July 28, 2014

A road map of China’s recovery: better times for the next 4 quarters

Commentary by Robert Balan, Senior Market Strategist

"“Sell in May and go away” has long been a popular – if overused – mantra for equity market investors in the western world. But China works to a different calendar, one where the lunar new year often marks the start of a sell-off, while the third quarter presents an opportunity to buy back in.”

Josh Noble, China’s second-half rally becomes an annual event, Financial Times, July 23rd 2014

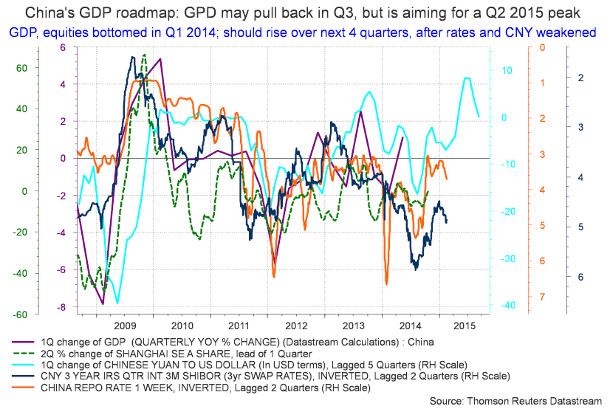

Regular readers of the Diapason Commodities Insight Weekly know that we have been enthusiastic about a China recovery since the start of the year, and have written a series of articles detailing the progress of the recovery and refining our improving outlook for China as more data flow in. Meanwhile, sentiment on China has improved tremendously since a better than expected Q2 2104 GDP, despite recent dire headlines of China's debt surging, which had not triggered a Chinese financial crash notwithstanding. What's more, Chinese equities are finally showing some upside momentum as the Shanghai Composite Index made a new 3-month high last week. We have further improved our China outlook and we now believe there is sufficient data to map a roadmap for Chinese growth over H2 2014 and until the early part of next year (see Chart of the Week).

The price of commodities linked to China, Chinese assets and Chinese-linked instruments are picking up speed. The DCI® Industrial Metals Index is one of the best performing commodity sector since the beginning of the year and rose by 5.5% year-to-date, confirming the recovery of the Chinese economy. The Shanghai Composite Index, which had suffered tremendously since 2009 due to the significant appreciation of the local currency (RMB) and the rise in domestic interest rates (and the consequent decline in M2 money supply), has started to get some traction. Repo and swap rates had peaked in January and had been falling since then. And the RMB, which had gained sharply since mid-2012 had also declined moderately since January this year, which was a part of the concerted effort by the PBoC to ease financial conditions. With China as the factory of the world, the currency exchange level matters a lot with regards to competitiveness. It should not be surprising therefore that the currency's FX rate has a profound impact on growth, and knock-on effects on rates, and consequently on the money supply.

The impact of lower rates and a weaker currency understandably lags behind, but mid-year 2014 is the right time when the easier financial conditions start to fully contribute to growth and help alleviate the dire conditions in the domestic housing market. Specifically, the fall in rates since January had stabilized house prices and real estate volume transaction data which are set to improved further during the second half of 2014. The year-to-year change in real estate new fixed assets investments made a trough in February and has been rising in the wake of falling rates. The bellwether cumulative amount of deposits and advanced payments (required before a new house unit is built) has been flat at the bottom of the range since April, but we expect it to rise during the H2 2014, as the lower interest rates since January makes housing loans more affordable. And most of all, the PBoC has told domestic banks to put a priority to mortgages, especially to first-time house buyers.

The improved China outlook over the next 4 quarters is not an isolated case of domestic, pumped-up recovery, otherwise the collective effort of the Chinese government to bolster the economy will amount to nought. Growth outside China is also picking up. This has contributed to help China macro data, which had beaten expectations. China’s 2Q 2014 GDP was a modest upside surprise, but a positive surprise was the July HSBC Flash PMI, which surged to an 18-month high of 52 from 50.8 in June (consensus: 51.0). Indeed, this data reinforced our belief that China’s growth bottomed in Q1 which was subsequently borne out the Q2 GDP numbers. Other indicators, specifically on China's real estate, provided clues that the sector will be less of a drag in Q3 2014, and may even start contributing to growth in Q4. Following these data, we upgraded our expectations for China GDP growth this year, from 7.7% - 8.0% to a trend in H2 to 8.7% - 8.8% — higher than in any six-month period since mid-2011.

