August 18, 2014

Global macro conditions still favourable for risk assets

Commentary by Robert Balan, Senior Market Strategist

"Whether the official GDP report is accurate at 7.5% or intentionally overstated we will never know – the Chinese never revise their GDP estimates – but the broad-based “improvement” in economic activity suggests that the Chinese economy is growing faster than many China skeptics believe – at least for now.”

John Mauldin, August 11th, 2014

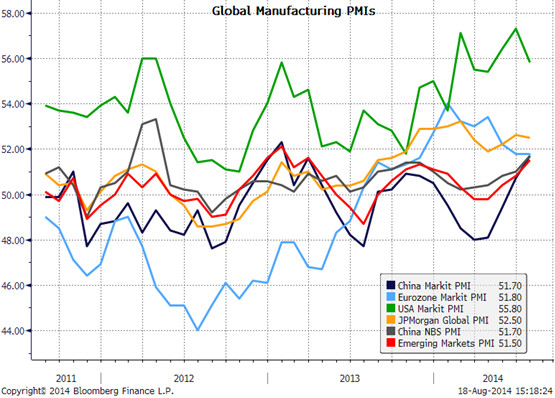

Latest manufacturing data continue to point to stronger global growth, which we expect to accelerate over the next 6 to 9 months driven especially by China and EM economies. Most of the globe will continue to benefit from a still dovish US Federal Reserve, the ECB, the BoJ, and from regional central banks which are starting to ease policy after a brief tightening period to combat inflation. The acceleration of the economic activity is currently particularly pronounced in the US — the July ISM manufacturing rose to 57.1 from 55.3, the highest reading in three years and considerably above consensus expectations.

However, in contrast to the US, the Eurozone is lagging behind. In the euro area, the final manufacturing PMIs were revised down slightly from the ‘flash’, to 51.8, unchanged from the level in June. While Germany and the Netherlands showed an improvement in the pace of manufacturing activity, in France, Italy and Spain manufacturing confidence was weaker, nonetheless. Offsetting eurozone's slow pace is the manufacturing activity in China, which has been picking up these past months, fuelled by government’s interventions. In China, the NBS PMI manufacturing surprised on the upside with a strong reading of 51.7 in July, a 27-month high. The final reading of the Markit PMI also indicated an improvement from June, to 51.7 (from 50.7), an 18-month high. China’s growth should improve further in the second half of the year as the Li government's efforts to juice the economy takes hold.

The on-going China re-rating is positively impacting assets that are linked to Chinese growth, such as China and EM equities and base metals. This is explained why the base metals sector has outperformed other commodity sector these past three months. During this period, the DCI® Base Metals Index is up by 4.5%, slightly behind MSCI Emerging Markets (+4.8%), while the DCI® Global Index is down by 4.0%. We expect commodities prices to rise more consistently over H2 2014, now that Chinese growth has finally taken off. We do not consider the total social financing July data a disaster: viewed from the year-on-year growth rate, China's loan data is merely a small downside blip. More importantly, and perhaps ironically, it will likely be a blessing in disguise. With this data the PBoC and the Li government will drop the half-hearted measures they have been adopting, if they want to achieve the 7.5% self-imposed minimum growth they have targeted — a policy rate cut in each of Q3 and Q4 2014 is now more likely.

The ongoing rise in global growth could mark the apogee of the business cycle which started in early 2009. Its uneven cadence however could make the q-o-q output for the primary economies peak in a sequence — the US in Q3 2014 (3.4% - 3.6%), the Eurozone in Q4 (0.5% - 0.6%) and China in Q1 2015 (8.5% - 8.6%). Global GDP may yet end 2014 at 4.1% - 4.3%, the strongest growth since the end of the global recession in 2009. With the outlook of a sequential topping out, global growth asset trends should shift soon. Chinese assets and Chinese-linked instruments are picking up speed with the re-rating of global growth, while we believe US equities are starting to plateau. The shift in risk asset trends may come to a head in late Q4 or in early Q1 2015, when we expect US growth to start to show weakness, and could handicap paper assets. Assets linked to Chinese and global growth (especially the hard assets e.g., commodities) may however continue to show relative strength well into late H1 2015. This should provide a more favourable environment in our long-projected commodities outperformance over paper assets. Base metals and EM equities should also do well over the next few quarters as the phase of the global economy transitions into an acceleration phase prior to a terminal plateau.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Saudi Arabia data suggests the oil market remains tight

