June 2, 2014

Government's measures should lead to a rebound in the Chinese housing market

Commentary by Robert Balan, Senior Market Strategist

"The real estate sector has been known as a significant pillar of China's economy for the last decade. According to the National Bureau of Statistics, real estate investment accounted for 15% of China's GDP in 2013. The percentage is higher if related industries, such as construction, steel, cement, and furniture, are taken into consideration. Given the impact property has on the overall economy, the government is expected to bolster property prices if China wants to meet its economic growth target at 7.5% 2014, as pledged by Premier Li Keqiang in his government work report. Once the housing development tumbles, so does the Chinese economy and the government is set to intervene to stabilize the market.”

Shan Xueying, “Is China’s housing market bottom in sight?” ChinaDaily, March 13, 2014

The current shared view is that China's vast property sector faces a bust, and is hard-pressed to avoid a meltdown that could send shock waves through the world's second-biggest economy. This is a popular meme, and the doom-sayers include Chinese individuals who have made fortunes on the spectacular rise of the sector. China Business News reported last week that Pan Shiyi, billionaire chairman of commercial developer SOHO China, said at a forum: “I think Chinese property is the Titanic about to crash into the iceberg right in front of it.” That may seem to carry some weight of authority but the final determinant of the fate of China's property sector is the Chinese government, not individual observers.

Take these cases in point: the People's Bank of China last month asked domestic lenders to give first-time home buyers priority in mortgage lending, which analysts saw as aimed at boosting home purchases amid oversupply. There is also the fact that the slowdown in the property sector was deliberately triggered by the government in H2 2013 after new home prices have soared, more than quadrupling in Beijing and Shanghai since 2003, and more than doubling in the country as a whole. We have seen similar episodes before, in 2009 and 2011, when the Chinese government also took measures to curb the sharp rise of house prices, only to relent when the sector started to drag down growth. And in fact, we may be again at that juncture of government capitulation — the Chinese government said last week it may soon ease further monetary policy by reducing reserves requirement for some banks.

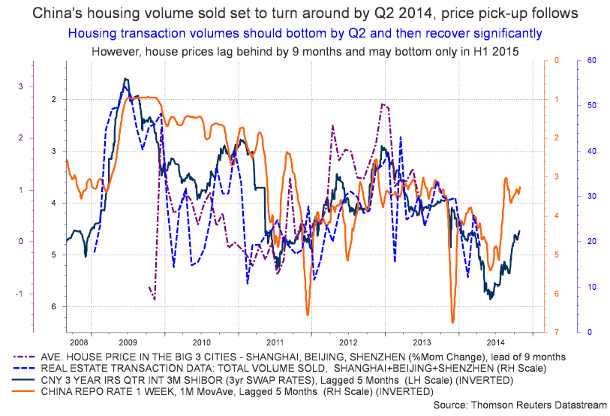

China launched a similar, targeted reserve cut for banks in rural areas just over a month ago as worries mounted that its economy — a key driver of world growth — was slowing more sharply than expected. It is clear to us that the government is becoming more concerned about the continued economic slowdown and wants to further increase the strength of policy support — primarily for the deflating housing sector. Blunt monetary policy instruments like cutting interest rates may not be forthcoming immediately, but the government has different means to support the housing market. Our conclusion is that a sudden collapse of property prices is not imminent, although house prices may continue to drift lower through the end of the year. However, our work on the sector shows that the volume of sales seemed to have stabilized and may have actually bottomed earlier in the year (please see charts of the week below).

Overall Chinese home prices fell 0.3% in May from April in the first monthly drop since June 2012. But the average result masks huge variety — some of the country's largest cities are still maintaining double-digit gains, Beijing house prices, for instance, rose 22.4% year-on-year in May. While it is fashionable to conflate the current clampdown on the property sector with the Li Keqiang government's desire to shift the country's growth model to private consumption from public-sponsored investment driving expansion, there is no intended link between the two issues as far as we can see. Moreover, whenever growth and activity data suggested that GDP might have slept below Mr. Li's 7.5% growth objective, Beijing has been quick to rev up stimulus measures (including tax breaks, bigger investments in housing, faster spending on railways and other megaprojects, and front-loading of outlays at the provincial level) to keep GDP from sliding below that level. There is also preliminary evidence that the central bank has eased up on its war against excess credit, and the shadow-banking system is still operating albeit in lower profile relative to last year. These measures have started to have a positive impact on the economy as the manufacturing activity in May rose at the fastest pace in five months. This should encourage the government to continue in this direction as the present government is bent on maintaining the stated, minimum growth of 7.5%. In order to succeed in meeting those goals, the government will have to keep the property sector afloat, and so a turn around in the sector should be supportive of growth momentum in 2014. In turn, this should have a positive impact on demand for commodities used in the construction sector. Base metals price activity is already confirming the turnaround in the housing sector. The DCI® Base Metals Index is up by 8.3% since mid-March 2014 to the highest level since October 2013.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

