September 29, 2014

Chinese monetary, not fiscal, policy is key to future growth

Commentary by Robert Balan, Senior Market Strategist

“There are expectations for more looser policies. It’s obvious the government wants the stock market to rise. The property data may be negative, but people are betting on more reforms”

Larry Wan, chief investment officer at ZhongRong Life Insurance Co., September 18th, 2014

China continues to play a key role in commodity prices as it accounts for most of the demand growth in several commodity markets. Because of its significance within the base metals sector, the latter is typically the most sensitive to the economic activity in China. Recent economic data suggested slower economic activity and recent speeches by Chinese officials have increased concerns about the pace of the Chinese growth. However, some elements are suggesting that the economic activity could accelerate in the next two quarters, preventing the growth of the Chinese GDP from falling below the 7.5% official target.

Both Premier Li Keqiang and Finance Minister Lou Jiwei,have been reported to have said that the government won't make any major economic adjustments "in response to a single economic data" after the fall in industrial production growth in August. But we think that the Chinese government is doing double talk here. This stance indeed contrasted with the announcement of a 500 billion yuan injection of liquidity to the 5 largest Chinese banks, the day after the industrial production numbers were reported. The move, made through the standing lending facility (SLF), was estimated to be equivalent to a 0.5 percentage-point cut in the reserves requirement rate at Chinese banks. The reinforcement of the SLF follows actions taken by the FED and more recently by the ECB to increase liquidity. While not as efficacious as a rate cut, it signifies the Li government’s alarm regarding the deterioration of economic activity data.

More targeted initiatives are likely to come in the next few months, as the government pursues its 7.5% self-imposed GDP target. Moreover, it is important to note that all the initiatives that are being taken come from adjustments in the monetary policy and not from the fiscal policy. Mr. Lou is likely talking about fiscal policy — he is after all the Finance Minister, not the head of the central bank. The Chinese government has not done anything major in this regard for the past two years, except for targeting investments in railroads, dams and social housing in the 4 year plan approved in the 4th Plenum last December.

On the other hand, monetary policy initiatives that have been taken include a sharp lowering of borrowing cost, further RRR cut to specific banks specializing in agriculture and real estate in the interior part, and the yuan was guided lower — all of these in the past three weeks. Obviously, the Chinese government wants to protect exports — the only source of growth at this time since domestic demand remains sluggish although retail sale had a small upside surprise last month. We could see even more aggressive easing on the monetary side, due to the possible replacement of Zhou Xiaochuan, the current PBoC’s head, which is seen as too cautious. It is confusing as the Chinese seem to be saying one thing, but doing something completely different. However, it appears that China is keeping its fiscal policy in check, while at the same time easing monetary conditions, exactly like the US government did. There has been practically no fiscal initiative in the US, and the heavy carrying was borne by the Federal Reserve.

