March 17, 2014

Doctor Copper's cold should not last long

Commentary by Senior Market Strategist Robert Balan, Metals Analyst Marion Megel

"What would you do if you were a property developer or businessperson in China and needed to borrow money—but because loan demand was so strong and the government so concerned with easy credit, that normal financing was unavailable? […] these cash strapped business folk in China got incredibly creative with copper as their unwitting accomplice."

Stephen Weiss

Chaori Solar’s default, the first one in China’s recent history, has sparked a collapse in the copper price to its lowest level since mid-2010. What specially stroke us is that copper’s nosebleed came with a sell-off on the physical market. Our understanding of the situation so far is that the highly leveraged Chinese companies involved in financing trades were hit by a perfect storm of regulatory tightening, diminishing funding sources and higher financing costs.

Firstly, let us explain in a concise and simplified manner how a typical Chinese copper financial deal works. Because China lacks an efficient bond market to allow companies to raise debt, a domestic company with funding needs will enter a complex financing scheme that uses metals, especially copper, as collateral. Why copper? Because the metal involved must have a high value-to-density ratio. Basically, a company will import copper and pay with a loan denominated in USD. It will thereafter pledge the imported copper to enter into a USD-CNY swap with a bank. Then, the company will invest the raised CNY into high-yield projects. At maturity of the USD loan, it will sell the copper back on the spot market. As long as the return in CNY is sufficiently high, the trade is profitable.

Now, what we think may have pushed the physical sell-off (companies having to sell the copper back to the market earlier than usual and at a higher discount) is a combination of financial and regulatory elements. Mainly, the financing costs of the copper trades have increased, due to:

• Chaori Solar’s default triggered a panic on the futures market on March 7, 2014; hence diminishing the value of the copper collateral.

• The depreciation of the Yuan also increased the cost of financing, as the company enters a USD-CNY swap with the bank.

• The copper market has been in backwardation since the start of the year, increasing the cost of carry. Usually, a contango market can lower the carrying costs: a simultaneous spot buy and forward sale can generate a positive spread to cover warehouse and insurance costs over time. With a backwardation, the market structure does not allow investors to cover these costs.

The conjunction of these three elements pushed companies to sell their physical copper in order to repay their loans and reduce the liability accounts on their balance sheets. In addition, the Chinese SAFE regulations that categorise companies as A-list or B-list may have accelerated the sell-off. To avoid the B listing and the higher financing costs that go with it, companies had to maintain their leverage ratios and therefore to sell their copper stocks last week. In addition, there is a multiplier effect that could have worsened the sell-off. The notional amount of Letters of Credit (used to buy copper) could actually represent up to 10-15 times the value of the metal stored.

This being said, we do not expect the Chinese copper financial deals to stop abruptly in the near term. The market sell-off was due to specific technical factors for certain Chinese companies; and at this stage, this phenomenon will probably ease. The restocking activity should continue, although at a slower pace. We discuss this issue in our chart of the week commentary below.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

US natural gas inventories are set to rebound at a rapid pace

The cold winter allowed an important reduction in US natural gas inventories through a combination of stronger demand and supply disruptions. Since the beginning of January 2014, US natural gas inventories indeed declined by 1’816 billion cubic feet, while these past 5 years they declined by 1’210 on average. This massive drawdown brought inventories last week to 1’001 billion cubic feet, down 46% from the 5-year average for this time of the year.

Nonetheless, the heating season is about to end and the injection season is likely to start at the end of the month. This implies that natural gas demand is expected to seasonally weaken (even if temperatures remain below than usual), while at the same time more normal conditions and higher natural gas prices should contribute to a rebound in US natural gas production.

The latter is likely to occur not only because companies are restarting activity at gas fields after well freeze-off interrupted output, but also due to the restart of oil wells that were affected by the cold waves. Indeed, associated natural gas production, which is produced alongside oil, remains an important part of total US natural gas supply, accounting for about 20% of overall US natural gas production.

Moreover, high natural gas prices on the US East Coast (spot natural gas prices in New York reached $15 per million Btu last week) could encourage more drilling activity in the Marcellus Shale, which is the major contributor to US shale production growth. US shale gas production now accounts for 45% of US dry natural gas production.

The rebound in natural gas production amid falling seasonal demand could allow US natural gas inventories to build at a faster than normal rate in the coming weeks, adding downside pressure on natural gas prices.

Libyan crude oil exports are less likely to rebound in the short run

Recent developments in Libya have reduced the uncertainty surrounding the rebound of Libyan crude oil exports. After autonomist groups in the eastern part of the country halted crude oil exports in mid-2013, crude oil output indeed declined from 1.2 million b/d in June 2013 to 0.3 in September 2013. This massive drop in light sweet crude oil supply had a major impact on the oil market, contributing to the rise in Brent prices to around $115 per barrel in September 2013.

