March 24, 2014

The Fed adds risk of replicating the 1937-38 mistake

Commentary by Senior Market Strategist Robert Balan

"The calls we’re hearing for an end to stimulus (…) will grow even louder. But if those calls are heeded, we’ll be repeating the Great Mistake of 1937, when the Fed and the Roosevelt administration decided that the Great Depression was over, that it was time for the economy to throw away its crutches. Spending was cut back, monetary policy was tightened — and the economy promptly plunged back into the depths."

Paul Krugman

The FOMC shifted away from thresholds to qualitative guidance after this week’s meeting. However, in a move that surprised the market, it guided a quicker-than-expected pace of its rate hike cycle — the median forecast of the fed funds rate rose by 25bp, to 1.0%, at the end of 2015 and by 50bp, to 2.25%, at the end of 2016.

The part of the FOMC statement that caught the market’s attention was the mention of a "considerable period" between the completion of the QE asset purchases and the first increase in rates – a period that Ms. Yellen defined as around six months later in the Q&A. Bond yields and the US Dollar went higher in a heartbeat. The reason is that the Fed had long implied the QE purchases will end in October. Ms. Yellen’s clarification that “considerable period” could be as short as six months points to a possible hike as early as Q2 2015 — which is way earlier than the market’s expectations (of a first hike in late Q3 or Q4 2015).

The quickening in the pace of expected rate hikes changes the parameters of the Fed's evolving monetary policy. Why the sudden change? The Fed has improved its employment outlook — the central tendency of the unemployment rate forecast was lowered for 2014 (6.1-6.3% from 6.3-6.6%), for 2015 (5.6-5.9% from 5.8-6.1%), and for 2016 (5.2-5.6% from 5.3-5.8%). The staff’s new unemployment projections seem to be the primary reason for the forward shift in the Fed’s tightening cycle. Optimism on employment and fear of inflation are now driving monetary policy.

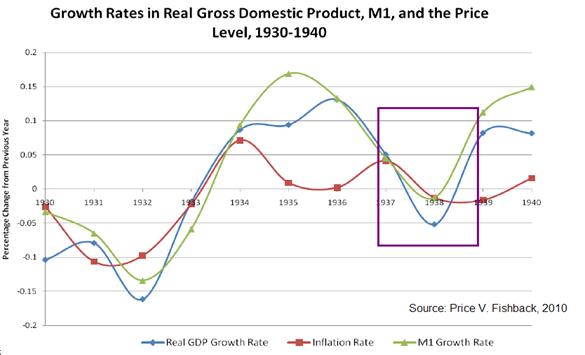

The shift in the Fed’s reaction function worries us; and this is why: this is a continuation of the policy mistakes that have been committed after the initial recovery from the Great Recession of 2007-2008, and those series of mistakes started with tightening in fiscal policy in 2011-12. It therefore alarms us that the Fed is making another move in tightening policy at a time that the fiscal conditions remain contractionary and growth is not yet well-anchored. It is not as if the US has not seen the deleterious impact of simultaneous fiscal and monetary consolidation before — the recession of 1937-1937 has been called the “biggest policy mistake” in history.

The 1937 episode provides a cautionary tale. Christina D. Romer said the urge to declare victory and get back to normal policy after an economic crisis is strong. But that urge needs to be resisted until the economy is again approaching full employment. Financial crises, she said, tend to leave scars that make economic agents behave differently. If both fiscal and monetary policies withdraw support too early, a return to economic decline or even panic could follow. That was indeed the case in 1937, when growth metrics were already falling even before the policy mistakes were made. The result was painful — real GDP was down 11 percent by 1938. That is why the Yellen Fed’s new inflation-oriented reaction function worries us so much.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

Could Brazil and Kazakhstan oil production disappoint again this year?

The US and Canada are expected to be the largest contributors to global oil supply growth this year, accounting for more than two-thirds of non-OPEC supply growth. Brazil and Kazakhstan are expected to contribute by respectively 130’000 b/d y/y and +50’000 b/d y/y to global supply growth. Nonetheless, uncertainties surrounding the actual amount that will reach the market are high.

In Brazil several oil fields are gradually ramping up output, while four major fields are expected to come on stream. Two fields, with a combined capacity of 360’000 b/d are expected to start in the first half of this year and, despite the delays (they were initially expected by the end of last year), should gradually ramp up output. On the other hand, the two major fields, with a combined capacity of 300’000 b/d, that are expected to come on stream in the second half of the year could face delays and might only start production next year. This would lead to a lower than expected rise in Brazilian crude oil output growth. These past few years, delays already had an important impact on oil supply growth.

Moreover, in Kazakhstan, the date of the restart of the massive Kashagan field remains unclear. The field started production last October but was rapidly shut due to a leak of toxic gas. The leak is still being investigated. The field is expected to become one of the world’s largest oil fields. The project with cost estimated at $50 billion was expected to start last year with an initial capacity of 180’000 b/d. The field could restart this year. Nonetheless, many questions persist such as when it could restart and how quickly production will rise.

These uncertainties concerning these two major oil producers reflect the uncertain oil supply outlook outside the US and Canada.

Iraqi crude oil exports could soon decline

According to the International Energy Agency, Iraqi crude oil production reached 3.6 million b/d in March 2014, the highest level since 1979. This would mark a radical change from these past two years when crude oil output stood between 2.8 million b/d and 3.2 million b/d due to infrastructure, bureaucratic, security and political issues.