Last week, oil prices fell following the release of the latest International Energy Agency report, which revised lower oil demand growth for this year. The agency thus forecasted a significantly weaker oil market than in the first half of the year. Global oil demand growth for 2014 was revised down to 1.0 million b/d y/y, from 1.2 million b/d y/y in its previous report, due to lower than expected oil demand in Q2 2014 and IMF’s downward revision of global growth forecast for 2014. According to the IEA, inventories in OECD countries rose for the sixth consecutive month in June to 2.7 billion barrels, the highest level since September 2013. The build in petroleum inventories in Q2 2014, was the largest quarterly build since Q3 2006. The IEA also expects further consolidation in the European refining sector and stronger crude oil exports from Libya. This has contributed to a sharp deterioration in the sentiment on oil prices. Net long speculative positions on oil futures fell last week to the lowest level since May 2013. The bullish sentiment also dwindled. For example, on heating oil prices, it fell to the lowest level since June 2012.

The fact that the supply/demand balance weakened during Q2 2014 is undeniable. However, the oil market is still expect to tighten in the second half of the year. Global growth has been picking up and should move higher in the coming months, driven by the US and emerging countries. Moreover, the deterioration of the political situation in Libya and in Iraq makes supply forecast extremely unreliable. Crude oil exports from these countries are likely to remain volatile. The uncertainty is likely to add upside pressure on oil prices.

Furthermore, some elements in the last IEA report — neglected by medias — are signalling that the supply/demand balance in the oil market is tight. According to the IEA, OPEC boosted crude oil production in July to a 5-month high at 30.4 million b/d, driven by stronger Saudi crude oil output. The latter indeed rose to 10.0 million b/d in July up from 9.8 million b/d in June and the highest level since September 2013. This is implying that the Kingdom had to increase crude oil output to meet domestic and foreign demand. Latest available data for the country show that in June 2014 crude and fuel oil burning by the power sector reached 1.2 million b/d and crude demand by refineries reached 2.1 million b/d. Both were a new record high for the period and may have increased further in these past weeks. Inventories in Saudi Arabia also have declined between April and June 2014, a period when they usually increase due to weaker seasonal demand. The IEA also expects the call on OPEC to increase to 30.8 million b/d in Q4 2014, implying that OPEC needs to rise its crude oil production by 400’000 b/d from July level to meet global oil demand. These elements and the fact that the bullish sentiment has fallen to an extremely low level could soon trigger an important rebound in prices.

Nickel: return of idled mines won’t be sufficient

This nickel has been the best performer within the base metals sector. LME nickel prices are up by more than 30% year-to-date due to the Indonesian ban on unprocessed ore exports. Indonesia being the largest producer and exporter of nickel ore, the ban is having an important impact on the market. But like every other commodity market, an important rise in prices usually trigger a change of the supply and the demand. One of the characteristic of the commodity market is the lag between the price signal and the response of supply. The latter is typically inelastic in the short run in commodity markets due to the significant time required to build new producing capacity in the energy and base metals market and seasonal and environmental constraints in the agriculture sector.

However, idled capacity exists in the nickel market due to the low prices last year, which led to the closure of several mines. LME Nickel prices indeed fell in 2012 to below $17’000 per metric tonnes and remained below $15’000 in the second half of 2013 and in Q1 2014, led to the closure of several mines. According to Norilsk Nickel, 25% of nickel production ex-China was loss-making with Nickel prices at $14’500 in mid-2013.

