June 30, 2014

The USD faces a perfect storm

Commentary by Robert Balan, Senior Market Strategist

"Overall, this is a perfect storm for the buck right now: data is not consistent to instil confidence in the US recovery story; yields remain extremely low, which is allowing other currencies to make headway against the buck, and low volatility is muting the prospect of a near-term change in trend.”

Kathleen Brooks, Forex.com, May 7th 2014

The favorable environment for commodities is likely to extend for at least three more quarters, and this trend should be hastened along by what we believe is an imminent decline in the US Dollar. This may seem surprising since we are seeing global, Chinese and US growth recovering in H2 2014, but the summary of expected conditions in the second half of the year, specifically Q3, suggests a weak period for the US currency.

US growth, which is often wrongly considered as a key factor for the US Dollar, has very little positive correlation with the currency, and in fact, the stronger correlation bends towards negative. This is due to the impact a strong USD has on the country's net exports, which is a direct component of GDP. The belief that a currency's valuation equates to the country's output is patently wrong, especially in the case of the primary reserve currency, and this is very easy to prove empirically. In fact, the only growth that matters to the US currency is growth outside the US, which tends to have a more important negative correlation with the USD, due to capital flows (carry trade). Our belief is that China's growth, which is fuelling the global economy, is on the upswing in H2 with upside risks. Furthermore, other large emerging economies are showing signs of accelerating growth, following a slowdown that started last year.

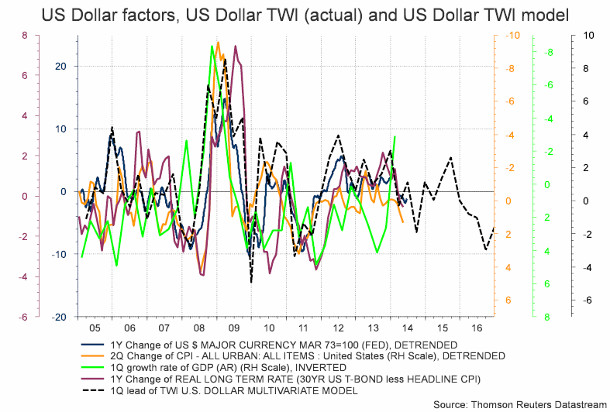

Moreover, we have seen analysts arguing that the recent sharp rise in inflation and inflation expectations are positive for the US currency. This too stems from the faulty notion discussed above that a country’s growth is a positive motive force for the currency. Stronger growth, the reasoning goes, generates inflation, which motivates the central bank to tighten monetary policy, verbally or otherwise, which leads to a US Dollar appreciation. There is nothing that is more egregiously wrong than this notion — a simple, inverse juxtaposition of the Headline CPI and the US Dollar Trade Weighted Index (TWI) will show how good the negative fit is. The reality is that CPI inflation is neither a cause nor an effect of the US Dollar evolution — it is simply a negative coefficient or a modifier of the currency — a strong rise in the CPI, which we have been expecting for some time, will very likely add downside pressure on the US currency later in the year. Furthermore, higher nominal rates do not necessarily impact the US Dollar positively — it is real rates that the US currency is positively correlated with.

So another negative factor that the US currency faces is the likely decline in real long rates. Last month, we made the case (see Commodities Insight Weekly, “Commodities should soon benefit from lower real rates”, May 26th 2014) that real interest rates were likely to decline and that would serve as a catalyst for a rise in commodity prices. The downward move of real rates is resulting from higher inflation and also a further decline in rates as the US economy is showing signs of weaknesses and its growth could peak in the second half of the year.

Finally, we presented last week the reasons why the EUR/USD is likely to strengthen in the coming weeks due to the expected, more important Chinese interventions in the FX market (See Commodities Insight Weekly “Euro could surprisingly strengthen in the second half of the year, driven by further increase in Chinese FX reserves”, June 23rd, 2014). This would add further downside pressure on the US Dollar.

If the current situation persists, and we believe rates will continue to decline in early Q3, during a period when we expect CPI inflation to rise sharply as well, then real long rates will decline faster and further in Q3. Coincidentally, we also expect US growth to peak in late Q3 or Q4, while the global economy ex-US is likely to accelerate. These factors combined with a stronger Euro are likely to lead to lower US Dollar until the end of the year and therefore provide a more supportive climate for commodities.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

US starts exporting condensate but not yet crude oil

Last week, the Bureau of Industry and Security of the US Department of Commerce gave the permission to Pioneer Natural Resources and Enterprise Products Partners to start exporting in August condensate from south Texas’ Eagle Ford Shale formation to foreign buyers. This action was interpreted as a move closer to the end of the crude oil exports ban, which is in place since the 1970s. However, the US government only allowed the export of condensate, but not crude oil. In fact, the situation has been confused by several press articles, which wrongly stated that the US government had allowed these companies to export “crude oil”.

