August 4, 2014

Base Metal sector leaders will likely stay on top for a while

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Energy Analyst

"Investors are slowly being drawn back into commodities, attracted by stronger global economic growth and more volatility within some sectors, typified by current investment flows out of grains into industrial metals.”

Maytaal Angel, Reuters, July 22nd, 2014

As the year began, the outlook for base metals seemed bleak. By late Q1, almost every metal in the sector was heading downwards, and some metals were making new lows relative to the 2011 peak. The sentiment on China was rock-bottom, even though the economy showed signs of stabilization. Rising Chinese debt became the new focus of the negative outlook. Nonetheless, we thought, at that time, that the extreme pessimism over base metals was unwarranted: although China's imports were still declining, the deterioration has significantly slowed. Given our positive take on medium-term Chinese growth prospects, along with the promise of Premier Li Kequiang not to let GDP growth drop below "7.5%", and the positive global outlook, the sour sentiment on base metals at that time were totally unjustified, by our reckoning.

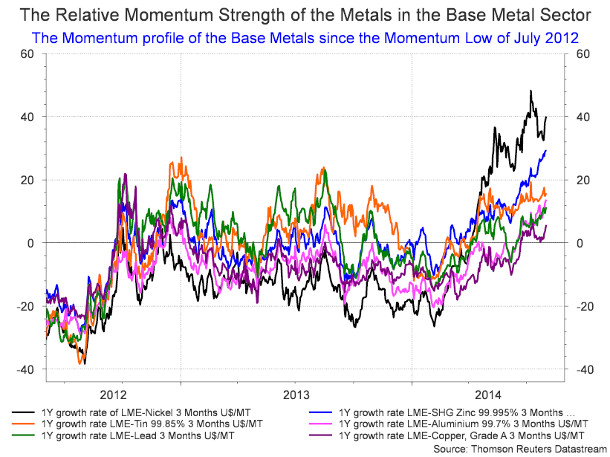

Eight months into the year, we see no reason to alter our positive outlook for base metals as the economic activity in China is likely to accelerate (See Diapason Commodities Insight Weekly, “A road map of China’s recovery: better times for the next 4 quarters”, July 28th, 2014) and supportive supply factors have entered the picture. We therefore expect the DCI® Industrial Index, which is already up by 5.5% year-to-date, to move higher in the coming months. The positive outlook for the sector is driven by supportive fundamentals for several metals, which have outperformed the sector. Nickel and zinc seem to be the leaders this time around. Indonesia’s raw ore export ban in January and the closure of major zinc mines early in the year ordained these two metals as the leaders so far this new bull phase. The base metals’ gains year-to-date are significant: nickel (31%) and zinc (13%). On the other side of the spectrum, lead and copper have lagged the sector year-to-date.

Will the current base metals sector leaders be able to hold on to the crown up to H1 2015, the time when we expect Chinese and global growth to plateau? Or put another way, will the laggards copper and lead (especially the former) get a chance to break into the leaders' circle? Part of the answer depends on the factors that propelled the current leading metals into prominence. The Indonesian government has so far shown no signs of relenting the ban on unprocessed ore exports, and so mineral processors have taken steps to comply with the regulations, and are building refineries inside the country. But this could take some time, so the impact of the export ban could extend well into H1 2015. That may mean there is plenty of potential for the current leaders — nickel and zinc — to stay in the forefront based on this outlook of constricted supply in the medium-term. The picture for zinc is especially appealing. Many large zinc mines will shut down in mid-2015, for example, Australia's largest open-cut zinc mine Century Zinc. Another mine, Lisheen in Ireland, is also set to close next year.

However, the expected acceleration in China's growth over the next several quarters should increase demand for copper. The Chinese government continues to push towards urbanization. This will require more and more of the red metal in the expansion of their electrical grid and satisfying the need for the hallmarks of urbanization, primarily home appliance products (refrigerators, air conditioning units, etc). Chinese electric power cable production has already been accelerating these past months. In Q2 2014, it rose by 20.5% y/y, a significant contrast with last year when it only grew slightly (+1.5% y/y), according to CEIC.

