July 14, 2014

Tighter supply/demand, low inventories and high supply risks; the recipe for a significant rise in oil prices

Commentary by Alessandro Gelli, Energy Analyst

"When global spare capacity becomes very tight, the swing producers – Saudi Arabia above all – face a dilemma. If they increase production in the face of disruptions elsewhere, they may calm prices temporarily. But the market notes that spare capacity has shrunk further, thus increasing vulnerability to a further outage. This is a reason to leave 1 million to 2 million barrels per day untouched except for the most stringent emergencies – so spare capacity for ordinary market management may be effectively exhausted this summer.”

Robin Mills, Manaar Energy, June 29th, 2014

Brent price was under pressure these past two weeks following reduced concerns about the situation in Iraq and the Libyan government’s announcement that some major eastern ports would soon be restarted. This led to Brent losing about $8 per barrel. It is interesting to note that this followed the almost $8 upward move last month due to the deteriorating political situation in Iraq and improved economic conditions in Asia. This contrasted with the period of low volatility that we experienced since the beginning of the year as Brent prices remained in the narrow $104-$111 per barrel range. The recent rise in the oil price’s volatility was caused by the tighter supply/demand balance and is unlikely to disappear anytime soon. The volatility could even increase further as the oil market has entered a period where the balance between supply and demand is likely to be very tight.

Demand is growing seasonally on top of improved economic data, which are increasing expectations of stronger oil demand growth in the second half of the year. The International Energy Agency forecasted last month a rise in global oil demand to 93.6 million b/d in Q3 2014, up 1.5 million b/d from Q2 2014 and from Q3 2013, driven by non-OECD countries. Oil demand from non-OECD countries is likely to reach 47.3 million b/d in Q3 2014, up 1.4 million b/d y/y, due to stronger economic activity, following weaker growth Q1 2014. But it the seasonal rise in demand from OECD countries which should account for the bulk of the summer oil demand growth. Oil demand from OECD countries is expected to reach 46.2 million b/d in Q3 2014, up 0.9 million b/d q/q, due to the driving season. OPEC would therefore need to pump 30.7 million b/d in Q3 2014, from an estimated output of 30.0 million b/d in Q2 2014, to meet global oil demand.

Moreover, this is occurring while supply disruptions are at elevated levels. According to the EIA, global crude oil supply disruptions have averaged 3.2 million b/d since the first half of the year due to the unstable political situation in Libya, Iraq and Yemen, the civil war in Syria and in South Sudan, international sanctions against Iran, oil theft in Nigeria and renewed attacks against the oil infrastructure in Colombia. Global disruptions reached 3.3 million b/d in June 2014, due to more important outages in Iraq and in Colombia. Last year, global supply disruptions averaged only 2.3 million b/d between January and June 2013. Moreover, North Sea’s oilfields are performing seasonal maintenance during the summer, leading to lower crude oil output, during a period of high refining activity. According to preliminary assessment, crude loading in the North Sea is expected to fall to 1.7 million b/d in August 2014, down 300’000 b/d from the 2014’s high made in March.

Another supportive factors and a major difference with last year is the significant reduction in visible petroleum inventories. OECD commercial crude and petroleum products inventories stood at 2.6 billion barrels at the end of March 2014, down 114.1 million barrels from the 5-year average (-4.3%), a low level. High frequency data also showed last week low global petroleum products inventories, down 5.9% from the 5-year average and down by 2.5% y/y. The restart of Libyan crude oil exports, if confirmed, are likely to be gradual and it may prove insufficient to meet stronger oil demand during the summer. This is why we expect Saudi Arabia to increase its crude oil output in July and August in order to meet domestic and foreign demand. Saudi oil demand indeed increases significantly during the summer as direct crude burning by the power sector increases due to power peak demand and the lack of alternative fuels.

This reduction in Saudi spare producing capacity, estimated at around 2.5 million b/d in June, would also add upside pressure on oil prices as the oil market would be more vulnerable to a supply shock. Indeed, geopolitical risks are also not far away and could rapidly come back as the Iranian nuclear negotiations, which should end on July 20th, are unlikely to succeed and the situation in Israel or in Iraq could spread throughout the MENA region, which accounts for 40% of oil traded internationally. Brent prices could therefore soon retest last year’s high at $117 and move towards the $120-125 area by the end of the summer.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Is it Aluminium’s turn to shine?