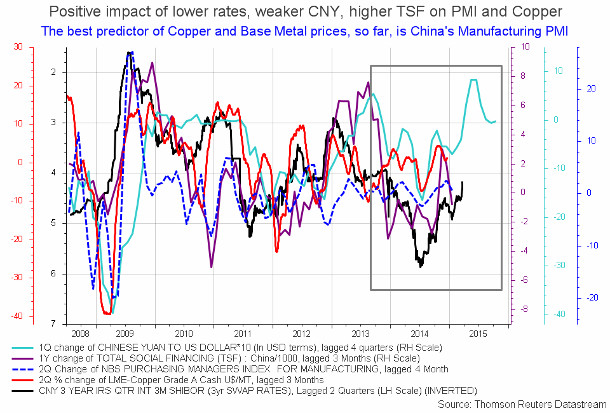

If this is the model that the Chinese government will follow, then it behoves that the same result should be expected. The Federal Reserves monetary policy initiatives have sparked fantastic gains in financial assets and especially in the US stock market. If the PBoC follows through on this model, then we should also expect positive impact on Chinese-linked financial assets and possibly to cyclical commodities. Most commodities, and more so the base metals, are linked to the Chinese economic activity, which in turn is highly dependent on loose or easier financial conditions (see charts of the week) especially the evolution of the interest rate and the yuan. The recent easing in monetary conditions also contributed to the strong performance of Chinese equities. The Shanghai Stock Exchange Composite is indeed up by 11% since the beginning of the year, implying that base metals prices could also soon move higher due to their strong link to the Chinese economic activity (see charts of the week). Thus, more than what the Chinese officials are saying, it is the actions made by the government on the fiscal but more importantly on the monetary policy that matter, and which could impact Chinese-linked financial assets and commodity prices.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Saudi Arabia may cut oil production further to support oil prices

In August 2014, Saudi Arabia cut production by 400’000 b/d, while it typically increases output during this period due to stronger domestic and foreign demand. Cooler than usual temperatures led to lower direct crude burning in the Gulf, while refineries in Europe and in Asia reduced crude purchases due to weak margins amid rising supply from Libya. This contributed to reduce demand for Saudi’s crude oil. The Kingdom could cut production further in September and in October, not only to respond to weaker seasonal demand, but also offset the recent large rise in Libyan crude oil production. The latter has indeed risen from 220’000 b/d in May 2014 to around 900’000 b/d at the end of last week. The Saudi intervention also reflects its willingness to balance the oil market in order to prevent a too rapid decline in oil prices.

In the past, Saudi Arabia has often reduced production in order to preserve oil price stability, and at the same time to keep oil prices high enough to cover the government’s expenses, which have increased sharply these past years – in fact more rapidly than oil prices. Growing social and defence spending contributed to a rise in Saudi’s government expenditures by 14.0% per year on average since 2003. We estimate that Saudi Arabia needs a barrel of oil at $95 on average in 2014 and 2015 to balance its budget. While Saudi Arabia could bear lower oil prices for a short period, it may cut production further if oil prices fell below $95 for a sustained period in order to balance the market.

The cut in Saudi crude oil production could occur while the Chinese government increases its purchases of crude oil for its Strategic Petroleum Reserves. These past 6 years, Chinese crude oil imports often accelerated following a large oil price correction such as the one we have just experienced. These interventions – both from the Chinese and the Saudi governments – if implemented, could rapidly lead to a tighter oil market, providing a strong support to oil prices.

Gold prices could soon stabilise but silver prices could start outperforming gold

Gold prices fell by 9.0% since mid-July and are approaching prices reached at the beginning of the year — they are still up 1.3% year-to-date. This slight positive performance contrasts greatly with last year’s price decline, when gold prices dwindled by 28.8% throughout the year. The decline in gold prices is expected to lead to production cuts in the second half of the year, contrasting with the rise in output in the first half of the year — +3.6% y/y —, while physical demand has declined by 26.3% y/y in the first part of the year, driven by lower jewellery production in China and in India, according to the Thomson Reuters GFMS Gold Survey 2014 — Update 1.

Persisting trade restrictions should keep Indian gold imports at a low level. Chinese demand for gold, which outpaced Indian demand last year, has declined sharply since the beginning of the year as suggested by the large reduction in Chinese gold imports from Hong Kong to 21.1 metric tonnes, the lowest level since January 2013 and down by 83.8% from the October 2013’s record level. Total known ETF gold holdings continued to decline this year — down 4.0% year-to-date — albeit at a slower pace than last year when it declined by 33.3%. ETF gold holdings have fallen to the lowest level since September 2009.

The strength in the US Dollar and higher economic activity in the US also contributed to the recent downside move in prices — as demand for safe haven assets declined. The amount of net long speculative positions has also declined back to June 2014 lows. The positive sentiment on gold fell to the lowest level since January 2014.

However, despite the current weak physical demand environment, the reduction in gold production, slower US economic growth and a weaker dollar could contribute to the stabilisation in gold prices. Indeed, signs of weaker US growth are appearing with the weak real estate market, lower than anticipated industrial production data this summer and possibly weaker future exports due to the recent rapid rise in the US dollar. The slowdown in US economic activity in turn could lead to a weaker US dollar through a possible change in stance of the Fed and the return of the carry trade, as growth in the rest of the world should accelerate. The correlation between gold and the EUR/USD exchange rate between July and September reached 0.945, above the average of 0.655 since 2000.

