June 23, 2014

Euro could surprisingly strengthen in the second half of the year, driven by further increase in Chinese FX reserves

Commentary by Robert Balan, Senior Market Strategist

"By most accounts, China likely doesn’t want to keep its increased stash of greenbacks. Traders and market participants on the front lines speculate that the U.S. dollars have been used to buy U.S. Treasuries and have been swapped for euros, adding to demand in those markets.”

Saumya Vaishampayan and Ben Eisen, MarketWatch, June 16th, 2014

The Euro has been moving lower since the beginning of May 2014, when the ECB President signalled the implementation of looser monetary policy to combat low inflation. But one of the unspoken objectives of the ECB's recent monetary policy easing is to weaken the euro's exchange rate, especially against the US Dollar. A weaker euro would help the ECB achieve its higher inflation goals and at the same time it could boost the export sector. In some respects, the effort to reduce the Euro has succeeded in the short-term, but it looks like it may be failing to attain its objectives in the intermediate term. The EUR/USD has recently moved upward, due to the recent FOMC announcement that it will keep interest rate near zero for a “considerable time” after the taper’s end.

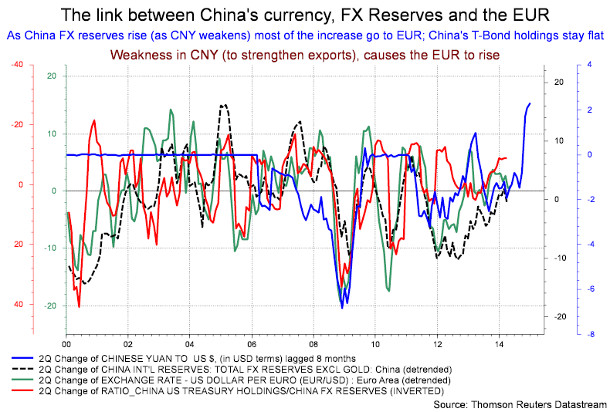

The continuing EUR strength, experienced since mid–2012, has puzzled many analysts. The rationale offered for the EUR outperformance has ranged from real interest rate differentials to the widening gap between the balance sheet of the Fed and that of the ECB. All of these may be true, but there are several other elements which contribute to the strength of the euro, which deserve to be examined critically — the recent decline in the exchange rate of CNY, and the subsequent increase in China's international FX reserves, for instance. To weaken the CNY or to keep it from strengthening, the People’s Bank of China buys foreign currencies – usually US Dollars – and these purchases help boost its currency reserves. Bloomberg reported that China has added $126 billion to a record $3.9 trillion in Q1 this year alone. This is a significant amount as China holds about a third of the world’s international reserve assets excluding gold. However, the PBoC has been holding the proportion of its US Dollar-denominated assets fairly constant over the past four years, and to prevent the US Dollar's share in its reserves from rising, the central bank has to sell USD it had acquired for other currencies, mainly the EUR.

Our work on the subject suggests that this is exactly the mechanism which the PBoC utilizes to prevent the CNY from appreciating, or to make it weaker in the FX markets. In the chart which we present below, we show evidence that periods of USD strength against the CNY have also been periods when the euro has appreciated against the US Dollar and other currencies. The chart supports this hypothesis in other ways as well — the changes in China's international FX reserves correspond very well to the changes in EUR/USD since 2000. To add further evidence, the changes in the ratio of China’s US Treasury holdings — value-wise — over China's total FX reserves also correspond to the changes in EUR/USD and the changes in the USD/CNY after a lag.

The imperatives of the PBoC of course collide with the unspoken desire of the ECB to tamp down the value of the EUR. And we believe that this development will pose more problems for the ECB as we expect China to keep the CNY value weaker in the intermediate term. The recovery in China has not yet fully taken hold, and the export sector needs all the help it can get, in terms of credit and a weaker currency to sharpen the sector's competitiveness. It will not surprise us — but it could surprise many market actors — if this mechanism will support the EUR exchange rate against the US Dollar and other major currencies during most of H2 2014. Naturally, the resulting weaker US Dollar would have a positive impact on commodity prices. The weakness of the US Dollar is one of several factors such as the acceleration of the Chinese economic activity and stronger growth in OECD countries, which are likely to lead to a major upward move in commodity prices during Q3 2014.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Iraq: long term risk rather than short term supply disruptions

Brent prices moved higher last week driven by concerns surrounding Iraq amid a tightening supply/demand balance. The Islamist State for Iraq and Syria (ISIS) has taken control of some areas in the northern part of the country. This had little impact on Iraqi crude oil production as some of the northern fields were already idle due to the shutdown of the Kirkuk-Ceyhan pipeline. The Kirkuk-Ceyhan, which is under control of ISIS and previously transported about 300’000 b/d of crude oil, was attacked in March 2014 and remained shut as security issues prevent work to repair it.

The ISIS’ attack on the 300’000 b/d Baiji refinery, Iraq’s largest refinery, forced the facility to shut in and could lead to a further drop in northern Iraqi crude oil production due to the lack of connection with the southern Iraqi pipeline network. Nonetheless, last week, the Kurdish Regional Government (KRG) took control of Kirkuk and the surrounding oilfields, which could be connected to the Kurdish pipeline system. The KRG has completed, at the end of last year, a new pipeline connecting its fields directly to Turkey, and hence bypassing the region of Mosul. With this pipeline and Kirkuk oil, the KRG could boost the pipeline’s flow to its maximum capacity at around 400’000 b/d.