Condensate is typically a light hydrocarbon in a gaseous form on the ground and condenses into a liquid when it is extracted alongside crude oil and natural gas. It is also produced in stabilizer units designed to separate natural gas from heavier hydrocarbons. Lease condensate has typically low sulphur and a significantly lower density than light crude oil and is chemically closer to some light petroleum products. It is hence different from crude oil but it was treated by the US government like crude oil. Furthermore, before being exported, the condensate needs to pass through a stabilizer to separate lighter and more volatile components in order to make it stable and safe for transportation.

The quantity of condensate produced in the US is estimated at about 1.2 million b/d, while US crude oil production (including condensate) stood at 8.4 million b/d in May 2014, according to the US government. However, this doesn’t mean that this will all be exported. Indeed, only two companies have received the approval to export condensate. It remains to be seen if the US government will give exports’ approval to other companies. Moreover, only the condensates along the Gulf Coast are likely to be exported. Condensate produced in the Midwest and especially in North Dakota are unlikely to be transported to the Gulf Coast to be exported. Some of the condensate produced in the Midwest is already been exported to Canada, where it is used as a diluent in order to facilitate the transportation of oil sands by pipeline. In fact, this is one of the primary use of condensate. The international oil market is therefore unlikely to be significantly affected by the export of US condensate, which are close to some light petroleum products such as natural gasoline (also called plant condensate) that the US already exports.

The end of the strike in South Africa won’t prevent a major deficit in the Platinum market

Last week, unions and the largest producers of platinum in South Africa reached an agreement, after a five-month strike. The strike, which lasted longer than initially anticipated, had a major impact on platinum supply as the country’s mine production of 4.3 million ounce in 2013 accounted for 72% of global platinum mined output. Despite the strike, platinum prices have not made a great performance since the beginning of the year as they rose by only 8.1%, lagging palladium prices, which rose by 16.8% during the same period. This occurred while the platinum production loss caused by the strike is estimated at around 1 million ounces, almost a quarter of South African platinum yearly production. This had a limited impact on platinum prices as the strike was widely anticipated by market participants, leading to stockpiling.

Nonetheless platinum production isn’t expected to move back to its pre-strike level until September, as miners are gradually coming back to mines and safety checks need to be made. Thus, supply disruptions are likely to persist, while inventories built before the strike have declined sharply. The need to replenish inventories amid persisting strong demand from the automobile sector should lead to stronger demand for platinum in the second half of the year. The platinum market is hence expected to face a major deficit this year even if the strike in South Africa has ended.

The deficit in the platinum market could reach 1 million ounces, which would be the largest deficit ever recorded. This should provide upside potential on platinum prices as any further supply disruption would tighten an already tight market. Moreover, the case of platinum is not isolated. The palladium market is also expected to face a considerable deficit this year due to the strong auto sectors in China and in the US, which is boosting palladium demand amid growing supply risks as tensions between Europe and Moscow could affect Russian palladium exports. For the coming weeks, the PGMs are hence supported by strong fundamentals.

Despite weak fundamentals, downside risks is limited for soybean prices

CBOT Soybean Futures price fell sharply from its high made at the end of May 2014. This followed a major price rally since January 2014, when soybean price increased by more than 20%, driven by dry weather in the US and in Brazil — the world’s two largest soybean producers. But the wetter weather conditions, especially in the US, and recent field reports are suggesting that these concerns over the soybean crop were exaggerated. According to the US Department of Agriculture, 72% of soybean crops in the main US growing areas were rated good or excellent as of June 22 — the highest level for this time of the year since 1986. The improved growing conditions are hence increasing expectations that the soybean crop could be significant.

The soybean market was in deficit the previous three years, leading to a significant upward move in prices. In response to these higher prices, US farmers have increased soybean planting to a record level this year (40.0 million hectares, up 6.5% y/y). The improved weather is having a significant impact on soybean prices as we are in the middle of the planting season in the US. On top of record planting, the improved crop conditions are expected to lead to a record high yield (to 3.0 metric tonnes per hectare, up 4.2% y/y). Thus, US soybean crop is expected to reach 98.9 million tons, a new record high level and up by 10.5% y/y.

Moreover, contrasting with wheat, soybean crops were not affected by heavy rains. Another downside factor for soybean is the likely occurrence of El Niño, which would bring wetter weather. This may contribute to higher yield if it occurs during the flowering stage between July and August. Furthermore, this could have a positive impact on South American soybean production. However, due to the past years deficit, demand for soybean is strong. China is rebuilding soybean inventories as its stock-to-use ratio fell to 58.5 days this year, the lowest level since 2008. This should provide a strong support to soybean prices as China is likely to increase soybean imports if prices decline significantly from this level.

Charts of the week: A lower US Dollar should be expected by the end of the year

|

Several factors should contribute to a decline in the US dollar in the coming weeks. Stronger growth outside the US, higher inflation and weakening interest rates (leading to significantly lower real rates) are occurring, while the Euro is likely to move upward in the coming weeks. The decline in the US dollar is likely to continue until the end of the year as suggested by our model. In this environment, commodity prices should perform well. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com