May 26, 2014

Commodities should soon benefit from lower real rates

Commentary by Robert Balan, Senior Market Strategist

"An often overlooked factor is the influence of interest rates. History shows a strong correlation between interest rates and prices for commodities, including oil, agricultural products, minerals, metals and other raw materials. Commodity prices generally climb when interest rates fall, and fall when interest rates rise.”

CoBank, “Outlook - Economic Data and Commentary”, October 2012

Academics and economists have long claimed that real long-term interest rates are key determinants of longer-term saving and investment decisions. There is also a broad market consensus that real long term interest rates influence business spending, household investment and the consumption of durable goods. And of course, the Federal Reserve conducts monetary policy using short-term rates as a tool to influence the evolution of the long-term real interest rates, and consequently, the business cycle. What is less discussed in policy papers is the impact of real long-term interest rates to commodity prices. That is unfortunate because real long-term rates are one of the primary determinants of commodity prices, and the proof of this claim can be seen from the recent episodes of spectacular outperformance of commodities over equities.

The first example can be seen during the summer of 2007, when the U.S. economy started to slow down noticeably, and was about to enter into a recession. And it was also clear that other countries were slowing down to some extent at least. In its forecast for the following period, the IMF World Economic Outlook revised downward the growth rate for virtually every region, including China. The overall global growth rate for 2008 has been marked down by 1.1% (from 5.2% in July 2007, just before the subprime mortgage crisis hit, to 4.1% as of January 29, 2008). And global growth prospects continued to deteriorate. Yet commodity prices found their second wind over precisely that period — up some 25% or more since August 2007, by a number of indices. It was a spectacular performance unmatched yet by any asset class under those global growth conditions.

The setting for the second example is early spring of 2010 (March), as the U.S. economy started to slow after peaking at 3.9% in the first quarter. However, commodity prices continued to rise sharply higher. This time, the talk was about how China and the rest of the Emerging Markets were "priming the pump" so to speak, and regardless of the outlook in growth in the U.S. and Europe, commodity demand was supposed to escalate. Commodities at that period performed their sharpest climb on record — more than 50% in less than a year. That happened despite a slide (and revaluation lower) of U.S. GDP growth to 0.4% in Q1 2011, and a Chinese GDP decline from 11.9% to 9.6%.

Clearly we can see that growth was not the only explanation behind higher commodity prices. There are other factors that can cause powerful spurts in price gains. How then can we explain the phenomenon of commodity prices going up while the global economy turns down? We are not trying to reduce the evolution of commodity prices to a single factor, nor to claim proof of any theory by a single data point, but clearly another broad macro force was the reason for the commodity outperformance other than growth.

That factor was the collapse of real long-term interest rates during those two periods cited above. To appreciate how low real long rates serve as catalysts for commodity outperformance, let us see why high real interest rates negatively impact commodity prices. "High interest rates reduce the demand for storable commodities, or increase the supply, through a variety of channels: by increasing the incentive for extraction today rather than tomorrow (think of the rates at which oil is pumped, gold mined, forests logged, or livestock herds culled); by decreasing firms' desire to carry inventories (think of oil inventories held in tanks); by encouraging speculators to shift out of spot commodity contracts, and into treasury bills." (Jeffrey Frankel, "An Explanation for Soaring Commodity Prices", March 25, 2008)

Mr. Frankel added further that all three mechanisms work to reduce the market price of commodities, as what happened when real interest rates where high in the early 1980s. A decrease in real interest rates has the opposite effect, he said, lowering the cost of carrying inventories, and raising commodity prices, as happened in the 1970s, and again during 2001-2004. It's the original "carry trade." It is clear that the common denominator of commodities outperformance during those periods cited above was low, and declining real long rates. The key takeaway from these episodes: Declining real interest rates are, in general, are supportive of commodity prices even during the preliminary stage of a growth recession.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

The Russia-China gas deal won’t affect EU gas supplies

After a decade of negotiation, Russia and China signed a major gas deal, following greater tensions between European countries and the Kremlin about Ukraine. This $400 billion deal confirms the gradual shift of Russian energy exports towards Asia at the expense of Europe. Already, oil exports to Asia have increased significantly these past few years. Russian crude oil exports to Asia now accounts for about 20% of total Russian crude oil exports from less than 1% in 2009.

It took more time to find an agreement on natural gas supply to China. The agreement would cover 38 billion cubic meter over 30 years to be transported by the Power of Siberia pipeline that will reach the heavily populated north eastern part of China. The pipeline is expected to start delivering natural gas in 2018. This project accounted for about 6% of Russian natural gas output and 29% of Russian natural gas exports to Europe (Ukraine and Belarus not included).

While this project represents a large part of Russian exports to Europe, the latter is not likely to miss Russian natural gas. Indeed, by the time the Russian pipeline will be built, Europe should have access to other major sources of supply. In Australia alone, 7 LNG terminals are expected to come on stream between 2014 and 2017 with a combined capacity of 84 billion cubic metres. The massive Gorgon LNG project, with a capacity of 21 billion cubic metres is expected to start operation in 2015.

Moreover, on top of gradually stronger LNG exports from the US, which could start by the end of next year, the construction of the Trans-Anatolian Gas Pipeline (TANAP) is expected to start this year and to be completed in 2018 with a planned capacity of 16 billion cubic metres. This pipeline would bring natural gas from Azerbaijan (and possibly later from Turkmenistan) to the Turkish-European border. While Europe would need to compete with Asia for some of the incremental LNG supply, it has the possibility to replace Russian gas exports.

