June 9, 2014

Falling bond yields: what does it say about equities and commodities

Commentary by Robert Balan, Senior Market Strategist

"The story about corporate Defined-Benefit pensions drifting toward Liability Driven Investing . . . is causing some traders to question short positions in the long end . . . and trying to figure out the math behind the potential differentials between net demand and net supply compared to the existing float of available high quality long-dated bonds. They are coming to the conclusion that demand exceeds the amount of secondary market securities outstanding. I remain a bond bull.”

Guy Haselmann, Scotiabank, April 2014

Is the fall in bond yields currently telling us one thing and the level of equity and commodity indices another? Maybe all of them are telling us the same thing. Despite moving higher, the equity market's internals have not been looking good lately, and the macro data that matters to growth and output had been dipping into negative territory as well. So falling yields may be the bond market's way of signalling that stormy weather might be lurking, but at the far horizon.

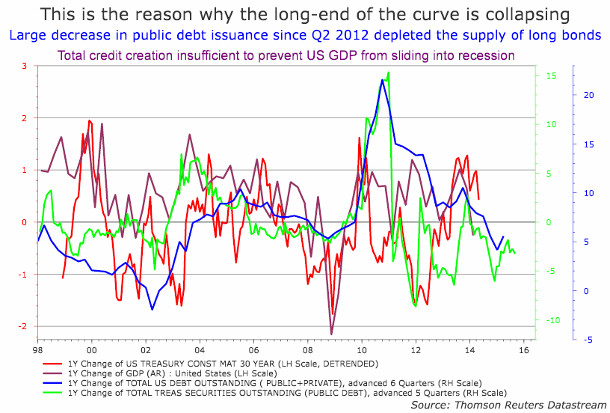

Historically, declining bond yields are often associated with future weak economic growth and falling equity prices — that is the immediate rationale that comes into mind, given that yields are currently low and are still falling. There are several reasons why bond yields have been falling for a while. The supply of US public debt (especially in long bond issuance) has been collapsing since Q2 2012, as the budget balance started to improve and deficit spending started to narrow. This depleted the supply of long-term risk-free assets. The US economy started to show stress primarily due to declining total credit supply — as deficit spending narrowed — total credit issuance including private debt has been collapsing since Q2 2012. The US economy was literally being starved of credit. With the signs of economic stress increasing, those who want to hedge or go to the safety of long bonds have to deal with diminished (and still falling) supply. Increasing demand vs diminishing supply equals higher prices. Bond bears who went short now add to the demand for the diminishing long bond supply if they want to cover their short positions at the long end.

Concerns about growth are confirmed by our modelling work. Our model of the US GDP shows that growth will probably top in Q3 2014, and from there decline to negative growth in Q1 and Q2 next year. Our US NIPA corporate profits model also suggests that we have seen the top for the year and will henceforth decline to sub-zero levels during H1 2015. What both models are telling us is that while we may not have seen the peak in equity markets yet, we have already seen the best contributions from the profit side, and all that may sustain equity markets to a peak in Q3 or thereabouts, is investing momentum. If this is indeed the case, then it makes perfect sense for yields to decline (further) while equities will show some old age discomfort every now and then and correct lower, but still have some oomph left for a final distribution activity phase later in Q3 or early Q4. This could hence explain why equities are moving higher even as bond yields are falling.

The relationship between falling yields and commodity prices on one hand has a positive context, while the relationship between falling yields and equity prices, on the other hand, has more negative connotations. To put it simply, the impact of falling real yields on commodities is positive, while its impact on equities is negative. The transmission mechanism in both cases is through the real rates or real yields — real rates are negatively correlated with commodities while it is positively correlated with equities. In the Diapason Commodities Insight Weekly, two weeks ago ("Commodities should soon benefit from lower real rates") we documented the outlook that real yields will likely fall further in the medium-term, and that the decline may accelerate as bond yields fall further and CPI inflation could rise quicker than the market expected.