In the case of lead, the Chinese vehicle industry took a pause after the government-engineered growth slowdown last year has had severe knock-on effects on the property market, with a negative impact on durable goods. But vehicle manufacturing in China is starting to grow at a stronger pace. Passenger vehicle sales in China rose by 12.3% y/y on average in Q2 2014, an improvement from the first quarter when sales grew by 11.0% y/y. This is also an improvement from Q2 last year when sales increased by 10.4% y/y, according to CEIC. We expect Chinese vehicle sales growth to remain strong. This should have a positive impact on demand for lead-acid batteries. Thanks to the boost in demand from vehicle sales growth, lead price may catch up with the leaders in the short run (see below Commodities and Economic Highlights, “LME lead price could temporarily outperform LME zinc price”), but it may not be enough to push it into real prominence and challenge the current leaders in the medium term. Thus, while copper and lead prices are likely to benefit from a short term boost, zinc and nickel are likely to remain the best performing commodities within the base metals sector until the end of H1 2015.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Geopolitical risks are underestimated by the market

Brent prices have remained stagnant these past two weeks following higher volatility in June. The oil market is indeed torn by opposing forces: improved Chinese economic data vs. unclear outlook in Europe, a US oil glut vs. extremely elevated supply disruptions in the rest of the world, high refining activity in the US vs. weak crude runs in Europe, relatively high crude oil inventories in the US vs. low petroleum inventories elsewhere. We already made the case for more supportive fundamentals on the oil market (See Diapason Commodities Insight Weekly, “Tighter supply/demand, low inventories and high supply risks; the recipe for a significant rise in oil prices”, July 14th, 2014). But a major factor is being underestimated by the market: geopolitical risks.

Indeed, geopolitical risks traditionally play a key role in the oil market. Recent events have particularly affected the oil markets and should have contributed to a higher risk premium on the oil barrel’s price. One key characteristic of the risk premium is that a threat of supply disruptions often has a more lasting impact than actual disruptions of supply, which typically trigger a response of Saudi Arabia or a release in Strategic Petroleum Reserves (SPR). In 2011, the Libyan civil war contributed to decrease Libyan crude oil production from about 1.6 million to zero b/d over several months. This was being offset by both a rise in Saudi Arabian crude oil production — which had remained since then above 9.0 million b/d, at an elevated level (compared with an average of 8.3 million b/d in 2010) — and the release of 60 million barrels in June 2011 by the US (30 million barrels) and European countries. This contributed to the reduction in Brent price from $125 in April 2011 to around $105 at the end of 2011.

However, the situation is currently tighter than in 2011. Indeed, Saudi Arabia crude oil production reached almost 10 million b/d in June, at a time when the US oil glut cannot be exported. The release of crude oil from US SPR on the Gulf Coast — where all the US SPR are located — would hence have a more limited impact on the international oil market than in 2011. Furthermore, a major difference with 2011 is the low level of petroleum inventories. According to the International Energy Agency, OECD commercial petroleum inventories reached 2.6 billion barrels at the end of May 2014 - the lowest level for this time of the year since 2008. On top of these tighter conditions, geopolitical risks have gradually increased these past months.

The situation in the Middle East is particularly worrisome as the civil war in Syria has spilled over the northern part of Iraq. Tensions between Ukraine and Russia, China and south-eastern Asian countries have also the potential to affect the oil market as they are occurring close to important oil routes (Turkish straits and the Malaysian straits) and are adding significant geopolitical uncertainty. These events — especially in the Middle East and in Ukraine — have deteriorated these past weeks without having a significant impact on international oil prices. Moreover, the fact that negotiation on Iran’s nuclear activity failed to result into an agreement in July is hardly good news for the region as it means that the issue has only been pushed down the road. The oil market has therefore so far failed to integrate these latest geopolitical developments into prices. The wake up call could be brutal.

The meat price outperformance may soon end

Grains and oilseeds prices fell sharply these past few weeks due to excellent crop conditions in the US, which should lead to a record crop of soybean and a bumper corn crop. The DCI® Grains Index fell by about 25% since the end of April 2014 to new lows for the year. However, within the agriculture sector, other commodities performed well these past three months. Cocoa prices have risen by more 7% during the same period. But the best performers were the meats, driven by a strong performance of US live cattle prices, which increased by 11%. The differentiation of prices implies that commodity prices are mostly driven by their specific drivers. But naturally the recent US Dollar strength has not helped agriculture prices.