China’s copper imports keep rising

China’s refined copper imports have remained strong in April. The Middle Kingdom imported 341,406 tonnes of the refined metal last month, an increase of 5% from March 2014 and a remarkable 86% rise year on year. Also, exports were relatively weak at 21,500 tonnes, up 50% m/m but down 26% y/y. Furthermore, China’s production of refined copper was also on the rise last month, totalling 584,277 tonnes, slightly down m/m but rising 4.8% from April 2013. This brought China’s refined copper apparent demand to 904,184 (net imports + production), close to the levels seen late last year.

These figures provide further indication that the current physical market remains tight, and that fears over China’s copper demand are overdone. Additional evidence suggesting a tight physical market are plentiful. Firstly, the copper forward curve is still in backwardation, despite the global surplus expected for this year and next year. Secondly, consumers’ premiums remain high globally and especially in China where they double the levels seen in 2012 and early 2013. These figures are particularly strong as the environment is said to be unfavourable to imports. Indeed, financing trades are said to have lessened in the past weeks and the depreciation of the Yuan has made the SHFE-LME arbitrage unfavourable to imports.

China’s restocking appears to indicate that it sees current prices as a buying opportunity. Despite the global surplus, copper could outperform in the coming weeks.

Gold in backwardation suggests market tightness

The Gold forward rate (GOFO), the prevailing rate used for gold / USD swap transactions and calculated as the difference between the LIBOR and the Gold Lease Rates, has moved in backwardation. Since mid-2013, the GOFO has been backwardated most of the time.

This is a very rare phenomenon: since the start of the bull market in 2002, it actually only happened on one brief occasion: in November 2008. As mining veteran Victor Rudenno explains “banks have very large stores of gold bullion in their vaults that earn no income. The banks are therefore willing to lend the gold at low interest rates, or at what is commonly referred to as a leasing rate. It is therefore possible for an investor to borrow the gold, sell it and invest the proceeds in the money market. If the interest rate provided by the money market is greater than the cost of leasing the gold, the investor will make a profit; however, the investor is exposed to variations in the gold price and the gold has to be returned to the bank at some time in the future." If the investor can buy a futures contract that guaranty delivery of the gold at that future date, then the investor can lock in a margin at little or no risk. The market will not allow such easy returns, so the future price that the investor is required to pay for the gold for delivery to the bank will be equal to the spot price plus the difference between the money market rate and the leasing rate.

The fact that the GOFO has moved in backwardation reflects low LIBOR rates as well as strong fundamental and physical demand. This coincides with several reports showing rising demand in Asia (China, India) and in the Middle East.

Projected record US corn and soybean crop to add short term downward pressure on prices

The USDA released its World Agricultural Supply and Demand Estimates (WASDE) Report earlier this month. The May report is highly scrutinised as it provides the first official estimates for the new crop year. The conclusions from the report show that although old corn and soybean crop supplies remain tight, the 2014/2015 season could see much higher production levels. The USDA confirmed that the US crop market is currently tight: projected US exports of old crop corn were increased again and estimated ending stocks were revised downwards from 1.33b bushels (9.9% stock-to-use) to 1.15b bushels. However, the agency expects the 2014/2015 US crop to reach a new record of 13.9b bushels. On the global scale, corn ending stocks for the next season are forecasted at 181.7m tonnes, the highest level in 15 years.

The scenario is similar to that for soybeans. The 2013/2014 US ending stocks were revised downward from 135m to 130m bushels, for a tight stock-to-use of 3.8%. However, new US crop soybean is also seen reaching a new record high in 2014/2015 at 3.63b bushels and ending stocks are expected to soar by 150% to 330m bushels. Globally, soybean production is expected to rise 5.6% y/y.

These forecasts could fuel downside risk on the two commodities. However, we are still very early in the season and could see volatility in the harvest expectations within the coming months as inventories for corn and soybeans remain at a relatively low level. Hence, the forecast of a strong grains crop could fail to materialise if climate conditions worsened. For example, the confirmation that El Niño will not occur would imply the risk of a warmer summer, while several states are already facing drought conditions. Moreover, if El Niño occurs, the crop would still be vulnerable to heavy rains and floods.

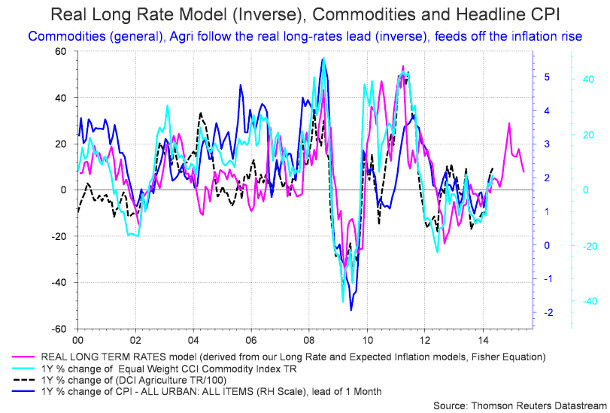

Charts of the week: Expected falling real long rates hint to higher commodity prices

|

We may again see a repeat of the 2007 and 2011 episodes (described in the main story) later this year. We expect a sharp decline in real long rates between now and H1 2015. We show in the chart below our model for real long interest rates, which is currently pacing the robust rise in commodity prices, and consequently, that of Headline CPI as well. Our real long term rate model is an offshoot of our long bond models which are calling for substantial declines in nominal rates into Q2 2015, and inflation expectations forecasts of sharply higher CPI rates for the rest of the year. If long-term rates do fall to the extent that our models suggest, and if CPI inflation rises to the degree shown by our inflation model, then a sharp decline in real long rates (as project by our model) should propel commodity prices significantly higher for the next three to four quarters. This thesis is also supported by our projections of a China recovery in H2 2014, and further prospects of decent growth for the US economy to at least Q3 2014. Sharply falling real long rates plus decent growth outlook for the twp largest economies in the world would bode well for another commodity outperformance over equities later this year. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com