The likely decline in the US dollar, which should occur before the end of the year, could hence have a major impact on gold prices. Nonetheless, the expected stronger economic growth in emerging countries and the stabilisation of the economic activity in Europe may mitigate the dollar effect on gold prices. Our scenario of a more rapid global growth and a weaker US dollar should on the other hand benefit silver prices, which have stronger links with the economic activity. Silver prices could therefore start to outperform gold prices. The gold/silver ratio, which has recently increased to the highest level since June 2010 and is up 20.7% from the 40-year average, could soon move in the other direction.

The downward trend in agriculture prices reached its terminal phase

Since April 2014, the agriculture sector has been the worst performer within the commodity complex with the notable exception of meat prices, which are among the best performing commodities since the beginning of the year due to a sharp reduction in supply. The DCI® Agriculture Index fell by more than 20% since the end of April 2014 to the lowest level since August 2010. The recent decline in agriculture prices was driven by lower grains prices as wheat, corn and soybeans are expected to experience bumper crop this year. The strong upward move of the US dollar also contributed to the weakness in agriculture prices. And finally, like in the energy sector, the large reduction in net long speculative positions amplified the decline in prices. Within agricultural commodities, wheat and corn prices were the worst performers this year, down 26.1% and 24.7% respectively year-to-date (using the DCI® mono-index, a single-commodity index invested on the front month). The downward move in corn and wheat prices followed a larger price correction, which started in mid-2012, when drought concerns on the US crop reached its climax.

Since then wheat and corn prices are down form their 2012 peak, by 57.3% and 57.2% respectively. It is interesting to note that the corn and wheat’s price peak occurred when sentiment on the US crop was extremely pessimistic as the US Midwest experienced the worst drought in half a century. On the subject of drought conditions, Dan Collins of the National Oceanic and Atmospheric Administration's Climate Prediction Center said on Thursday 19th of July 2012: "There's a greater chance that there is no relief possible or in sight" for the U.S. Midwest. The following day the price of wheat peaked… The sentiment at that time contrasts greatly with the current over optimistic outlook over the US grain crops.

Current fundamentals are indeed suggesting an oversupplied grain market. Moreover, the upcoming corn and soybean harvest in the US could lead to further downside pressure as concerns are rising as to whether North American storage capacity would be sufficient for the crop. However, prices have fallen rapidly, too rapidly.

Corn prices for instance fell in gold terms to the lowest level since at least 1975. Moreover, corn prices have fallen below farm’s cash-cost in the US — estimated at $3.75 per bushel — and in Brazil — estimated at $3.60 per bushel. As corn prices have moved significantly below the cash-cost, the planted area for next year is likely to be significantly lower than this year. In 2008/09, when the corn market experienced a similar situation, the US corn area decreased by 8%. We also expect the US dollar to weaken, as previously mentioned. Amid large short speculative positions, these factors should limit the downside potential in grains market. This is suggesting that the downward trend of agricultural prices has reached its terminal phase.

Charts of the week: Monetary conditions pointing to stronger growth - Base Metals to catch up with Chinese equities

|

The ongoing decline in interest rates, which started at the beginning of January 2014 and the weaker yuan, since June 2014, should contribute to a stronger Chinese economic activity in Q4 2014. Moreover, monetary easing could add further upside pressure to the Chinese growth. Base metals have strong links with the Chinese economy as suggested by the second chart. The improved economic situation in China and further monetary easing should fuel the growth in Chinese equities. This should have a positive impact on base metals prices. The recent divergence between the DCI® Base Metals Index and the Shanghai Stock Exchange Composite Index suggests that the former is undervalued relative to the state of the Chinese economy and hence has a more important upside potential than Chinese equities. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com