April 14, 2014

A strong El Niño is expected this year: a key factor for the agricultural sector

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Energy Analyst

"There is a strong chance of developing El Nino this year, there is zero percent chance of excess rainfall, 98 per cent chance of below normal rainfall and also 68 per cent probability of drought this year in India.”

Jatin Singh, CEO of Delhi-based Skymet Weather Services, April 2014

Last week, the US National Oceanic and Atmospheric Administration (NOAA) increased the probability that El Niño will develop in the fall to 65% (up from previously 50%) and said that there is now a 50% chance of it developing during summer. This followed an upward revision from the Australian Bureau of Meteorology over the likelihood of an El Niño in the next four months to 70% due to significantly warmer-than-average water under the Pacific ocean surface. In March 2014, temperatures for most of the eastern and the central Pacific Ocean were the warmest since 1979 for this time of the year. This is implying that the upcoming El Niño could be more important than usual and it could even be more intense that the one that occurred in 1997-1998, which killed thousands due to floods in China and caused significant drought in South East Asia.

The occurrence of this major meteorological event, which contributes to extreme weather, is likely to have an important impact on the agriculture sector. However, the impact will be variable among agricultural commodities. El Niño is likely to bring dry weather in South East Asia, where some countries are already facing dryness. This is the case in Australia where wheat, sugar, cotton and beef output could be negatively impacted by El Niño. In Indonesia and Malaysia, palm oil producers could suffer from below-than-average rainfalls. This could also hurt further rice crops in Thailand, which is one of the world’s largest rice exporters. Rice and sugar crops in India and the Philippines could also be harmed by the effect of El Niño. In China, the latter could bring more rain, possibly triggering floods in the major rice and cotton regions, while colder-than-usual weather could hit corn and soybean crops in the north-eastern part of the country. Cocoa prices have rallied further following the announcement of the increase likelihood of El Niño, as the top 3 cocoa producers (Ivory Coast, Ghana and Indonesia) could face drier weather, negatively affecting cocoa production.

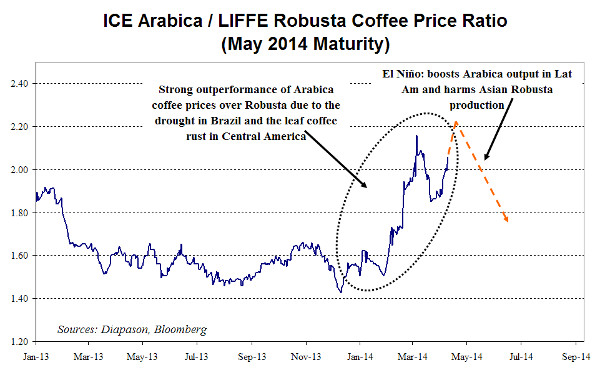

On the other hand, El Niño is likely to bring milder temperatures and a wetter-than-normal summer in the US, Canada and a warm winter in South America. This should have a positive impact on the North and South American corn and soybeans crops, provided that there is no excessive rain. The impact on prices may therefore be negative for these crops. While US and Canadian wheat crops could also benefit from El Niño, they account for only 13% of global wheat production. Wheat crops in China, India and Australia account for about 34% of global wheat production and that could be harmed by the dryness caused by El Niño. This should contribute to add net upside pressure on wheat prices. As for coffee, El Niño would lead to the deterioration of robusta coffee output, while it could boost that of arabica (see chart of the week).

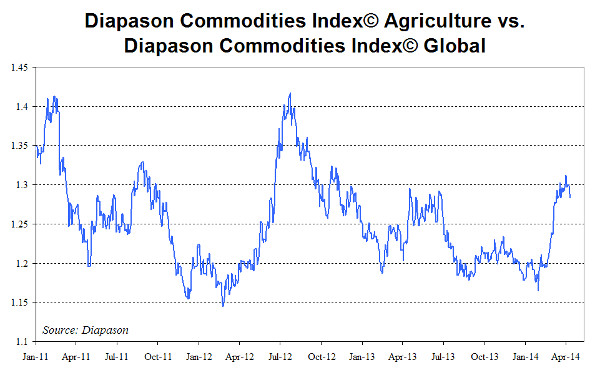

In summary, El Niño could be a major factor for the agricultural market this year. Prices for agricultural commodities such as sugar, cotton, robusta coffee, rice and wheat could see a significant upward move once the likely timeframe of El Niño 's onset is confirmed. The historical precursors of El Niño have been reported to be comparatively stronger than those of recent episodes, and comprehensive analysis is being undertaken now. Since the beginning of the year, the agricultural sector already saw a readjustment in prices, reflected by the outperformance of this sector against other commodity sectors and the important reduction in short speculative positions on agricultural products. The high degree of uncertainty regarding how much each crops could be affected by El Niño could fuel more upside pressure on the overall agriculture sector.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

The possible return of Libyan crude oil is mitigated by supply issues elsewhere

Recent developments in Libya are suggesting that Libyan crude oil exports could soon rebound and hence have a negative impact on oil prices. The rebel group that controls four eastern oil terminals said last week that those ports could soon reopen. This could lead to a gradual recovery in Libyan crude oil exports by about 700’000 b/d in the coming months. This could have an important impact on Brent prices on the short run. However, oil supply issues have increased in other part of the world, mitigating the downside pressure on Brent prices.

Indeed, Iraqi crude oil exports growth is likely to weaken due to quality issues. While they have reached the highest level since 1979 in February 2014, more buyers have been complaining about the high water content in the crude oil. This could lead to more stringent inspection and slow down loading schedules.