Aluminium prices finally started to catch up with other non-ferrous metals. Indeed, LME aluminium prices rose by 10% from its May’s low, outpacing the LME Index (composed of copper, aluminium, tin, zinc and nickel), which rose by almost 7% during the same period. In the past two months, only zinc prices outperformed aluminium prices. This is contrasting with the poor performance of LME Aluminium price these past 24-months, when it lagged the base metals sector.

The aluminium market suffered from a surplus due to the overcapacity of Chinese smelters and their lack of discipline to reduce output in face of low prices. According to the World Bureau of Metal Statistics, global production of primary aluminium rose to 47.7 million mt in 2013, up from 46.3 million mt in 2012, driven by stronger Chinese output, which reached 22.0 million mt (+8.9% y/y, or +1.8 million mt). The increase in Chinese aluminium output has contributed to an important rise in inventories last year. Aluminium inventories at major exchanges reached a record high level in July 2013 at 5.9 million mt.

However, the market’s conditions have gradually improved these past few months. The aluminium surplus is now likely to be smaller than initially expected due to the combination of lower supply and stronger demand. Margins for aluminium smelters declined due to the Indonesian ban, which added upside pressure on bauxite prices and because of lower aluminium prices. This contributed to the closure of the least efficient smelters. About 2 million mt of smelting capacity in China has shutdown between late 2013 and May 2014. Moreover, smelting capacity outside China is expected to decline by 1.5 million mt this year. Amid production capacity cuts, demand for aluminium has picked up — +5.2% y/y in the first 4 months of 2014 vs –5.2% y/y during the same period in 2013, driven by stronger demand from the transportation sector. Global vehicle sales were up 2.5% y/y in May 2014 and were on average between January and May 2014 up 4.1% y/y. Rusal, the world’s largest aluminium producer, estimated the global market ex-China should move into deficit, which could reach 1.3 million mt this year and 985’000 million mt next year.

Aluminium inventories at major exchanges dwindled sharply due to lower supply amid rising demand and also as some aluminium was moved into bonded warehouses. In the second week of July, aluminium inventories at major exchanges reached 5.4 million mt, the lowest level since October 2012. The tighter supply/demand balance is also reflected in the rise to record high levels of aluminium premiums in Japan, Rotterdam and Singapore. These physical premiums, which are paid on top of LME prices for ready delivery, are suggesting that the upward move of aluminium prices isn’t over.

However, Chinese aluminium production could rebound. About 700-800’000 mt of capacity could restart in China in the second half of the year if prices continue to increase. Moreover, some local governments are encouraging their industry by implementing subsidy on power, which is the main cost for aluminium smelters. Nonetheless a 15-20% upside move from current prices isn’t impossible under current conditions.

The weak Indian monsoon is starting to impact commodity markets

This year, the monsoon in India, which usually occurs between June and September and typically provides more than 70% of annual rainfall to the Indian subcontinent, has started on a weaker note. Indian rainfall has been since the beginning of June 43% below average for this time of the year. This is increasing the probability of drought in the coming months — currently at 60%. Moreover, the possible occurrence of El Niño would bring additional dry weather and hence further increase the probability of drought.

A major drought in India could have a significant impact on commodity supply and demand. In the agriculture sector, a drought would have a negative impact on the sugarcane output. India is the world’s second largest sugar producer after Brazil and accounted for 15.4% of global sugar production in 2013. According to MacQuarie, the sugarcane crop is the most vulnerable to El Niño. The latter would also negatively affect the sugar crop in Thailand, which is the world’s fifth largest producer.