Since then, the market has considered Libya as a major downside risk on oil prices as Libyan crude oil production could rapidly rebound. Indeed, unlike Iranian crude oil which is heavier, the good quality of the Libyan crude oil makes it easy to flow. In 2011, after the end of the civil war, Libyan crude oil production rose from 10’000 b/d in September 2011 to 1.2 million b/d in January 2012.

This week, the Libyan government decided to take the eastern oil terminals by force and has started to mobilize troops at Sirte. This could lead to another civil war and is suggesting a diplomatic resolution of the issue is becoming less likely. Therefore, crude oil production from the eastern part of the country (about 1 million b/d) is not likely to restart in the coming weeks.

The copper price currently trades at marginal cost

Since Chaori Solar’s default on March 7 2014, the copper price has tumbled by as much as 9%, dragging the red metal to its lowest level since mid-2010. On March 13, 2014, the 3-month copper price closed at $6,421/tonne on the LME. Copper is now traded at its estimated marginal cost of production of $6,500/t. Most producers operating at this cost level are said to be located in China.

If such depressed price levels were to persist, Chinese mines and smelters could be forced to cut production. Most smelters in particular could face significant losses because they usually do not hedge their concentrates inventories. One exception seems to be Jiangxi Copper, who announced last week that it was fully hedged. Most smelters however bought concentrates a few weeks ago at higher prices and will have to sell refined cathodes at much lower prices. Furthermore, the secondary market could not come to the rescue due to a shortage of scrap supply.

Already suggesting that pressure has come to smelters and that supply of concentrates could lessen, treatment and refining charges appear on a downward trend. Metal Bulletin launched last week a TC/RCs index, which is currently estimated at $91.9/tonne and ¢9.19/lb, down from a high of $122.3/tonne and ¢12.23/lb at the end of November last year.

According to Metal Bulletin, copper mines in China may already be thinking about shuttering production. Mines are likely to decide to bring forward any maintenance plans in order to mitigate the price pressure.

Can Coffee prices move higher?

Coffee has been the best performing commodity since the beginning of the year, up by more than 80% YTD, since it is expected to move from a surplus to a deficit this year due to the deterioration of weather conditions. Despite the rapid up-run in prices, coffee remains about 30% below the mid-2011 peak. This suggests that the commodity could still have some upside potential.

Since January 2014, a major drought has hit the southern part of Brazil, the world’s largest coffee producer, accounting for 46% of global Arabica coffee production. The combined January and February rain deficit is approaching 500 mm in the south of Minas Gerais, which is where most of the state’s coffee is produced. This has contributed to the sharp rise in coffee prices.

Other producers apart from Brazil are experiencing adverse weather conditions too. Vietnam, the world’s second largest producer is being hit by dry weather and significantly lower than normal temperatures for the season, affecting primarily Robusta, but also Arabica. Vietnamese coffee production could decline by 8% y/y. On top of that, coffee producers in Central America continue to suffer from leaf rust, which already reduced production by 1.9 million bags in the 2012/13 season; and could cut output by another 1.8 million bags in the 2013/14 season. This plague, which affected all countries of the region with a 53% incidence, is the worst seen since it appeared in Central America in 1976. In January 2014, total exports of coffee by exporting countries fell by 8.4% y/y.

While production has been severely hit, demand for coffee continues to expand at a rapid pace. In 2013, it reached 146 million bags, up 3.8% y/y, the strongest growth since 2010. Coffee demand is expected to show strong growth again in 2014. This should allow coffee prices to move higher.

Chart of the week: The copper physical sell-off is unlikely to continue

|

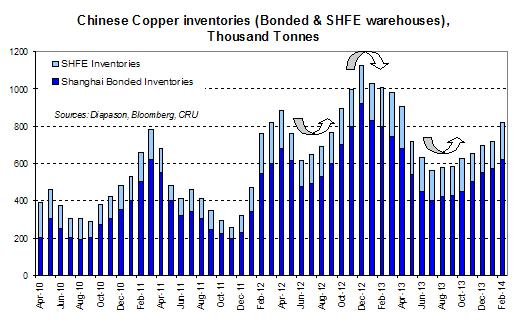

Copper inventories in China (SHFE and bonded warehouses) are estimated at about 800,000 tonnes currently. The risk that this material could be released has weighed heavily on copper’s recent performance in our opinion. However, we believe we have seen most of the physical sell-off activity. The current pressure on the Chinese copper financing trades should not result in a massive release of inventories onto the physical market. It seems that highly leveraged companies were mostly involved in the rapid sell-off. Other companies however usually are short-hedged, meaning that they are not impacted by the falling price.Furthermore, this is not the first time that such events occur in China (2012 CNY depreciation, boom of interbank rates last year) and so far, these events have not stopped the financing mechanism. Like in 2012, when the PBoC cut reserve ratio in order to ease monetary conditions, the central bank could move further towards more growth-oriented policies this year. The restocking process should continue over the coming months, but probably at a slower pace because of the CNY depreciation, which has made SHFE copper 2.5% cheaper than LME material. Import levels should decelerate due to this negative trade arbitrage.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com