The Asian LNG prices are set to rise this summer

The global LNG market has recently been affected by unusually strong purchases of LNG by Brazil. The latter is indeed facing drought conditions in several states, reducing hydroelectricity generation, forcing the grid to use a greater amount of fossil fuel such as natural gas and diesel. Moreover, the country is also building up fuel reserves ahead of the World Cup. Argentina also increased imports of LNG due to the hot weather. Latin American demand has hence kept spot LNG prices at around $14.0 per million Btu, down from $19.7 per million Btu in February 2014 but nonetheless an elevated level for the season, as May is typically considered as a shoulder month (low seasonal demand for heating or cooling) due to weak demand from Asian countries. The latter indeed do not possess sufficient storage capacity and hence cannot purchase a great amount of LNG during the shoulder season.

While Latin American demand for LNG is expected to decline in July, Asian demand is likely to be strong enough to see a major rise in LNG prices. Indeed, LNG supply growth has only be limited these past few years due to the 2008-2009 glut, which led Qatar to impose a moratorium on new projects (which should run through 2015). At the same time, demand for LNG continues to increase rapidly driven by new LNG terminals in China. Between January and April 2014, Chinese LNG imports are up by 22.0% on average. Persistently idle nuclear reactors in Japan should also contribute to strong Japanese LNG demand this summer.

However, no additional liquefaction capacity is expected to come on stream before Q4 2014, with the start of BG Group’s Curtis LNG project in Australia. Several liquefaction terminals are expected to come on stream next year such as Chevron’s massive Gorgon field, with a capacity of 21.2 billion cubic metres per year. This is suggesting that the tightness on LNG market could ease next year. The rise of LNG prices this summer could encourage substitution in the power sector. Indeed, with spot LNG prices at $19 per million Btu ($106 per barrel of crude oil equivalent), some power plants may be encouraged to use crude or oil products instead.

Reduced Libyan crude supply would especially affect markets in July-August

China’sIn April 2014, an agreement between the government in Tripoli and eastern autonomists groups has increased hopes of an improved political situation, which would have raised the chances of an important rebound in Libyan crude oil exports. The agreement was rapidly followed by the reopening of two oil ports in the eastern parts of Libya that were closed since July last year, when eastern autonomist groups blocked oil exports. This action had contributed to the decline in Libyan crude oil production from 1.2 million b/d in July 2013 to about 200’000 b/d currently.

Nonetheless, Libyan crude oil production failed to rebound due to protest in the western part of the country. Moreover, the appointment of Ahmed Maiteeq as prime minister in early May 2014 displeased eastern federalist groups, which have recently reoccupied the Hariga oil port in the eastern part of the country.

Moreover, attacks by General Khalifa Haftar and his supporters against islamist groups and the parliament have contributed to a deterioration of the political situation, creating more uncertainty in an already unstable country. This is likely to add a negative impact on the local oil industry. Indeed, islamist groups which are fighting Haftar could in a near future target oil infrastructures under the protection of Haftar’s allies such as the eastern autonomists.

Reduced Libyan oil supply had a limited impact these past few weeks due to the global refining maintenance season. However, refineries are increasing activity. According to the International Energy Agency, global crude runs are likely to increase by 2.9 million b/d between April and August 2014 (to 78.3 million b/d, up 800’000 b/d y/y). It is really during July (when global crude runs are expected to reach 78.0 million b/d) and August 2014 that the reduction of Libyan crude oil would be felt the most by global crude oil markets.

Nickel: it is just the beginning

Nickel has gained more than 40% since January 12, 2014 when the Indonesian mineral export ban was introduced. We could expect some downward pressure in June as the restocking cycle is now over. However, the medium and long term prospects are much stronger: Nickel could be set for a long super-cycle, provided that the Indonesian ban is maintained.

So far, nothing indicates that Jakarta could lift the ban. It was introduced to force local producers to develop refineries and to export products with a higher value added. Local producers have already started to invest massively in refinery projects so we do not expect the government to reverse a policy that has proved to be efficient so far. Furthermore, the ban is very popular within the countries and political parties have unanimously backed the policy.

