April 28, 2014

Growth revival and higher supply risks are inviting a new focus on commodities

Commentary by Robert Balan, Senior Market Strategist

"After several tough years, investors are once again starting to warm to commodities. […] Analysts at Citi reckon investors are starting to take commodities seriously as a portfolio diversification tool because for the first time in many years raw materials are not moving in lock-step with either equities or the US dollar. ”

Neil Hume, “Commodities back in favour as a portfolio diversifier”, Financial Times, 24 April 2014

Commodity markets have underperformed equities between 2011 and 2013 due to weaker global economic growth and especially fears regarding China, bringing the positive sentiment on this asset class to the lowest level since the end of 2008 (see Commodities Insight Weekly “Stop fearing commodities: value is there”, January 13, 2014). But commodity prices have recently moved higher alongside improving macro-economic conditions. The moderate recovery being seen in the US and, to some degree, the eurozone's rebound from negative growth have removed some of the negative sentiment regarding commodities in recent months. Moreover, these improved economic conditions are occurring during a phase of escalating geopolitical tensions, a weak dollar and growing risks of weather disturbance. But the key factor that contributed to a refocus on commodities is the beginning of a sea-change in investors' attitude towards the travails of the Chinese economy. World investors are turning more positive towards China, and with it, the prospects of commodities as an asset class has improved significantly.

In fact, commodity markets have performed remarkably strongly since the start of the year. The 9.8% YTD return in the DJ-UBS Commodity Index and the 5.8% YTD return for the Diapason Commodities Index® are strong early performances, the best YTD starts since 2008. One of the factors behind this performance is the improving global macro conditions. We believe the latter will further improve and will have a positive impact on commodities going into H2 2014. In the US, retail sales and industrial production data suggest that negative weather effects in late 2013 and early 2014 have been reversed by March. We expect US GDP to be at circa 3.0% - 3.2% by Q3 this year. The Euro area industrial production growth may be at circa 0.5% q/q in Q1 2014, and we expect 0.4% real GDP growth in the same period. This is occurring amid rising tensions between the US and Russia over Ukraine, a more unstable political situation in the Middle East (rising violence ahead of the general elections in Iraq, the rupture of the peace talk in Israel, risk of civil war in Libya, strong inflation in Iran) and important social protests in Venezuela. These events are increasing geopolitical risk premiums as these countries play an important role in commodity markets.

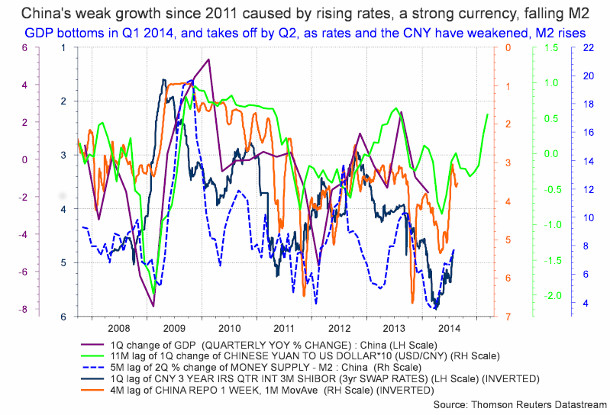

However, the most compelling macro case for commodities is, for us, a reversal of economic fortunes in China. We have always maintained that the slowdown in its growth since late 2011 has been caused by a perfect storm of rising interest rates, a strongly appreciating currency, and sharply falling M2 money supply (see chart of the week). In a Western economy, that potent brew would have meant a likely quick trip to recession-territory. But these growth factors will likely become positive in Q2 2014. Given indications from the PBoC that the Yuan will likely fall further, we believe the recovery in China could extend into Q1 2015. The Wall Street Journal described the change in investor mind-set succinctly about commodity prices and China (Wayne Arnold, "Commodity Markets Shift to Brighter View of China", April 24, 2014): "[…] many investors and analysts are betting [commodity] prices have bottomed. They contend China's government is likely to avert an economic meltdown and that growth will stabilize at current levels around 7%. While that is below the double-digit expansions of the past decade, the economy is now so large it will continue to suck in rising quantities of raw materials for years to come, they argue."

The acceleration of the US economy in the coming quarters, as the situation in Europe improves, is occurring concurrently with a likely rebound in Chinese economic growth. It is the first time since 2010 when these conditions are happening at the same time, which could only mean stronger demand for commodities. Furthermore, these positive macro factors are appearing while commodity supply is at risk due to the unstable geopolitical situation — that can only be positive for commodities.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

Strong demand and low inventories could push gasoline prices higher

This past month, gasoline prices have been the best performer within the oil sector due to the more rapid than usual decline in US gasoline inventories. The latter indeed dwindled from elevated levels in February to recently the lowest level since 2011. This large decline in US gasoline inventories occurred despite high utilisation rates at US refineries and an increase in US refining capacity.

