March 10, 2014

Climate, weak dollar and geopoliticals risks are feeding agriculture prices’ rise

Commentary by Senior Market Strategist Robert Balan, Metals Analyst Marion Megel, Energy Analyst Alessandro Gelli

"And as the sharp sun struck day after day, the leaves of the young corn became less stiff and erect; they bent in a curve at first, and then as the central ribs of strength grew weak, each leaf tilted downward. Then it was June, and the sun shone more fiercely. The brown lines on the corn leaves widened and moved in on the central ribs. The weeds frayed and edged back toward their roots. The air was thin and the sky more pale; and every day the earth paled."

John Steinbeck, The Grapes of Wrath, 1939

Last year, prices of agricultural goods fell due to an important rebound in production. The Diapason Commodities Index® Agriculture Sector dwindled by 9.2% in 2013, driven by US corn and US wheat which were the worst performers in this sector, dropping by respectively 30.6% and 26.8% over the year. Grains were indeed particularly affected as global production is estimated during the 2013/14 season at 1’966 million tons, up 9.8% y/y, outpacing global demand for grains, which is estimated at 1’914 million tons. This surplus, which is the largest since the 2008/09 season, contributed to a major rise in global grains inventories to an estimated 386 million tons, up 15.6% y/y and the highest level since the 2009/10 season. This led to a significant build in short speculative positions in the agriculture sector, which peaked in January 2014, when agriculture prices bottomed.

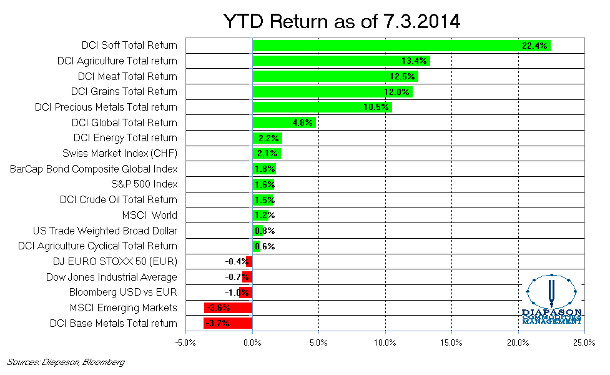

The near-perfect crop conditions in 2013 are highly unlikely to be repeated this year. In fact, markets have already started to adjust to a different environment than last year. The Diapason Commodities Index® Agriculture Sector is the best performing commodity sector since the beginning of the year, up by 13.4% YTD. In February 2014, the agriculture sector rose by 9% over the month, which was the strongest monthly gain since July 2012, when a major drought hit the US Midwest. Several factors have contributed to the upward move in agriculture prices this year. First, the drought that has hit South America, Asia and California has led to a rapid deterioration in the supply outlook of several commodities. Arabica coffee prices grew by more than 70% YTD due to these conditions. According to the Brazilian National Institute of Meteorology, the southeast part of Brazil is facing the driest summer since 1972. This is also having an impact on Brazilian sugar output. Unica, Brazil’s sugarcane industry association, estimated that the drought could damage 35-40 million tonnes of sugarcane (6-7% of the 2012/13 Brazilian sugarcane output). Other grains such as soybeans and corn produced in the region could be affected by the drought. The USDA reduced last month its projection for Argentinean soybean production by 0.9% for the 2013/14 season.

Moreover, a new study published in the Proceedings of the National Academy of Sciences last month shows that there is at least a 76% likelihood that an El Niño event will occur later this year, potentially reshaping global weather patterns for a year or more and raising the odds that 2015 will set a record for the warmest year since instrument records began in the late 19th century. This could add a negative impact on agriculture production. The news has already contributed to some short-covering of Agriculture short positions after it was published. The situation in South East Asia could be especially worrisome as this region is sensitive to El Nino and is already experiencing a drought, which have contributed to the rise in palm oil spot prices by 14% since its January 2014 low and recently reached its highest level since September 2012.