Moreover, the weak monsoon is likely to have a negative impact on India’s grains production, especially on rice and wheat crop. India is the world’s second largest milled rice producer after China and the world’s third biggest wheat producer after the European Union and China. Concerns about the weak monsoon has led the Indian government to hold on to supplies of rice and wheat. This should lead to lower rice and wheat exports and should hence have an important impact on grains market. India is indeed the world’s largest exporter of rice and its wheat exports reached last year 3.7% of global wheat exports. India has become only recently a wheat exporters as a ban on wheat exports was lifted in September 2011. The Indian government typically buys a third of domestic grain production in order to maintain buffer stocks. Concerns on grains supply have arisen after delayed planting of the summer rice crop in eastern India due to the lack of rainfall.

Furthermore, the weak monsoon is likely to boost fossil fuel consumption. The resulting lower hydroelectricity generation will increase the use of coal and diesel-fired power plants. At the same time, power demand is likely to increase due to rising air-conditioning demand and especially due to the more important use of water-pumping equipments. The last major drought in 2012 contributed in a significant rise in diesel demand, which increased by 150’000 b/d y/y between June and August 2012, while it grew by only 90’000 b/d y/y during the rest of the year on average. The confirmation of a drought would thus be supportive for commodity prices and especially for wheat, sugar, and oil as these commodities are already experiencing a tighter supply/demand balance.

Chinese commodity imports should rebound in July

Last week, widely followed data on Chinese commodity imports were released and showed a decline in imports of key commodities. Crude oil, iron ore, steel products and copper imports indeed dwindled in June, increasing concerns on the health of the Chinese economies. However, it was mainly short term factors that contributed to these weak numbers. Imports for these commodities are likely to rebound in July.

Crude oil imports fell by 10.7% m/m to 5.7 million b/d. This was due to higher oil prices, which discouraged crude oil purchases for new refineries and for strategic petroleum reserves. Since the beginning of the year, the Chinese government has started to fill up new storage facility used as strategic petroleum reserves. But the government typically slows down such purchases when prices are considered too high. Moreover, demand for crude oil declined due to the refining maintenance season. According to the International Energy Agency, Chinese refining activity should have reached 9.6 million b/d in Q2 2014, down from 9.8 million in Q1 2014. However, the recent correction in oil prices are making crude purchases by the Chinese government more likely, while Chinese refining activity is expected to increase to 10.0 million b/d in Q3 2014. These factors should lead to a rebound in crude oil imports in July.

Copper imports also dwindled to 350’000 mt, the lowest level since April 2013, down 100’000 mt from April. This again was caused by factors which are unlikely to persist. Copper imports suffered in June from the tight credit conditions, following the metal financing probe at the Qingdao port. Moreover, weak arbitrage opportunities and physical premiums in April had a negative impact on June’s copper imports as it usually takes 1-2 months to ship copper to China. Premiums at bonded warehouse also fell in China, below several alternative destinations in Asia and Europe. However, credit concerns have eased as metal financing is moving to more regulated areas — Shanghai bonded warehouses are more regulated than the ones in Qingdao. Premiums in Shanghai have rebounded back to May’s 2014 highs. The SHFE-LME arbitrage combined with the physical premiums is slightly positive, which is a significant improvement from March-April’s low levels. On top of this, the Chinese economic activity is expected to accelerate in the coming months. These factors are likely to trigger an important rebound in Chinese copper imports.

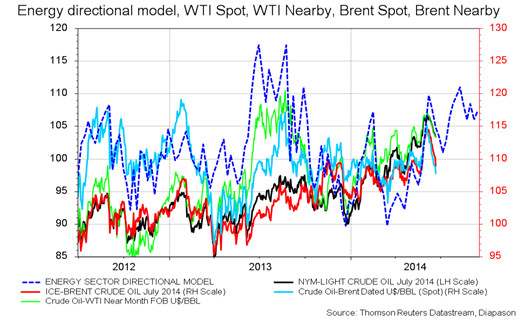

Chart of the week: Oil prices are likely to rebound and could retest last year’s high

|

Oil prices have recently fallen to interesting entry levels. Moreover, the correction allowed to wash out net long speculative positions which had reached a record high level on Brent at the end of June 2014. This allowed Brent prices to leave overbought territories. Our energy model also expects oil prices to rebound soon and to retest by the end of Q3 2014, last year’s highs at $117 for Brent and $110 for WTI, driven by the tighter supply/demand balance, low inventories and persisting geopolitical risks. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com