If that is indeed the case, then falling yields will continue to benefit commodities, while it becomes a negative factor for equities. Falling yields (accompanied by flattening yield curves) warn of intermediate negative growth shock so it impacts equities in that respect (equities discount future growth). Commodities, on the other hand, celebrate the lower cost of carry and lower cost of financing of inventories accruing from falling nominal (and specially real) rates, driving prices higher. Proof? Backwardation becomes prevalent as declining real yields tend to discourage extraction and boost demand through inventory building.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

Crack spreads are likely to decline in July

US crack spreads remained at a relatively high level due to strong US and foreign demand amid low US petroleum products inventories. These elevated margins should encourage US refineries to increase further crude runs, which are already at an elevated level. Refinery utilisation rates reached 90.8% in the last week of May, close to record high level reached in 2012 for this time of the year. However, European refineries are exposed to lower refining margins due to maintenance work in the North Sea and the lack of Libyan crude oil supply and low diesel prices in the region. This has prompted refiners to announce a decrease in crude runs in the summer. While refinery utilization rate in Western Europe averaged around 83% last summer, it could fall to around 75% this year. Lower refining activity in Europe is contrasting with the situation in the US, where refineries are benefiting from low input costs due to the tight oil boom.

European refiners are also facing more competition from large crude oil exporter such as Russia and Saudi Arabia, which are increasing their refining capacity. Indeed, investment in the downstream sector, encouraged by the Russian government, has allowed Russian refiners to increase the output of petroleum products of high quality, boosting margins. This has encouraged higher refining activity in this country. In May 2014, Russian crude runs reached 5.8 million b/d, up 340’000 b/d y/y. They are likely to rise further and peak in August. Russian crude runs reached at 5.9 million b/d in August 2013.

Furthermore, the start of the large 400’000 b/d Jubail refinery in Saudi Arabia in November 2013 has contributed to boost Saudi crude runs to 1.9 million b/d in Q1 2014, up 400’000 b/d y/y. Saudi crude runs are likely to increase and could peak in July-August. Both Saudi and Russian refineries are designed to maximise the production of middle distillate such as diesel and jet fuel, while at the same time it reduces their capacity to export crude oil. Artificially low domestic crude oil prices allow these refiners to be insulated from international crack spreads, which are hence likely to suffer from high refining activity in these countries and in the US.

Zinc supply issues to support prices within the coming two years

Zinc prospects appear bright for the next two years, although the metal’s performance has been lacklustre so far this year. We believe that zinc is set to outperform within the next two years on supply exhaustion. On the other hand, the long term prospects (beyond 2016) should be less favourable to zinc as the up run in prices should allow zinc smelters to develop new capacities. Zinc should not be the “new copper” but should be considered as a buying opportunity given the supportive supply/demand picture expected this year and next year.

Although the magnitude of the supply crunch is uncertain (as estimates vary between 1 million tonnes and 2.5 million tonnes by 2016), the consensus is extremely strong that the market will report a deep deficit over the next two years. Some very important mines have closed or are about to close due to the ore exhaustion and crashing ore grades. Brunswick and Perseverance mines in Canada have closed for a combined production loss of 316,000 tonnes; Australia’s 500,000 tonnes per year Century mine, the world’s third largest zinc mine, is expected to be close mid-next year. In Ireland, Galmoy and Lisheen mines should remove 350,000 tonnes from the market.

On the other hand, very few projects should be able to compensate for these production losses in the short term. As prices remain near their marginal cost of production, producers have not been incentivised to develop new projects. According to WoodMackenzie, a price of $2,160/tonne is required to develop new projects… for a 2019 start up.

Palladium demand prospects are rising

Demand for palladium has surged in the past months. Holdings of physically backed palladium ETFs have soared to 85 tonnes, a 30% increase since the start of April, helped by the launch of new ETFs in South Africa by Absa and Standard Bank.