Growing tensions in the Black Sea region could also have an impact on grain supply. Indeed, the unstable political situation may disrupt the planting season in Ukraine. Moreover, a drought is also likely to have a negative impact on the crop yield. On top of that, sanctions against Russia could also affect grains trade flow, adding upside pressure on prices. These events occurred while the US Dollar has been weakening. This also contributed to the rise in agricultural prices. As mentioned last week, the US Dollar is likely to come down further in the coming months. Therefore, deteriorating climate conditions, the falling US Dollar and geopolitical risks suggest that upside potential remains important for agricultural commodities. This sector, which lagged other commodities sector last year is set to perform well in 2014-2015.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli and Marion Megel

Low oil inventories are mitigating the impact of seasonal weaknesses

The oil market is entering a delicate period when oil demand seasonally declines. This could last until the end of April. Demand for space heating and from the power sector decline during this period. Lower seasonal demand is encouraging refiners to perform during this period their maintenance work which is required every 2-3 years for typically several weeks. Global crude runs are indeed expected to decline by 1.9 million b/d between February and April 2014.

Moreover, crude oil supply is expected to increase. The refining maintenance season in oil exporting countries is indeed leading to higher crude oil exports. Russian crude oil exports are indeed expected to rise and are likely to make their seasonal peak in April like in the previous years. In the past 5 years, Russian crude oil exports rose by about 300’000 b/d between February and April. In the Middle East, lower refining activity will also make available more crude oil for exports. Therefore, global crude oil inventories are likely to increase at a faster pace in the coming weeks, adding downside pressure on crude oil prices.

However, this year, oil inventories have fallen to a low level due to unexpected strength in oil demand from OECD countries amid significant supply disruptions. OECD oil inventories dwindled by 1.5 million b/d in Q4 2013, the steepest decline since 1999 to the lowest level since 2008. This is likely to mitigate the impact of seasonal weaknesses. Thus, downside pressure on oil prices is not likely to be as important as the previous years.

Furthermore, petroleum products are likely to benefit from the oil market’s need to replenish low products inventories and from the refining maintenance season. Gasoline prices should particularly do well as US demand is set to rebound after being negatively affected by cold temperatures. Indeed, while distillate demand tends to decline during this period, gasoline demand tends to gradually rise until the end of the summer driving season. This should lead to the outperformance of gasoline in the coming weeks.

European gas market unlikely to be affected by Ukraine

In Europe, the situation in Ukraine has increased concerns about the European gas supply. About 15% of European natural gas supplies (and about half of Russian natural gas exports to Europe) transit through Ukraine. However, the situation is not as tight as in 2006 when Russia halted gas exports to Ukraine affecting greatly the European gas market. At the beginning of January 2006, UK natural gas spot prices rose from $7 per million Btu to near $15 in two days due to the reduction in Russian natural gas supplies amid colder than usual temperatures. In January 2009, Russia also halted natural gas flows to Ukraine for longer period than in 2006. However, the impact on European natural gas prices was less important due to mild temperatures and the economic recession that reduced natural gas demand. UK spot prices rose from about $6.2 per million Btu to $9.0 in one day.

A sharp rise in European natural gas prices like in 2006 and even like 2009 is very unlikely. Indeed, the unused Nord stream pipeline became fully operational in 2012 and connects directly Russia to Germany with a capacity of 32 bcm, half the amount of European natural gas that transits through Ukraine. The pipeline can hence replace part of the gas exported through Ukraine if Russia halts gas flows to Ukraine.

Moreover, European natural gas inventories are at a high level up 37% from the 5-year average (and up 27% y/y) due to the warm weather and as the European power sector is substituting natural gas for coal. Coal prices are low relative to European natural gas prices, due to rising US coal exports.

Furthermore, the heating season is about to end. This is reducing natural gas demand in Europe and in Asia. Consequently, this is also making available for Europe more LNG supply from the Middle East. Thus, Europe is in a better position to face a possible cut in Russian gas flows to Ukraine and the situation in Ukraine is unlikely to have a major impact on the European gas market.

Palladium’s performance: it’s not all about Ukraine

Palladium rose strongly last week, up 4.2% - compared to the modest performances of 0.1% reported for gold and of 1.8% for platinum. Last week indeed saw the coincidence of supply risks emerging from the two largest producing countries - Russia and South Africa. These also come on top of a healthy demand from the automotive industry.

The tensions in Ukraine have brought fears that the Western World could impose trade sanctions to Russia, the world’s largest producer of palladium, accounting for 41% of global supply. Since the unrests have started escalating in Ukraine in mid-February 2014 with the Sochi Winter Olympics, palladium has surged 9.6%, outperforming the precious metals complex. Retaliations against Moscow could worsen the supply of palladium, already affected by the depletion of the Russian stockpiles, which contributed to only 1.6% of total supply last year, against 14% back in 2009.