The global market should be more or less balanced this year as inventories remain high – but the market is likely to report a strong deficit next year as the Indonesian export ban could reduce global supply by 20% in 2015. The question is the pace at which China’s nickel pig iron (cheaper substitute to refined nickel developed in China) supply would decline. China has been able to produce NPI thanks to the Indonesian nickel ore, whose properties are highly beneficial to the NPI production process. Producers could keep running for another six to eight months due to high inventories but output should tumble by the end of the year.

Furthermore, very little projects in the rest of the world could compensate for Indonesia’s production losses. Apart from the NPI projects (which are now at risk), only five nickel projects are in the pipelines and these ones only contributed to increase global production by 1% last year. Among the projects that were launched in 2007 and 2008, nearly none of them include a second phase because nickel prices have been depressed over the past two years.

Cotton prices’ correction appears overextended

Cotton prices fell by about 10% since the beginning of the month, driven by expectation of strong crop. Drought conditions in the US have contributed to the rise in cotton prices to a two-year high in March 2014. Nonetheless, despite these conditions the USDA forecasted in its May report an increase in US cotton production by 12% y/y to 14.5 million bales for the 2014/15 season. This was the first report on this season and hence had an important impact on the cotton market. Moreover, improved weather conditions these past few days with rains in Texas also reduced concerns over the US cotton crop. The US is a key actor in the global cotton market as it is the world’s third largest cotton producer, accounting for 13% of global production and the world’s largest exporter, accounting for about 27% of global cotton exports.

The USDA also predicted a decline in US cotton exports to 9.7 million bales, the lowest level since the 2000/01 season due to lower demand from key cotton importers such as China, Turkey, Mexico and Vietnam. This should contribute to a rise in cotton inventories and stock-to-use ratio to record high levels. These fundamentals should add strong downside pressure on cotton prices.

Nonetheless, the correction appears overdone as market participants may underestimate several factors. Indeed, demand for cotton could be stronger than initially expected due to the likely acceleration of the Chinese economy, which is not expected by many market participants. On top of that, the USDA is likely to revise lower ending stocks due to stronger export sales. The build in global cotton ending stocks, which was already expected to be the smallest of the past three seasons, could hence increase at an even slower pace. This would make the cotton market close to a deficit. This situation could occur if cotton crops in China, the world’s largest cotton producer, are damaged by floods, which could be caused by El Niño. Moreover, there is also a risk of worsening drought conditions in the US, which could negatively affect cotton production. Thus, the volatility in the cotton market is not likely to disappear. Prices could bounce rapidly due to a deterioration of the fundamentals.

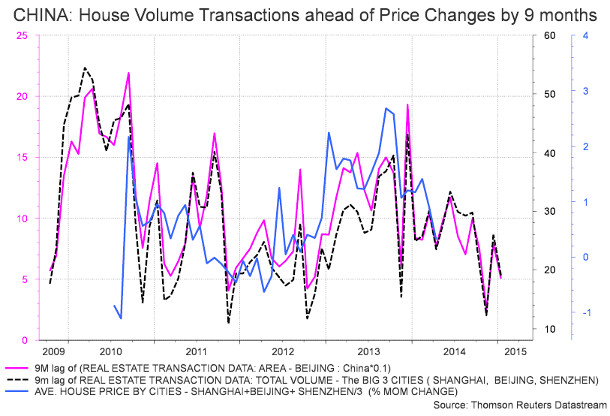

Charts of the week: China’s housing volume sold is set to rebound

|

China's property sector, like any other housing market in the world, follows the interest rate cycle with a lag. In China, as in the United States housing market, the evolution of volume sold lags behind changes in interest rates by 5 to 6 months. This co-movement of housing and interest rate in China suggest therefore that based on historical relationships, the bottom in house volume sold may be seen within the next two to three months. House prices in both China and the US however lags far behind volume transaction details. In the present case, and as shown in the chart below, house prices in China lags volume transactions by circa 9 months. This implies that house prices in China in general may see bottom only in late Q2 or early Q3 2015. However, it is volume that matters to GDP calculations and contributions, so we would expect the property sector to become less of a drag by late Q2 this year. And by early H2, we would expect the property sector to start contributing to growth, although it may be by Q4 this year that a more broad-based recovery (from both volume and price) may become manifest. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com