Assets linked to Chinese and global growth such as commodities should therefore benefit from this situation. This should confirm our long-projected commodities outperformance over developed economies’ stock markets. Base metals and EM equities should continue to do well in that kind of regime. Our conclusion: we believe that the global business cycle has 3 to 4 quarters more of growth left, and its top could mark the peak of the global business cycle which started in early 2009. It could be a relatively strong period of growth before that peak nonetheless, as China will likely continue to benefit from accommodative central banks and from the strong Chinese government’s commitment to growth.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Thermal coal prices are likely to rebound

Newcastle thermal coal prices in Australia recently dwindled to the lowest level since the end of 2009, due to weaker demand for China amid plenty of supply. Nonetheless, coal prices could soon rebound due to several factors, which however are not expected to last. In the short run, the global coal market could move into a deficit due to a combination of seasonal factors, stronger economic activity and slower output growth. Several mining companies have indeed announced cut in staff, greenfield development delays or cancellations and reduced investment in existing projects in reaction to low coal prices. Australian companies have suffered not only from lower coal prices but also from the strength in the Australian dollar. This could lead to a slowdown in production growth while demand should be growing at more rapid pace in the coming weeks.

Indeed, Chinese thermal coal demand from the power sector could rebound due to the acceleration of the economic activity despite the growing reluctance to use this polluting fuel. The country has limited alternative available fuel in the short term. Nonetheless, Chinese coal-fired power plants are increasingly using, as a measure to reduce pollution, higher quality and less-polluting coal from Australia rather than low quality coal from Indonesia.

Moreover, Indian coal demand could also provide some support to international coal prices. India, the world’s third largest consumer, is becoming a more important player in the coal market — but remains small relative to China, which demand for coal accounted for 50.3% of global demand in 2013, while Indian coal demand accounted for only 8.5% of total. The election of Narendra Modi has increased expectations for stronger economic activity, which in turn should lead to stronger use of coal by the power sector. Coal-fired plants account for about two third of all generating capacity in the country. This could occur amid an important rise in demand due to the weak monsoon. The lack of rain is indeed putting pressure on the power grid as it reduces hydroelectricity generation and at the same time it is boosting demand for water pumping and air-conditioning. Moreover, coal inventories at power plants are at an alarming low level. About half of the power plants have inventories for a week or less. This tight situation should lead to stronger Indian coal imports. The latter should also be encouraged by the new government that have promised to reduce blackouts. The deficit of the Indian coal market should last as the lack of infrastructure and administrative delays are negatively affecting coal mines development. On the other hand, 80% of newly built power plants in the coming five years will use coal as fuel.

Another factor, which could push coal prices higher in the coming weeks, is the lack of coal inventories at US power plants. Indeed, inventories of coal have already declined sharply last year before coal demand surged at the beginning of the year due to the extremely cold temperature. This has contributed to bring US coal inventories at power plants to the lowest level since 2006. Contrasting with international prices, US thermal coal prices have increased reducing the incentives to export coal and boosting coal imports. Between January and May 2014, US thermal coal exports fell by 25% y/y. They are likely to fall further in the coming months.

These factors are likely to contribute to an upward move in coal prices in the coming weeks. However, the rally is unlikely to last due weaker coal demand next year. Indeed, coal demand from the US is likely to decline due to new environmental regulations, which should lead to an important amount of closures of coal-fired power plants, while the expected slowdown in economic activity in the US and in Europe should reduce further demand from these regions.

Uncertainty in Indonesia may weight temporarily on nickel prices

Nickel prices have been the second best performer within the commodity sector year-to-date (+34.6%). However, these past two weeks, they lagged the base metals sector. In fact, LME nickel prices have recently fallen below the $19’000 level, down from $19’990 in early July 2014, while other base metals prices have increased during this period. The underperformance has occurred despite no radical change in fundamentals. The nickel market is still expected to move into a slight deficit this year, following the Indonesian ban on ore exports. The deficit is expected to widen significantly next year if the ban remains in place.