In addition, wage talks between producers and unions in South Africa collapsed on Wednesday last week – and this came as a surprise, dashing hopes for an end to a severe six-week strike. Talks are now suspended indefinitely. Several PGMs producers, including Lonmin, announced they will not meet sales targets this year; and reports are showing that only Anglo Platinum may have sufficient PGMs stocks to maintain its supply rate for now.

On the other hand, demand looks strong, considering the automotive markets in the US and in China, where the metal is mostly consumed. As opposed to platinum, palladium should not suffer from substitution risks: because it is still much cheaper than platinum, it is often preferred to manufacture auto catalysts when the technology allows it.

Wheat prices boosted by Ukraine-Russia crisis

Grain prices moved sharply following military occupation of Crimea by Russia last weekend as Ukraine is an important grain exporter. The country has traditionally be an important producer and exporter of wheat but it has recently became a major exporter of corn. According to the USDA, Ukraine could take over Argentina for the place of the world’s third largest corn exporter during the 2013/14 season (July to June) with corn exports that are likely to reach 18.5 million metric tons, up 45.4% from the last season. Ukraine is expected to account for 16.4% of global corn trade in 2013/14.

Ukrainian wheat exports are also important for the global wheat market and are expected to account for 6.4% of global wheat trade during the 2013/14 season. Despite the lower importance of Ukrainian wheat than corn on international markets, US wheat prices reacted the most to the deterioration of the political situation in the country. On Monday March 3rd, 2014, US wheat prices rose by 4.9% over the day, while US corn prices increased by 1.5%.

The stronger performance of US wheat prices can be explained by its tighter fundamentals and the risk of Russian grains trade’s disruptions. Indeed, according to the International Grains Council, global wheat inventories are below their 5-year average and are expected to rise only modestly in the coming years. On the other hand, global corn inventories are expected to increase sharply during the 2013/14 season and to remain above the 5-year average in the following two years. Moreover, Russia is an important exporter of wheat and is expected to account for 10.6% of global wheat trade in 2013/14, while it will account for only 2.7% of global corn trade. Sanctions against Russia, if implemented could hence have a larger impact on wheat than the corn market.

Thus, recent developments in Ukraine have hence confirmed that the wheat market remains vulnerable to a supply shock due to its tight fundamentals. On the other hand, corn prices are likely to underperform the grains sector further.

Chart of the week: Ukraine highlighted improving conditions for commodities

|

Last week, Russia took de facto control of the Crimean peninsula. Worries have consequently emerged concerning possible sanctions against Moscow, which have subsequently negatively affected the Russian stock market and foreign companies involved in this country. On the other hand, grains, oil and palladium prices moved higher due to the significant importance of Russia in these markets. Gold prices also benefited from the tensions due to its safe heaven status. However, the upward move in commodity prices cannot be interpreted as the result of this event alone. In fact, underlying fundamentals for these commodities have been improving these past few months. It is not a surprise hence that commodities have been the best performing asset class since the beginning of the year. The Diapason Commodities Index® is up by 4.8% YTD, driven by the agriculture sector (+13.4% YTD) and the precious metals sector (+10.5% YTD). The importance of Russia and Ukraine in the corn and wheat market contributed to higher grain prices last week. However, it was the expanding drought in South America, Asia and California, growing concerns about the return of El Niño and oversold conditions that were the main drivers of the upward move in agriculture prices since the end of January. Similarly, for the palladium market, Russia is the world’s top producer but fundamentals were already tight, due to the depletion of Russian stockpiles and ongoing disruptions in South Africa where miners’ strikes are likely to continue. Gold prices have not only benefited from the tensions in Ukraine but have been positively affected by the weaker US Dollar and the growing investors’ confidence since the beginning of the year. The oil market remained tight as stronger than expected demand from OECD countries and especially the US in the second half of last year occurred while supply disruptions increased to elevated levels. This contributed to a rapid depletion in petroleum inventories to the lowest level since 2008, while global oil demand is set to grow this year at the most rapid pace since 2010. The situation in Ukraine highlighted the tightness in the commodity sector, which has been overlooked by investors these past few months following its poor performance relative to the equity sector. Improving conditions for several commodities should allow the commodity sector to outperform further other asset classes in the coming months. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com