April 22, 2014

Copper is moving in isolation and does not reflect the base metals sector’s improvement

Commentary by Marion Megel, Metals Analyst

"In reality, copper is more like the metal with a PhD in mathematical finance. So the recent sharp fall in copper prices may say less about the pace of China’s growth than it does about the trading decisions of leveraged speculators.”

Andrew Batson, Gavekal Research

The prevailing financial doctrine today is that market prices reflect the best available information about the future. This means that economic fundamentals are used to understand prices as much as prices are believed to be the best objective indicators of economic trends. This is one of the bases of G. Soros’ theory of reflexivity.

One good example of this reciprocal relationship between prices and fundamentals is copper. Traders have long referred to copper as the metal with a Ph.D. in economics: as the metal is widely used in industrial applications, notably in the construction and power sectors, its price has historically been perceived as a barometer of economic growth and of Chinese industrial activity as the country accounts for 43% of copper’s demand. Therefore, the red metal’s lacklustre performance in the past months, and particularly since the beginning of March this year, has been viewed by many as the reliable indicator of China’s supposed fragile and unstable economy.

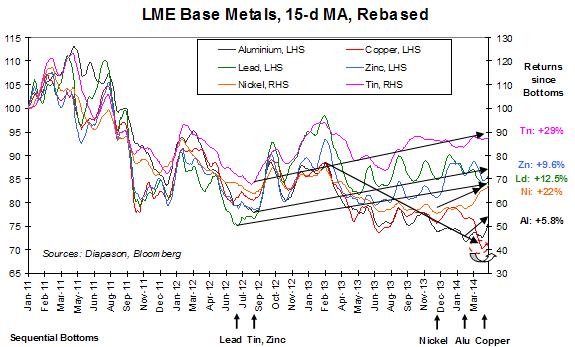

The depressed sentiment over copper (positive opinions fell below 30% last week, in a territory considered as “oversold”) has triggered a general scepticism over the entire base metals complex, ignoring the very strong performance of the rest of LME’s metals. Since the start of the year, copper has indeed moved in isolation. While the red metal has declined by 6.1%, all other metals have posted positive returns: nickel is up by a remarkable 27.4%, aluminium by 7.9%, tin by 6.6%, zinc by 4.4% and lead by 1.1%. Furthermore, palladium and platinum – which can be classified as industrial metals – are up respectively by 13.8% and 4.3% year to date.

Copper has distracted us from the bigger picture, which is that fundamentals of the base metals sector are stronger, with a tightening supply-demand picture for several metals. On the demand side, China’s demand remains strong and is expected to pick up in the coming months, as the infrastructure programme announced last month (which strongly emphasizes on electricity and transportation development) should translate into metals orders as early as in Q2 and Q3 this year.

The supply side is specific to each metal but we can identify three major sources of immediate or imminent damage to the supply of industrial metals. The Indonesian State’s increasing grip on the mineral and metals markets (which includes a mineral export ban) is a game changer for nickel and tin. The ongoing 13-week strike in South Africa has already resulted in a production loss equivalent to 8% of last year’s platinum output. Tensions surrounding Russia could also potentially affect the supply of nickel, palladium and aluminium. These production issues arise while most producers are struggling to generate positive margins as most base metals are still traded below or just above their marginal cost of production. Global inventories are also shrinking for some metals including zinc and tin.

The base metals sector seems to have turned around as fundamentals are tightening. The specific situation in the copper market has masked the sector’s overall improvement. After a three-year setback, the base metals sector offers interesting potential from their current depressed levels — on improving demand growth, supply issues, decreasing inventories and production costs constraints — and should carry on this trend of sequential price improvement, which started in mid-2013 (see chart of the week below).

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

Iranian crude oil exports are not likely to rebound before July

In its latest report, the International Energy Agency (IEA) estimated Iranian crude oil exports at 1.65 million b/d for February 2014. This contrasted with a statement from the Iranian government that crude oil exports have remained at around 1.0 million b/d in early February and March 2014.

The possible rise in Iranian crude oil exports occurred after the November 2013 agreement between the P5+1 and Iran on an interim deal, which reduces some international sanctions against Iran but does not allow Iran to increase its crude oil exports. The deal however increased expectations that a final agreement could be concluded by July 2014 (when the interim deal ends), allowing Iran to boost crude oil exports.

The IEA’s estimation over Iranian crude oil exports is also significantly above the 1.0 million b/d limit imposed by the US government. However, this quota covers a period of 6 months, implying that if Iranian crude oil exports are reduced sufficiently, buyers of Iranian crude oil could meet the 1.0 million b/d limit over a 6 months period. This appears likely (and is expected by the US Government) due to the spring refining maintenance season, which reduces demand for crude oil.

Indeed, according to the IEA, global crude runs are expected to bottom in April 2014 at 74.8 million b/d, down 2.1 million b/d from February 2014 level. The important rise in Iranian crude oil exports in February have therefore matched strong demand from refineries (crude runs were up by 1.3 million b/d y/y). The seasonal decline in demand should then reduce the need to import Iranian crude oil.

Thus, even if Iranian crude oil exports have increase in early 2014, they are likely to average about 1 million b/d in the first half of this year, a level similar to that of the second half of last year. This contrasts with the previous two years when the US government required buyers of Iranian crude oil to reduce their purchase of Iranian crude oil every 6 months.