Strong domestic and foreign demand amid elevated gasoline production has contributed to the drop. Indeed, in March 2013, US gasoline demand rebounded from the winter’s low to 8.7 million b/d, the highest level since 2011 and up by 240’000 b/d from the past two years average. While gasoline demand growth could slow down in the coming weeks due to more elevated gasoline prices, the strong US economic activity is likely to provide sufficient support for gasoline demand in the coming months.

In Europe, demand for gasoline rose on a y/y basis both in January and February 2014, contrasting with declines in the previous years. Moreover, the 3-month moving average of gasoline demand reached in February its highest level since August 2009. Strong European and especially US gasoline demand is having a major impact on the global gasoline market as OECD countries account for about 65% of global gasoline consumption (while they account for 50% of global distillate demand). Stronger gasoline demand from OECD countries amid low inventories and the upcoming start of the refining maintenance season in Asia should contribute to further outperformance of gasoline prices.

Platinum’s reaction still muted despite South African crisis and higher European car sales

Platinum has underperformed since the start of the year, up by only 1.6%, compared to a remarkable 11% increase recorded by its peer-metal palladium. Platinum has also underperformed gold as well as all base metals except copper.

We wrote about platinum’s disappointing returns in late March this year and we wondered how long the market could ignore the metals’ changing fundamentals. Three weeks later, news has become even more supportive for platinum with little reaction from the price.

In particular, the Financial Times reported earlier this week that Anglo American was preparing for an exit from part of its South African platinum business. The concerned operations are believed to be the deep mines at Rustenberg, which accounted for 9% of global output in 2012. Anglo American would keep its other PGM mines located in the North East of the country.

Secondly, the economic activity is improving in Europe. Markit’s flash Eurozone PMI hit a three-year high in April at 54 from 53.1 in March, beating economists’ forecast. Especially, Europe’s car sales rose for a seventh straight month in March, up 10.6%, taking the year to date growth in car sales to 8.4%. This is particularly supportive news for platinum, which is mostly used in the European car industry to make auto catalysts that reduce vehicle emissions (unlike palladium, mostly used in the US and in China). The EU will also implement a much more stringent regulation on car emissions by 2017, which would increase the demand for platinum.

China’s gold demand growth set to decelerate this year

According to the latest study by the World Gold Council, China’s demand growth for the metal is expected to decelerate this year, after having surged 32% in 2013 and set China as the world’s largest consumer of the yellow metal. The research house believes that the gold price’s drop last year, allied with poor stock market performance, pushed many Chinese consumers to bring forward their gold purchases.

Private sector demand for gold jewellery, investment and industrial applications hit a record high at 1,132 tonnes last year. The jewellery sector was particularly strong, accounting for 60% of all private sector demand with 669 tonnes bought. Investment demand totalled 397 tonnes, compared to less than 300 tonnes in 2012 and with merely 10 tonnes in 2004. Last year, demand for gold as credit collateral also boosted demand.

Considering the very strong demand last year, the World Gold Council believes that such a growth will not be repeated this year. Although demand in volume should keep growing, the percentage term is set to decline. However, we do not expect the deceleration of China’s demand to have a significant negative impact on prices: last year, demand soared but did not provide any support to the metal. Gold prime drivers should remain real interest rates and movements in the US dollar.

Corn improves further as the US market is tighter than expected

Corn has improved over the past weeks and stands now at its highest level since August last year, confirming the view we expressed late last year that grains would bottom in early 2014. Also, the soybean to corn ratio has been declining since November last year, following months of a continuous increase in the ratio, meaning that corn’s performance has been strong on relative terms too.

The April USDA report provided further support to corn, showing a tighter-than-expected balance in the US. The US agency increased its projection of US corn exports by 125mn bushels to 1.75bn bushels, due to an increased expected global corn demand and strong shipment pace. This was the fifth upward revision in US exports over the last six months.

Consequently, US corn ending stocks are set to be much tighter than expected, at 1.331bn bushels against 1.456bn bushels previously expected and against consensus expectations for ending stocks of 1.40bn bushels. The US stock-to-use ratio has also been revised downwards by 1 percentage point to 9.9%, dragging also the projected global stock-to-use ratio down 0.2 percentage points to 16.5%.

However, downside risk persists on the corn market: El Niño is likely to bring milder temperatures and a wetter-than-normal summer in the US over the coming months. This should have a positive impact on the North American corn (and soybeans) crops, provided that there is no excessive rain. We therefore expect corn to underperform compared to commodities such as sugar, cotton, robusta coffee, rice and wheat.

Chart of the week: The Chinese economic growth is set to take off by Q2 2014

|

The slow down of the Chinese economy since 2011 has been caused by the combination of a tighter monetary and fiscal policy, while the Yuan strengthened adding further downside pressure on the industrial activity and growth. These policies were first implemented to fight rising food and property prices, shadow banking, local government’s indebtedness and at the same time the Chinese authorities tried to orientate too rapidly the economy towards a consumer-driven economy. These policies backfired and now the Chinese government is backtracking. The neutralisation of the previous policies has enabled a decline of the Yuan, a stronger money supply and lower rates. These factors are setting the conditions for stronger Chinese economic growth during the rest of the year. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com