cuts in OSPs may have been negatively interpreted, this does not mean that OPEC crude oil exports may not decline further in the near future. In fact, OPEC could still reduce production. According to UBS, past cuts in OSPs have been followed by a decrease in oil production, which could hence occur in the coming months, while global crude demand should gradually increase as global refining activity rises seasonally.

Moreover, the Saudi price cut should add increasing pressure on the other Gulf countries, which have benefited greatly these past few years of unilateral production cuts from Saudi Arabia, while they were pumping as much oil as possible. Riyadh may want to remind other OPEC members ahead of the next OPEC meeting in November that it has a lower need for elevated oil prices than them. This could then result in a more concerted production cut from OPEC, especially from the Gulf countries — contrasting with previous unilateral cuts made by Saudi Arabia. This would also imply that Saudi’s measure — to cut OSPs — was made to restore order within the organisation rather than to start a price war, which can only be won by Saudi Arabia.

Iron ore price weakness is not over

Since the beginning of the year, Chinese iron ore prices have fallen by 40% to about $80 per metric tonne, the lowest level since 2009. This was an important downward move and followed a decline which started in early 2011 when the price of Chinese iron ore peaked at $190 per metric tonne. However, the decline in the price of iron ore may not be over.

Vale, Rio Tinto and BHP, which are accounting for 60% of global iron ore’s trade, are currently boosting output in order to squeeze high costs producers. On the other hand, Chinese iron ore producers, which require an elevated iron ore price to be profitable, are likely to suffer the most from a possible further downside move in iron ore’s price. Indeed, while production is increasing, Chinese demand for iron ore has declined for the first time since at least 2000, due to slower economic growth. Different prices for Chinese steel products also declined sharply. Chinese hot rolled steel sheet price fell to the lowest level since 2003. Chinese steel rebar (25 mm) price dwindled to the lowest level since 2006, reflecting ample supply and slower demand growth. While Chinese demand for steel products could accelerate in the coming months due to recent stimuli efforts for the economy and in particular for the real estate market, rising iron ore supply from the top 3 miners are likely to prevent a major rebound in prices.

Contrasting with high cost producers, iron ore’s operations of Vale, Rio Tinto and BHP are still largely profitable in the current price environment due to a low cost structure. BHP only needs iron ore price at $25 per metric tonne to break even. The company recently announced plans to reduce cost below Rio Tinto’s cost of production at $20 per metric tonne. These companies have also announced significant capacity expansions. BHP aims to increase its iron ore output from 225 million metric tonnes in June 2014 to 290 million metric tonnes by the end of June 2017. Vale plans to see its output grow from 306 million metric tonnes last year to 450 million metric tonnes by 2018, while Rio Tinto wants to boost production from 266 million metric tonnes last year to 360 million metric tonnes by 2015. Thus, a recovery in iron ore demand from China amid lower domestic output — because of too low prices — may not be sufficient to lead to a rebound in iron ore’s price as large mining companies are likely to bring to the market more than sufficient new capacity in the coming years.

Coffee: Volatility in prices may continue

Coffee has been one of the best performing commodities since the beginning of the year due to dry weather in Brazil, which damaged this season’s crop. Brazilian coffee crop fell by 6.4% y/y during the 2013/14 season — which ends in June. This occurred, while the coffee trees in Central America were still suffering from the fungus roya since the 2011/12 season, leading to lower output. Persisting adverse weather conditions in Brazil have then increased concerns about next year’s crop, which is an off-year in Brazil’s two-year crop cycle — implying that coffee output was already expected to be weak. The Brazilian Arabica coffee crop, which accounted for 46% of global Arabica coffee output in 2013, is expected to decline next year for the second year in a row by 16.0% y/y during the 2014/15 season. This has recently triggered a 25% upward move in Arabica coffee prices since mid-September.

Concerns over the Brazilian crop were only slightly mitigated by improved crop conditions in Central America. Following two consecutive years of falling production, Arabica coffee output in Central America and Mexico is expected to recover in the 2014/15 season. Production could rise by 6.7% y/y. Coffee exports from Honduras are for instance expected to rise by 14.5% y/y. Mexico and Central America account for one-fifth of global Arabica beans production.

However, other concerns are arising, but this time in the Robusta coffee market. According to the Vietnam Coffee and Cocoa Association, Vietnam, which is the largest Robusta coffee producer, is expected to experience a decline in coffee output to 25 million 60-kg bags in the 2014/15 season, down for the first time on an annual basis since the 2008/2009 season. The fall is due to a combination of heavy rains in some areas and aging trees. Also, global coffee exports fell in August by 1.2% y/y to 8.8 million 60-kg bags, due to weaker shipments from Colombia, Indonesia and India. This could add further stress in an already vulnerable market. The stock-to-use ratio for coffee — Arabica and Robusta combined — is expected to fall to 21.7% this year, the lowest level since 2011 (18.3%), which was the lowest on record since at least 1961. Further deterioration of weather conditions either in Brazil or Vietnam could push coffee prices higher.

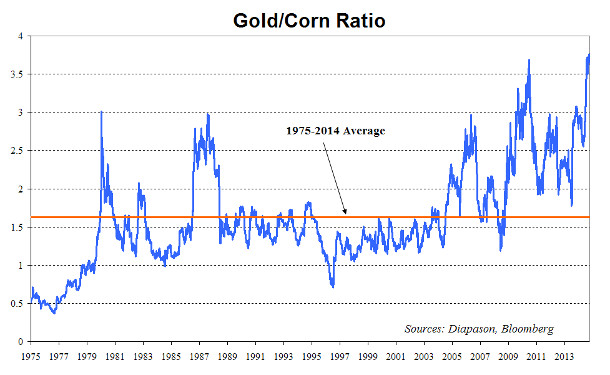

Chart of the week: The gold/corn ratio reached a new record high

|

The gold/corn ratio has recently made a new high. The ratio reached 3.8, which is significantly above the 1975-2014 average of 1.6, implying that corn is very cheap at the moment relative to gold prices. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com