Furthermore, demand prospects from the industrial sector also look stronger. According to the leading statistics provider Johnson Matthey, platinum can now be substituted by palladium in a 1:1 ratio in gasoline cars’ catalysts, compared with a ratio of 1:1.5 previously acknowledged. This means that historically, platinum needed to be at least 50% higher compared to palladium to encourage substitution. It is no longer the case and we could expect faster substitution in the next few years, to the benefit of palladium. In addition to the sole price incentive, catalysts producers could also decide to use palladium instead of platinum because of the supply of palladium is much more secured: just 30% of the world’s palladium is produced in South Africa, compared with 70% of platinum.

Palladium’s fundamentals appear thus stronger than those of platinum. However, we believe that short term prospects could benefit platinum given the depressed price levels. The palladium to platinum ratio is still near its highest level since 2002 despite the enormous supply pressure caused by the South African strike. We recommend higher platinum exposure in the short term.

The agricultural sector’s price correction isn’t likely to last

Prices of most agricultural commodities have moved down since the beginning of May. The DCI® Agriculture Excess Return Index dropped by 6.0% during this period, contrasting with the good performance in the first four month of this year (the DCI® Agriculture Index was up 17.8% during this period). Agricultural prices had reached at the end of April overbought conditions, while the improved crop outlook triggered the correction. The latter has been followed by an important reduction in speculative positions on grains futures. The decline of speculative positions on soybeans futures was the most impressive as they fell from the highest level since September 2012 in early April 2014 to recently back to early January 2014 levels.

On coffee, prices fell by about 20% since the April peak due to expectations that the Brazilian crop will not be as bad as initially forecasted. Nonetheless, speculative positions remained flat, while the contango widened on ICE coffee futures, suggesting that speculative positions may have moved down the curve. This is reflecting that concerns have increased on the 2014/15 coffee crop. Other agricultural commodities have made a better performance. Sugar has been moving in a range since the beginning of March, while cocoa prices moved higher, driven by the confirmation that the market is likely to be in a deficit for the second year in a row. The lack of supply due to the major deadly disease that is affecting US pork ahead of the BBQ season also contributed to elevated meat prices. The DCI® Meat Price Index reached in early June 2014, a record high level.

The more resilient price action on softs and meats hint that concerns on the agriculture sector aren’t over. In fact, fundamentals for these sector remain strong. These sector are especially vulnerable to El Niño, which still has a 70% probability to develop this year, according to the Bureau of Meteorology of the Australian government. Moreover, the important price correction in the grain sector and the large reduction of speculative positions give the sector interesting upside potential, especially as supply risks remain important and could rapidly change in favor of higher prices.

Charts of the week: This is why bond yields are collapsing

|

As we see it, the decline in long bond yields is not a conundrum at all — it is a direct consequence of the US government’s decision to pare down the budget deficit (cut down deficit spending), and reduced debt issuance as an aftermath. This may be a policy mistake, given the inability of the private sector to generate sustainable activity at this time to keep output from sliding down further. The fear of “unsustainable” budget deficits has supplanted the earlier fear of the Great Financial Crisis which decimated jobs and home prices. The most troubling aspect of this fiscal policy is that it comes even as the Fed’s stimulus packages wind down and temporary benefits for those that been rendered jobless were allowed to lapse. For us, this is a mistake as the economy is still very likely years away from a full recovery. Our position is that the US does not need to balance its fiscal budget today — it has a lot of time to get the “fiscal house” in order when the economy has recovered (and from the looks of it now, that may be a few years down the road). There is no urgency to do the “balancing” (if indeed there is a need to “balance” it at all) at a time when the economy is still very susceptible to input shocks. Also, on operational grounds, the US does not need to balance its budget now or anytime as a matter of exigency. Balancing the fiscal budget is a policy choice — for us a very bad one — but there are no constraints which require that it be done at this juncture. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com