The restart of nuclear reactors will reduce the use of oil by the Japanese power sector in H2 2014

Japan, the world’s third largest consumer of petroleum, is about to experience a rebound in nuclear power generation that could have a negative impact on the oil usage by the power sector. Last week, the Japanese government approved an energy policy, which will reverse previous plans to gradually phase out nuclear energy. This unpopular move is a sign that nuclear power plants could soon be restarted.

Nonetheless, a report suggested that only 40% of nuclear power plants may be restarted as the remaining reactors are too old and would require significant investment to comply with new safety rules. The closure of some nuclear reactors would have a greater impact on natural gas demand from the power sector than on oil as the latter is usually considered as the fuel of last resort, being the most expensive fuel. Thus, while natural gas demand for power generation is likely to remain at an elevated level, the gradual restart of nuclear reactors should replace oil consumption with power plants.

In February 2014, the latter reached 630’000 b/d, up 40’000 b/d y/y due to the halt of the last two remaining nuclear power plants at the end of last year and cold temperatures, which boosted power demand. It could fall below 500’000 b/d (like in 2013) if at least two nuclear reactors are restarted.

Nonetheless, the decline in oil usage by the Japanese power sector is likely to occur only in the second half of this year as currently nuclear reactors are still under review by the government. The first two reactors that are likely to gain approval to restart before the summer are Kyushu Electric Power’s N°1 and N°2 reactors at the Sendai plant. The process to restart a nuclear reactor under the new safety rules is stringent. After gaining the approval by the Nuclear Regulation Authority (following an extended safety review), the utility needs to receive permission from local government authorities to restart nuclear reactors. This adds a relatively important political risk in this process, especially because of the unpopularity of nuclear energy, leading to increasing risks of delay.

Aluminium catching up with other metals but fundamentals remain weak

Apart from that of copper, the performance of base metals year to date has been remarkable (see main commentary above). Metals have finally started to react to their own fundamentals, following months of returns related the risk-on/risk-off mood of the markets. Nickel and tin have rebounded following the Indonesian restrictive export policies; zinc rallied in response to the declining global inventories and tightening global supply.

The case of aluminium is trickier as we can not identify any significant improvement in the light metal’s fundamentals. The market reacted positively to the fact that the LME postponed the implementation of new warehousing rules, after a British Court ruled in favour of Rusal in the dispute that opposed the exchange to the aluminium producer over the new minimum unloading quotas at warehouses. As the market feared that such new rules would trigger a massive flow of aluminium into the physical market, the court’s decision was supportive for aluminium prices.

However, we see this as a negative for aluminium in the medium term. We did not view that the new regulations would have led to a massive release of inventories (due to physical constraints and the likeliness that cash and carry deals would continue and shift to warehouses not concerned by the new regulations). We believed it would have had more impact on aluminium premiums than on prices – and this would have been positive for prices in the long run. Indeed, in the past years, aluminium producers have enjoyed strong premiums (and hence better margins) due to these inventory games, which have discouraged producers to curtail production and alleviate the global supply surplus. Strong premiums incentivise supply indiscipline. The postponing of LME regulations should therefore maintain premiums elevated and the global market into surplus.

We continue to view aluminium’s fundamentals as poor. The recent performance in our opinion is mostly the result of aluminium catching up with other metals’ performances (as it has largely underperformed over the past years) and of risk-on strategies.

Beef prices at an all time high: could it last?

Australian beef prices rose to $4.4 per kilo last month, a new record high. In the US, beef prices have also increased to record high levels due to several factors. These past years, drought conditions (which have lasted for several years and risen input costs) have contributed to reduce the American herd to 87.7 million head of cattle at the beginning of the year, the lowest level since 1951, according to the USDA.

The rise in grain prices has also contributed to increased feed costs, while at the same time demand for beef has increased at a rapid pace, especially in China, where domestic production lags demand growth. China should continue to be the main driver of global demand growth as the transition towards a consumer-driven economy is likely to increase the purchasing power and hence demand for more expensive food items such as beef. This factor as well as the time lag to replenish the herd is likely to keep beef prices at an elevated level.

Moreover, the probable apparition of El Niño could also add further upside pressure on beef prices. Nonetheless, prices have risen rapidly and a correction could soon occur before the BBQ season, when demand tends to peak seasonally. With seasonally stronger demand amid tight supply, beef prices could retest record high level during the summer. This is likely to encourage the use of beef’s substitute this year. The strong rise in beef prices and the likely spill over on other meats should contribute to push higher the headline CPI.

Chart of the week: Base metals sequential bottoms show strong sector performance

|

Copper’s decline (following the default of China’s Chaori Solar on March 7, 2014), has masked the absolute and relative strong performance of other base metals. From the analysis of metals’ returns from their 2011 highs, we can identify two major sector trends: Firstly, all metals but copper have seen their bottom between the summer 2012 and the very beginning of 2014; and since then, they have all posted good or remarkable performance. Tin is up 29% from its bottom, Nickel up 22%, Lead 12.5%, Zinc 9.6% and Aluminium 5.8%. These strong returns have been neglected in our opinion as markets have remained focused on copper’s fall. Secondly, base metals can be classified in two groups. The first one is made of tin, zinc and lead, which have all bottomed around the summer 2012. The second group is made of nickel and aluminium, which have seen their lows between December 2013 and February 2014. It is particularly interesting that these two metals are finally catching up because they both have been the ugly ducklings of the base metals sector over the past years, due to their long surpluses. Their rally suggests a strong sector performance as well as the return of risk on positions. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com