Moreover, while tensions are rising in the northern part of the country, crude oil exports from the south are expected to reach a new record high this month at 2.8 million b/d due to the start of a new 800’000 b/d single point mooring system jetty (an offshore crude oil loading terminal). The previous high was reached in February 2014 at 2.6 million b/d. Thus, the recent developments in Iraq are having a very limited impact on Iraqi crude oil supply.

On the other hand, this is having a more important impact on the medium and long term outlook of Iraqi crude oil production growth. Indeed, due to its vast reserves and investment made by foreign companies, the country was expected to become one of the largest contributors to global supply growth in the coming years. The deterioration of the political situation is discouraging the massive investment required to boost output. This forced the International Energy Agency to revise its outlook of Iraqi crude oil production capacity growth lower by 500’000 b/d. It now expects production capacity to reach 4.5 million b/d in 2019, lower than the government’s estimate of up to 9.0 million b/d by 2020. According to Energy Intelligence Group, Iraqi crude oil production stood at 3.4 million b/d in April 2014.

Medium term fundamentals remain strong for copper

Since the beginning of the year, the copper market is in a deficit, leading to an important reduction in inventories. Copper inventories at the LME and the Shanghai Futures Exchange indeed dwindled by respectively 73.5% y/y and 55.3% y/y. They fell last week to 259’000 mt, the lowest level since October 2008. This was partially mitigated by the rise in Chinese copper bonded warehouses stocks, which rose by 94.1% between Q3 2013 and Q2 2014 to 825’000 mt and fell to 810’000 mt last week. Copper inventory on major exchanges and in Chinese bonded warehouses fell from 1.6 million mt in Q1 2013 to 1.1 million mt by mid-June 2014. The amount of copper in bonded warehouses is likely to be moved to the more regulated LME warehouses due to the recent financing metal fraud.

The metal’s price has suffered from the investigation about copper in warehouses used as collateral. Indeed, batches of copper held in inventories have been used several times to get bank loans. This led to increased concerns about the use of metals as collateral and should lead to more stringent controls over financial operations linked to base metals. The financial scandal could therefore lead to lower imports of base metals. In May 2014, Chinese copper imports already dwindled by 15.6% m/m to 380 mt and hence could fall further in the coming months. Nonetheless, this setback for copper prices isn’t likely to last as medium term fundamentals are improving.

According to the World Bureau of Metal Statistics, the copper market was in deficit three out of the four first months of this year. With demand outpacing production by 71’500 mt, the copper market has experienced, during the first four months of 2014, its largest deficit since 2004. This has contributed to an 8.3% rise in LME copper prices between mid-March and the end of May 2014, before the metal probe occurred. However, copper prices remain at a relatively low level, down by more than 30% from the 2011 high of $10’160/mt. The metal has an important upside potential, as we expect the Chinese economy to accelerate in the coming months. The tighter supply/demand balance is already reflected in the curve of LME copper futures prices, which is in backwardation.

Copper prices could experience some further downside pressure in the coming days due to the development of the metal probe in China. However, this would offer interesting entry opportunities to benefit from the acceleration of the Chinese economy, while the copper market is already in a deficit.

Higher upside risk on wheat prices

Rain in the US Midwest increased concerns last week that the wheat harvest could be delayed, which could cause a deterioration of the crop quality. Rain can have indeed a major impact on the harvest of winter wheat, which typically occurs between May and July. Oklahoma and the southern part Kansas, which are the US’ largest winter wheat growers, have been particularly hit by the rain. According to the USDA, the percentage of winter wheat harvested reached two weeks ago 16%, while during these past five years it stood at 18.6% for this time of the year. This has triggered a rebound in wheat prices, which had been falling since the beginning of May due to the expected large surplus for this year. Global inventories are expected to rise by 6.1% y/y this year and by 1.5% y/y next season.

However, it is the wheat crop quality which is at risk more than the amount produced. This is reflected by the higher premium of higher protein wheat over wheat of lower quality. The premium of Kansas wheat over the Chicago wheat indeed increased to its highest level since 2011 as the Kansas wheat has a more important protein content and can be used by millers to produce flour for human consumption. On the other hand, the Chicago wheat is only used as animal feed. The decline in quality caused by the possible delayed harvest could reduce the amount of high protein wheat available for human consumption.

The quality issue could increase further if El Niño appeared before the end of July. Indeed, this meteorological phenomenon would lead to more rain than normal over North America and hence could lead to further delay in harvesting. However, if El Niño occurs after July it would have no negative impact on the US wheat crop but would harm wheat crop in Asia and Oceania. Last week, the Australian government cut its wheat crop outlook due to the dry weather and the risk of the apparition of El Niño, which could increase the risk of droughts. China and India’s wheat crops are also vulnerable to El Niño, which has a 70% probability to appear this year according to the Australian government. Thus, the risk of lower quality of the US wheat crop adds another upside risk pressure on wheat prices.

Charts of the week: Higher China FX reserves translate into a stronger EUR

|

One of the primary factors that has been supporting the EUR vs the US Dollar has been the policy of the PBoC to limit China’s exposure to US Treasuries. The recent policy of the Chinese central bank to keep the exchange rate of the CNY low to preserve export competitiveness has boosted international FX reserves. But instead of putting the increments towards US denominated assets, the PBoC has been putting them mostly in EUR. The chart below illustrates the mechanism. This will help the EUR/USD appreciate later in the year — mostly in Q3. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com