Meat prices have performed well since the beginning of the year as have lean hogs and live cattle prices which are up by about 25%. The US hogs herds have been hit by a deadly virus, the porcine epidemic diarrhoea, which is estimated to have killed more than 100’000 piglets and young hogs each week since it appeared in May 2013. According to the USDA, this has contributed to a decline in US hogs slaughtered by 3.8% y/y since the beginning of year on average. The impact has been especially important these past weeks as US hogs slaughtered dropped by 6.3% y/y since the beginning of June. This contributed to a rise in the price of pork chops by 8% since the beginning of the year, according to the USDA. Live cattle prices also increased sharply this year following several years of drought conditions and high feed costs that have reduced the American herd at the beginning of 2014 to the lowest level since 1951. These are not isolate cases. Chicken cold storage inventories stood at the end of June at the lowest levels since 1997 for this time of the year.

The BBQ season also recently contributed to the recent tighter supply-demand balance. Elevated beef prices also encouraged the use of pork, a cheaper substitute. Nonetheless, the significant outperformance of meats, especially lean hogs, over the agriculture sector may not last. Demand for meat is close to its seasonal peak and should gradually decline from there on. On the supply side, the rise in meat prices combined with the large drop in animal feed prices (corn and soybean) have increased farmer’s margins significantly, encouraging to rebuild the pork and cattle herd. While the virus could still have a negative impact in the short run on hog’s supply, improved efforts to fight the virus could trigger a rebound in the hogs herd. According to the American Association of Swine Veterinarians, the weekly case counts of infected swine dropped below 100 in five of the six weeks ended July 19th from a peak of 315 in mid-February. Moreover, the swine herd could rebuild at a relatively fast pace as fattening pigs need only to be 4 to 10 months old to be slaughtered. On the other hand, the best age to slaughter cattle is between 24 and 30 months. Thus, the cattle herd will take more time to rebuild. This should contribute to the outperformance of live cattle over lean hogs in the coming months. The increase in swine and cattle herds, encouraged by elevated margins, is likely to contribute in turn to stronger animal feed demand, adding support to corn and soybean prices. This could contribute to the outperformance of grain and oilseeds prices over meat prices in the coming months.

LME lead price could temporarily outperform LME zinc price

These past few days LME lead price started to outperform other base metals (except LME tin price), whilst it has lagged the sector performance alongside copper since the beginning of the year. Several factors could contribute to further outperformance of lead price.

First, lead and zinc prices have diverged since the end of 2013 as zinc fundamentals tightened significantly. This contributed to bring the lead-zinc spread into negative territory, while lead traded at a relatively stable premium over zinc since mid-2007 (+$130/mt). The price spread reached — $125/mt at the end of July — the lowest level since April 2010. The prices of these two metals have been moving alongside each other due to the fact that they occur together in mineral deposits and are therefore typically extracted from the same mines, and are both heavily influenced by the Chinese economic activity. Nonetheless, their physical characteristics and usage differ greatly. The divergence in prices has occurred due to the larger expected deficit in the zinc market than that in the lead market. According to the International Lead and Zinc Study Group (ILZSG), the deficit this year could reach 49’000 mt for lead and 117’000 mt for zinc. Furthermore, LME lead inventories have recently declined less rapidly than LME zinc inventories, confirming a larger deficit in the zinc market. Moreover, China is a net importer of zinc but a small net exporter of lead (despite an important 10% export tax).

However, the outperformance of zinc prices over lead may be close to an end. The price spread has moved too low too fast. Moreover, zinc may face some temporary downside pressure. Lower Shanghai zinc premiums, which recently dwindled to a 15-month low, are implying lower physical interest for zinc. Weaker SHFE-LME arbitrate opportunities could also discourage Chinese zinc imports. On the other hand, lead premiums have remained stable since March 2014. Lead has gained some traction in China, reflected by the important rise in the open interest on the Shanghai Futures Exchange lead contract. Lead should also benefit from stronger seasonal demand as electric bicycle consumption typically increase during the summer. Thus, these factors should contribute to a temporary outperformance of lead over zinc price. Nonetheless, zinc fundamentals remain stronger than lead in the medium run.

Chart of the week: Copper and lead are likely to catch up with the leaders

|

Base metals do tend to move in tandem, but at time-varying speed. Moreover, the sector leadership usually rotates. Nickel has outperformed the sector since the beginning of the year, contrasting with its poor performance between July 2012 and January 2014, when it lagged the sector. Zinc has also performed well these past months. On the other hand, copper prices, which performed well in 2012, gradually fell behind its peers. Nonetheless, current fundamentals are suggesting that both copper and lead, the laggards since the beginning of the year, could perform well in the coming weeks. This should allow them to catch up with the leaders in due time. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com