Depletion of nickel inventories has nonetheless been less important than anticipated. While industrial nickel inventories have probably fallen, visible LME nickel inventories, typically used as a last resort, rose without major interruptions since the end of 2011, reducing concerns of supply shortages. But the major factor that contributed to the recent underperformance of nickel prices is the growing expectations of a possible restart of Indonesian nickel exports. Indeed, 2 mining companies recently agreed to pay the new 20% export tax to start shipping out of Indonesia iron, lead and zinc concentrate. This has increased expectations that Indonesia could soon export some nickel concentrates, especially to China, which use it to produce nickel pig iron. However, the escalating export tax, which should reach 60% in the second half of 2016, may prevent significant amount of concentrates exports.

Another fact which has contributed to add downside pressure on nickel was the recent attempt to get around the export ban on nickel ore exports by labelling a shipment as “iron ore”, while it contained a lower grade nickel ore — 1.5% of nickel and 50% of iron compared with 1.0 to 2.0% of nickel and 40% of iron in usual Indonesian nickel ore shipments to China. The quantity of the nickel ore exported is marginal. Nonetheless, these two events occurred while the presidential election was won by the more liberal candidate. With this more business-friendly environment, market participants have therefore priced a higher probability of the end of the Indonesian ban on nickel ore exports in the near future. This probability remains nonetheless low.

Amid this short term uncertainty, long term fundamentals remain supportive for nickel prices. Low nickel prices in 2012 and 2013 are likely to result in fewer greenfield nickel mines in the next three to five years. The acceleration of the Chinese economy should also have a positive impact on nickel demand growth. Thus, while nickel prices may underperform in the short run due to the political and legal (surrounding the two cases of ore/concentrates exports) uncertainty, the ban on unprocessed ore exports is unlikely to be removed, bringing the global market into a major deficit next year.

Cocoa prices could move higher, driven by strong demand

Stronger demand for chocolate is driving cocoa prices higher. In the second quarter, cocoa grinding accelerated in Asia. According to the Cocoa Association of Asia, cocoa grindings increased by 5.2% y/y in Q2 2014 in Malaysia, Singapore and Indonesia. Moreover, data from the US are also supportive for cocoa prices. According to the National Confectioners Association, North American grindings increased by 4.5% y/y in Q2 2014, mitigating slightly lower demand in Europe, where grindings fell by 0.7% y/y during the same period, according to the European Cocoa Association. Except for Europe, these numbers are confirming expectations of strong global demand growth for cocoa this year.

Strong demand has offset the impact of improving crop conditions in Ivory Coast, which is the world’s largest producer, accounting for 37.8% of global output. Rain in this region mixed with sunny spells has increased the chances of a strong crop. According to the International Cocoa Organization, Ivory Coast output could reach 1.55 million mt in the 2013-2014 season, up 7.0% y/y. This large rebound would follow two consecutive years of decline in output due to bad weather and the lack of investment following the 2011 civil war.

The cocoa crop remains nonetheless vulnerable to dry weather until the end of the main crop harvest in March 2015. But even without drier weather, the supply/demand balance in the cocoa market will remain tight. According to the ICCO, despite the rebound of cocoa output, the market is likely to face a deficit of 74’000 mt in the 2013-2014 season. This would be the second deficit in a row and should bring down global inventories to 1.5 million mt, the lowest level since the 2009-2010 season, adding upside pressure on cocoa prices.

Chart of the week: A weaker Yuan hints to stronger Chinese economic growth

|

A simple juxtaposition of the CNY's level changes with the Chinese GDP show that the currency's impact extends as far as 5 quarters into the future. This outlook, if the correlations continue to hold, provide a good road map of what to expect of China's recovery. This simple model tells us that the acceleration of China GDP may slow in Q3, but should rise significantly in Q4 2014. Another slowdown occurs in Q1 2015, but growth should extend gains into at least Q2 2015. Cyclical commodities and especially base metals are likely to follow the path of the Chinese recovery. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com