September 22, 2014

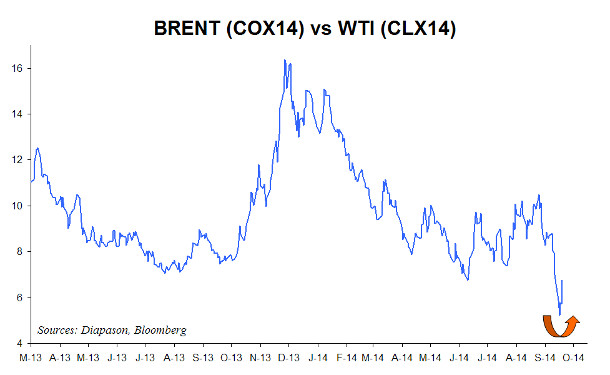

The Brent-WTI spread may widen significantly in the coming weeks

Commentary by Alessandro Gelli, Commodity Analyst

“Most U.S. crude oil cannot be exported, so domestic producers can only sell their oil to U.S. refiners. As U.S. oil output has climbed in recent years, producers have discounted their crude below global prices so U.S. refiners will buy more domestically instead of importing from abroad.”

Nicole Friedman, Wall Street Journal, September 12, 2014

The Brent-WTI spread has recently moved to its lowest level since the beginning of the year. The spread on the November maturities indeed reached $5.2 per barrel last week, while it has averaged about $10 per barrel year-to-date. However, the spread may be close to a low and could rebound significantly in the coming weeks. The start of the refining maintenance season, the ban on crude oil exports and ongoing strong crude oil production growth from tight oil fields are likely to trigger a rebound in US crude oil inventories, which in turn could lead to a wider Brent-WTI spread.

The Brent’s premium over WTI is caused by a US oil surplus due to the tight oil boom, the ban on crude oil exports, and the incapacity of local refineries to absorb all of US domestic crude oil output growth. The spread has fluctuated these past years as production increased and due to improved infrastructure in the form of new pipelines and new rail oil terminals, which contributed to move the oil surplus from the US Midwest to coastal regions, where most US refineries are located. This allowed refiners to replace imported crude oil with domestically produced crude oil. US crude oil imports dwindled to 7.7 million b/d in 2013, down from 10.1 million b/d in 2006, while crude oil demand by US refineries rose by about 100’000 b/d to 15.3 million b/d during the same period.

The improved rail and pipeline infrastructure in turn contributed to reduce the oil surplus located in the Midwest, leading to a major drawdown in crude oil inventories at Cushing in Oklahoma, the delivery point of WTI futures and a key storage and transit hub in the Midwest. The situation in Cushing is therefore having a major impact on NYMEX light sweet crude oil prices. Since January 2014, crude oil inventories at Cushing fell by more than 50% to 20.0 million barrels in mid-September, slightly up from the July’s low of 17.9 million barrels, which was the lowest level since the end of 2008. This contributed to a strong backwardation on WTI futures and a narrower Brent-WTI spread.

However, the Brent-WTI spread is likely to rebound in the coming weeks due to lower seasonal demand from refineries, while supply continues to grow and cannot be exported. The start of the refining maintenance season, should lead to a decline in crude demand and an increase in crude oil inventories. According to Bloomberg, US planned refinery outages are expected to rise by 1.0 million b/d by mid-October, a time when the refining maintenance season should peak. On the other hand, US crude oil supply continues to grow at a rapid pace. According to the latest data from the US EIA, US crude oil production grew by 1.2 million b/d y/y in Q2 2014 to 8.5 million b/d, while it increased by 900’000 b/d y/y in Q1 2014 and by 950’000 b/d y/y in 2013. Between January and June 2014, US crude oil production rose by 110’000 b/d per month on average compared with an average monthly rise of 65’000 b/d in 2013. This year’s acceleration in US crude oil production growth was caused by increasing drilling activity — a combination of a rise in rig counts and higher productivity. While crude oil production growth could slowdown in the coming months due to limited spare drilling capacity and high decline rates at tight oil wells, US crude oil production is still likely to grow at a rapid pace.

The seasonal decline in demand amid strong production growth would have a limited impact on US prices if crude oil exports would be allowed and if the light sweet domestic output could fully replace imported medium/heavy crude oil needed by US refiners. Modern US refineries on the US Gulf Coast, which account for more than half of US refining capacity, have in fact been designed to process heavy crude oil. The lack of domestic heavy/medium crude oil supply forces US refineries to import this type of crude even though the US has a surplus of light sweet crude oil. The lack of flexibility from the refining industry and the export ban should hence contribute to a major rebound in US crude oil inventories in the coming weeks. This is likely to lead to the underperformance of WTI prices relative to Brent prices. In turn, this could have an impact on the structure of the forward curve as it should lead to a significantly narrower backwardation on WTI.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Why is Libya so important to the Brent market?