However, there are still many uncertainties surrounding the Iraqi oil industry. Can this level of production be maintained while the political situation could rapidly deteriorate with the incoming April’s general elections? Following the 2010’s general elections, it took 8 months to form the government, although the political situation was much more stable than now, back then.

Moreover, we have to distinguish between crude oil exports and production as the former is typically used for the estimation of crude oil production (exported crude oil + estimated domestic crude oil use by refineries = estimated crude oil production). Iraqi crude exports in February 2014 reached 2.8 million b/d, up 570’000 b/d m/m. The elevated export level of February 2014 has been used to estimate Iraqi crude oil production at 3.6 million b/d. However, the strength in exports may not be fully explained by stronger domestic production but by improved weather and new infrastructure that allowed stronger exports through a reduction in crude oil inventories. Thus, current lowering crude oil inventories could slowdown exports in the coming months.

Furthermore, the Kurdish government’s decision to restart crude oil exports at 100’000 b/d was offset by the prolonged halt of the Kirkuk-Ceyhan pipeline, which was attacked at the beginning of the month. This suggests that northern Iraqi crude oil exports are likely to be significantly reduced this month, contributing to the reduction in Iraqi crude oil exports in March. Finally, the crude oil exports could be negatively affected in the coming months by the unstable political situation following the general elections.

Gold continues to attract investors

The uptrend in the gold price is still on track despite the 3% decline observed last week. In addition to the persistence of safe haven bids, which still contribute to the revival of the gold price, we have identified additional factors supporting the yellow metal.

Long interest rates in particular have headed downwards despite the recent rebound. The 10-Year Treasury rate stands now at 2.79%, still below the 3% level we saw at the very beginning of the year and despite the Fed’s indication that it would raise interest rates sooner than expected. Furthermore, inflation expectations have probably bottomed in Q2 last year. The 10-year Treasury Inflation-Protected Securities (TIPS) started to accelerate in May 2013 at (-0.62%) and from these extremely low levels have soared to +0.92% in September 2013 - the highest level since April 2011. Since then TIPS have hovered between +0.5% and +0.8%, an elevated level compared with the past 2 years. As far as the USD is concerned, we believe it was the main driver of the decline in the gold price last week: the DXY jumped from 79.385 on March 17 to 80.105 as of March 21 following the Fed’s comments.

Despite last week’s price decline, investors’ appetite for gold has remained unaltered so far. On the Comex, net speculative positions have strongly risen to 152,267 lots more than doubling the early-December 2013 levels. This rise in net positions is the result of a 28% increase in longs and a 60% decrease in shorts since late last year

Furthermore, the world’s gold ETFs have seen inflows these past weeks; in fact they have seen their holdings rise by 1.5% since mid-February. This looks like a small figure but it is actually a considerable improvement compared to the massive outflows that were recorded in the past year.

US soybean inventories expected to be tight this summer

Soybean prices have rallied over the past weeks, mostly on strong US exports and adverse weather in Brazil (although soybean was not the most affected commodity in Brazil). The US could be running out of soybean in the coming months, as the country is getting rid of its production much faster than expected. This is due to a combination of high crush margins and strong exports, notably to China, which has embarked in a strong inventory rebuilding activity.

As crush margins have improved recently, the soybean crushing activity has accelerated. According to the National Oilseed Processors Association, US members crushed 141.612 million bushels of soybean last month, slightly above the already-elevated consensus.

In addition, US exports have been remarkably strong these past weeks. The USDA raised its 2013/2014 forecast of US soybean exports this month by 20 million bushels to 1.53 billion. This number is even more impressive considering the large crop and exports from Brazil in February and the fact that US cash prices remain higher than the South American ones. However, the risk remains that China’s slumping crush margins may lead to cancellations of US deliveries.

The US could be over-exporting at the moment, which could lead to tight domestic inventories this summer. At the beginning of the 2013/14 season, US soybean supplies where 227 million bushels higher than in the previous season. However, record demand may leave stocks this month just a little above their year-ago level. The rapid depletion of inventories could push US to import this summer (especially given the price divergence with Brazil). Forecasts of US soybean imports for 2013/14 were indeed revised upwards by 5 million bushels this month to 35 million.

Chart of the week: The 1937-38 recession was caused by tightening monetary and fiscal policies

|

As discussed in our main commentary here above, we are concerned that the US Federal reserve could be tightening at a time that the fiscal conditions remain contractionary and growth is not yet secured. In our opinion, conditions are very much alike that of 1937-1938, which led to what is called the “biggest policy mistake” in history. In particular, similar to today, the fear of inflation initiated the tightening that led to the 1937 mistake, despite the fact that prices had not yet met their 1926 target. In an editorial from December 2011, the Economist explains: “Whatever relative importance is assigned to monetary and fiscal policy, though, there is little doubt that their simultaneous tightening five years into the Depression led to a vicious relapse (in 1937). (…). By that point the national debt had reached an unheard of 40% of GDP. Congress cut spending, increased taxes and wiped out a deficit of 5.5% of GDP between 1936 and 1938. (…) At the same time the Fed doubled reserve requirements between mid-1936 and mid-1937, encouraging banks to pull money out of the economy. The Treasury began to restrict the money supply in step with the level of gold imports.”

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com