The significant recovery in nickel prices this year has restored the economic profitability of closed mines. Several Australian mining companies have announced that they will restart an operation at idled mines. About 220’000 metric tonnes of mining capacity was idled since 2009 and about 170’000 metric tonnes could potentially be restarted if prices are high enough. Some of these mines were built in 2006 and 2007 when LME nickel prices averaged about $30’000 per metric tonnes.

However, despite the nickel deficit for 2015 estimated between 100’000 and 200’000 metric tonnes, this won’t be sufficient to prevent its prices from remaining at this level. Indeed, it could first take time to restart a mine. QCG Resources Pty Ltd announced at the end of May 2014 — when LME nickel prices stood at around $19’000 per metric tonnes — that it will reopen its Avebury Nickel Mine in Tasmania, after being closed in 2009, in the first half of 2015 only. The mine is expected to have a capacity of 12’000 metric tonnes of nickel concentrate a year. Other larger mines could take more time to restart and output would only increase gradually. Moreover, nickel prices would need to remain at or above current level in order to justify these restarts. Finally, the ramp up of idled mines may only mitigate the fact that very few new projects are expected in the next 3 to 5 years due to the period of underinvestment in 2012 and 2013. Thus, the return of these new mines isn’t likely to have a major impact on the nickel market in the short run. Prices would need to increase further to see other producers restart idled mines.

Corn: medium term fundamentals remain negative

Grain prices again declined last week, following the release of the World Agriculture Supply and Demand Estimates (WASDE) report made by the USDA. The report showed that the corn crop should not be as large as expected. According to the USDA, the corn yield for the 2014 US crop is forecasted to reach 167.4 bushels per acre against market expectations of 170.1 bushels per acre. This contributed to a weaker US corn crop production for 2014 than expected at 14.0 billion bushels against market expectations of 14.3 billion bushels. This is nonetheless a record high level, up by 0.8% y/y.

On the other hand, the USDA improved the supply estimates for soybean and wheat. US Soybean ending stocks estimate for 2014 and 2015 were both higher than expectations. On the wheat market, US production was also estimated above market expectations. These better than estimated data for corn, while they were more negative for soybean and wheat could lead to a temporary outperformance of corn within the grains sector. Corn could also benefit from uncertainty surrounding the crop as the harvest in the US will occur only in October and November. Until then the crop remains vulnerable to dry weather during the silking period, which should end in September and the above than usual rains during the harvest. This is contrasting with US winter wheat, of which 95% has already been harvested. Winter wheat typically accounts for 70-80% of the US wheat crop. However, the outperformance of corn is likely to be short-lived as corn fundamentals remain worst than soybean and wheat in the medium term.

Indeed, contrasting with soybean, global corn inventories are already at a relatively elevated level due to the last year’s bumper crop, which brought global corn ending crops 6.7 billion bushels, the highest level since 2000. On the other hand, global soybean ending stock stood last year at 2.5 billion bushels, the highest level since 2010. The stock-to-usage is even more illustrating of the tighter soybean market relative to the corn market. The percentage stocks-to-use of the global soybean market stood at 4.2% last year the lowest level since 1964, while it stood at 8.7% on the global corn market, the highest level since 2009. Wheat fundamentals are also stronger than corn for the medium term. Global wheat ending stocks stood last year in the middle of the last 10 year range. The percentage stocks-to-use of the global wheat market remains also at a relative low level compared with previous years. Moreover, demand for corn by ethanol producer could even decline next year as the ethanol blend wall is reached and US ethanol usage quota for 2015 is likely to be revised lower. Thus, corn fundamentals remain significantly weaker than soybean and wheat. Corn prices are likely to underperform further other grains and oilseeds prices.

Chart of the week: Manufacturing data are indicating stronger economic growth

|

Latest manufacturing data are pointing to a stronger growth. The JPMorgan global manufacturing PMI increased to 52.5 in July 2014, slightly down month-on-month but still at an elevated level. The clear recovery in Chinese PMI data (both the NBS and the HSBC Markit PMI) should support a stronger global growth ahead, mitigating the impact of the slower activity in Europe. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com