Last week in Lybia, the Sharara oil field and the Zawiya refinery were shut down as a precaution following a rocket attack on the Zawiya refinery on the coast, which is connected to the inland field. It is the first time since May 2014, when the political situation started to deteriorate significantly, that the oil infrastructure has been attacked. The field, with a capacity of 350’000 b/d, was producing about 250’000 b/d before the disruption, accounting for almost a third of Libyan crude oil production in early September 2014. Thus, this contributed to the decline in Libyan crude oil production to around 600’000 b/d. Brent prices moved higher last Tuesday following the field’s halt.

The situation in Libya is carefully watched by the market due to the size, quality and location of the Libyan oil production. Indeed, in 2011 and in 2013, the decline in Libyan crude oil output, by 1.5 and 1.3 million b/d respectively, were significant as Libyan crude oil production accounted in both periods for 5% of total OPEC production before the disruptions. Before the 2011 civil war, Libya had a production capacity of about 1.6 million b/d. Moreover, the quality of the light sweet Libyan crude oil is high as it has similar chemical characteristics to Brent. It is therefore greatly appreciated by European refiners. The location of Libya - close to European refineries on the Mediterranean coast - also makes Libyan crude oil valuable. Supply disruptions in Libya are hence having an important impact on Brent prices.

In 2011 and in 2013, the decline in Libyan crude oil production was followed by a rise in Brent prices by between $18 and $30 in the following 4 months. Moreover, if the state of civil war persists, worries of further supply disruptions could add upside pressure on Brent prices. Evidently, the divergence between rising crude oil production and deteriorating security and political conditions is not sustainable.

Tin could move back into backwardation

Indonesia continues to make the headlines in the base metals sector. The country was indeed the principal driver of the rally in nickel prices since the beginning of the year, following the implementation of a ban on ore exports. This also affected the copper and the bauxite markets. The goal of the Indonesian government with the implementation of this law, which had a major impact on the base metals sector, was to help miners and to develop smelting capacities, as the export of processed ores is allowed. In years prior to the ban, Indonesian miners have indeed suffered from the low price environment in the base metals sector. Prices below production costs discouraged investments and threatened a key industry for the country. The implementation of the ban on unprocessed ore exports was the solution found by the government to support the domestic mining industry.

Now, it is the turn of the tin market to be affected by Indonesia. In August 2014, Indonesian tin exports fell to 3595 metric tonnes - the lowest level since September 2013. Tin exports are expected to fall further in September. This is contributing to adding upside pressure on tin prices. Indonesia is not as important in the tin market as in the nickel market but it remains a large producer of tin. It accounted for 25% of global mined tin supply and for 33% of mined nickel supply in 2013.

By voluntarily reducing exports, Indonesian miners contributed to a significant reduction in tin inventories at the LME, which indeed declined by 27% since the middle of August 2014 to around 9’900 metric tonnes - the lowest level since early May 2014. This also contributed to an important decline of the tin contango. If the situation continues the tin’s term structure could move back into backwardation like in the first half of the year. The last time tin futures moved into backwardation, at the end of last year, LME tin inventories were falling and were close to current levels.

Soybean could outperform corn on low inventories

The grains market continues to be under pressure following recent reports, which are confirming bumper crops. The September USDA Grain report, released two weeks ago, did not help especially on the corn and soybeans, which are about to be harvested. US corn yields for the next harvest were revised higher to 171.7 bushels per acre, a record high level, up from an estimate made in August of 167.4 bushels per acre. This is significantly higher than last year when US corn yields reached 158.8 bushels per acre. Thus despite the reduction in planted acres by 4.0% y/y to 91.6 million acres, US corn production is expected to reach 14.4 billion bushels, a new record high, and up from 13.9 billion bushels last year, the previous historical high.

US soybeans yields were also revised higher to 46.6 bushels per acre, also a record high, up from an estimate made in August of 45.4 bushels per acre. This is significantly higher than the previous record level reached in the 2009-2010 season at 44.0 bushels per acre. Record yields are occurring while planting also reached a historically high level at 84.8 million acres. This is therefore leading to an exceptional rise in US soybean production of 3.9 billion bushels, up from 3.3 billion bushels last year.

These impressive crops are expected to lead to a major build in grains inventories. US corn inventories are expected to almost double to 2.0 billion bushels from 1.2 billion bushels last year. The situation is not as bad on the soybean market due to previous years of deficit. US soybeans inventories are likely to increase to 475 million bushels, up from 130 million bushels last year. This has contributed to a significant downward move in corn and soybean prices. Soybeans and corn prices fell by 36% and 34% respectively since the end of April. The underperformance of soybeans appears overdone however. US soybeans inventories remain at a low level following three years of deficit. Moreover, US soybeans could benefit from stronger Chinese demand, while US corn exports to China have halved due to Chinese concerns on genetically modified crops. This could contribute to the outperformance of soybeans over corn in the coming weeks.

Chart of the week: The Brent-WTI spread could rebound in the coming weeks

|

The Brent-WTI spread has been falling sharply these past weeks following the important decline in crude oil inventories at Cushing. However, the start of the refining maintenance season, strong crude oil production growth, the ban on crude oil exports and the lack of flexibility of US refiners should lead to a major rise in crude oil inventories in the US. This should add downside pressure on WTI prices relative to Brent prices, leading to a rebound in the price spread. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com