Moreover, the restart of the Kashagan oil field in Kazakhstan could be again delayed due to technical issues. The field, which was expected to become one of the world’s largest oil field with projected output at 1.6 million b/d, is hence unlikely to restart this year. This should lead to a weaker than initially expected Kazakh crude oil production growth this year at around +40’000 b/d y/y, down from previously +140’000 b/d y/y.

Finally, Colombian crude oil output, which stands now at 1.0 million b/d, is likely to be under pressure due to growing attacks against the oil infrastructure ahead of the May presidential elections and the 50th anniversary, in June 2014, of the founding of the FARC. These factors should hence contribute to mitigate the impact of the possible rebound in Libyan crude oil exports on Brent prices.

Lead could be set to recover

Lead has been the second worst performing metal on the LME since the start of the year (-1% YTD) and has particularly suffered over the past month – as we expected – since temperatures have normalised in North America. The metal is indeed primarily used in the manufacturing of car batteries, whose replacement usage exceeded expectations this winter as the cold temperatures damaged car batteries. The first quarter of the year is also generally negative for lead demand, due to the combined effects of the New Year holiday week in China and the lowering demand for electric bikes – as sales decrease in the winter. China has indeed remained a net lead exporter so far this year.

However, it might now be time to increase exposure to lead, considering the current good value of the metal and its brighter prospects for the coming months. Demand for electric bikes is set to improve over the coming months. Although Chinese authorities are restraining the use of this transportation method due to security issues, the consensus expects ebikes sales to increase by another 4-5% this year.

In addition, the spring season (along with the fall) is also the time when battery makers rebuild their inventories ahead of the summer months (and winter months as far as the fall restocking season is concerned), during which replacement batteries often break.

Furthermore, it seems there is currently a shortage of scrap supply, which usually meets about half of global lead demand. Currently, scrap battery prices in the US are only 7% below their 2012 all-time high. As secondary smelters are running below full capacity, the lead market should see its deficit widening this year, from a balanced market in 2013.

Two new South African palladium ETFs should increase market tightness

Palladium has strongly outperformed the other precious metals since the start of the year, up by 14% compared for instance with a 6.1% increase for its peer metal platinum. The palladium/platinum ratio is now at its highest level since early 2002.

Palladium’s supply demand picture has been very tight over the past months: Russian sales to Switzerland (proxy for total Russian exports) have been nearly inexistent. In South Africa, strikes continue; resulting so far in a PGM production loss of about 530,000 ounces, equivalent to nearly 8% of 2013 output. This level exceeds the dramatic 2012 losses.

Over the past weeks, another factor arose which could increase the tightness in the palladium market: the launch of two South African palladium ETFs. One is the long awaited Absa New Palladium ETF, which has already accumulated 25,000 ounces in holdings since it was launched on March 27. However, the surprise was the announcement by Standard Bank of an Africa Palladium ETF. To get approval for these products, Absa and Standard Bank must insure that the metal held is extracted and refined in South Africa; meaning that these would most likely tighten the country’s supply of palladium even further. Given the recent performance of the metal, these ETFs are likely to attract investors.

We continue to see tighter fundamentals as for palladium. However, given the 12-year high in the palladium/platinum ratio (given platinum’s underperformance) we see stronger prospects for the platinum price, as platinum supply is highly dependent on South Africa. We wonder how long the market can ignore platinum supply deficits.

The wheat price correction may not last

The tensions surrounding Ukraine and possible sanctions against Russia have had only a limited impact on wheat prices as global supply could increase at a faster pace. Indeed, these past few days, wheat prices were under pressure due to rain in parts of Australia, in the US and in Ukraine.

In Australia, the winter wheat is currently being planted. The rain, which hit the southern parts of Australia, reduced dry conditions and should boost soil moisture, helping wheat germination. Moreover, the US government revised higher its forecast of US wheat inventories by 4.5% to 583 million bushels due the expected wetter weather in key areas. This is likely to contribute to the reduction in wheat under moisture stress, ahead of the harvest season, which should start in May. In Ukraine, the rain is also helping the crop growth ahead of the summer harvest.

Nonetheless, this correction may not last as weather conditions could rapidly change. Indeed, as mentioned above, the occurrence of El Niño could severely affect wheat crop in Asia as it will bring dry weather in the region. On the other hand, it could boost wheat output in the US and in Canada by bringing more rain and warmth that could assist crop growth. But too much rain in North America could also trigger floods that would harm crop. The net impact on wheat supply could be supportive for prices due to the significant size of the Asian (including Australian) wheat market (47% of global supplies) relative to the North American market (13% of global supplies).

Chart of the week: Robusta coffee could soon outperform Arabica prices

|

As far as coffee is concerned, El Niño is expected to have a different impact on the robusta and the arabica markets. Robusta coffee output in Vietnam, and Indonesia, which are respectively the world’s top and third largest producers of robusta (accounting respectively for 43% and 12% of global supplies), could suffer from the dry weather caused by El Niño. The coffee production in Indonesia was already expected to decline during the 2013/14 season due to dry weather at the start of the season. El Niño would lead to a stronger drop in coffee production in this region. This is contrasting with the arabica market, which saw a major upward move in prices since the beginning of the year. El Niño should bring a warmer winter in Brazil, the world’s top arabica producer with 45% of global supplies, and in Colombia, the world’s second largest producer of arabica coffee, with 12% of global supplies, reducing the risk of frost. Furthermore, drier weather in Central America and Mexico (20% of global production) could reduce the leaf rust disease, which has reduced arabica output in this area by 24% between the 2011/12 season and the 2013/14 season. The increasing likelihood of El Niño should contribute to improve significantly the outlook of the arabica coffee production. Thus, El Niño could lead to the outperformance of robusta coffee prices relative to arabica coffee prices, reversing the price ratio movement seen in the first quarter of 2014. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com