March 3, 2014

US Dollar to bounce but the rally will not last

Commentary by Senior Market Strategist Robert Balan

"Clearly the dollar weakness is a big factor, not just for gold but for the other metals as well."

Stephen Briggs

Following our comments on the Chinese central bank last week, the latter has confirmed its intention to shift from a contractionary stance towards a growth-oriented policy. The significant PBoC’s intervention on the FX market last week contributed to the sharpest decline in the renminbi since 2005 — when the currency was de-pegged. Massive US dollar purchases by the PBoC and state-owned banks were probably designed to deter bets on one-way appreciation of the CNY and at the same time stimulate exports and an economy that has slowed down these past few weeks. On the other hand, there is another dimension, which rationally explains the CNY depreciation — the 7-day repo rate has been falling sharply since the start of the year — it was fixed at 6.44% during the last week of 2013, and has fallen to 3.21% last week. To us, this signifies a new willingness by the PBoC to inject liquidity into the system without the consequences of the blunt effect of an interest rate cut.

On the other side of the spectrum, these monetary developments and other geopolitical events e.g., Russian troops in Crimea, and idiosyncratic risks in the EM universe as the election cycle is approaching, are all contributing to strengthen the US Dollar. This could last few weeks longer. However, the bigger risk to the US Dollar over the next quarter at least is to the downside. Activity is slowing down in the US, whether the Fed wants to acknowledge it or not. US GDP was revised lower on Friday from 3.2% to an annualized rate of 2.2% q/q. Most of the damage was from revised private consumption as retail sales continue to deteriorate — it was at -0.4% in January, the lowest level since the growth scare of June 2012. In fact, this is a continuation of the weak trend in consumption — durable goods have also been trending lower since September 2013. Another point is that even before the onset of the snow fall in the US Eastern Seaboard, housing took a nasty downturn in August, and has been on a downward trend since. It will likely deteriorate further over the coming months.

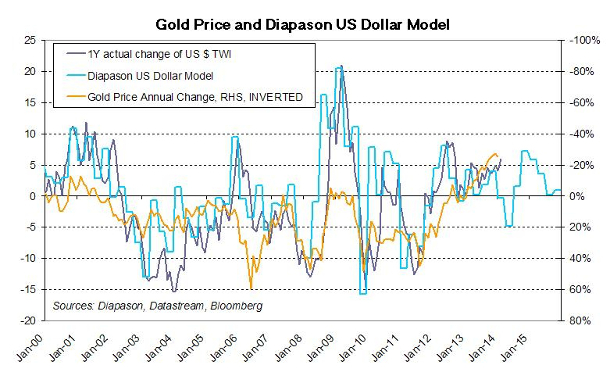

Reflecting the deterioration of economic activity, bond yields have been sinking fast — obviously the bond market is less optimistic about the state of the economy, unlike the Fed and many sell-side economists. The problem with a let's-pretend stance is that when the snow finally dissipates, as it will eventually, and the economy continues its slide, the negative reaction will be much sharper than if the acceptance of a deteriorating economy is taken as it happens now. The Fed is vulnerable in making this sharp negative reaction, especially with regards to their QE tapering process. We expect that at some point in time, the deteriorating data will finally rudely intrude into the Fed's state of denial, and force it to finally take action. We expect the Fed to modify the tapering intensity, and maybe even to stop it altogether. This is one of the primary elements which may cause the US Dollar and bond yields to fall quickly into Q2 2014. In this environment of lower US growth and monetary easing, gold prices are likely to perform particularly well (see chart of the week).

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Chinese SPR contributed to strong crude oil imports

Chinese crude oil imports made two consecutive record highs in December 2013 (6.3 million b/d, up 13.1% y/y) and January 2014 (6.7 million b/d, up 13.2% y/y). The start of new refineries and the early Chinese New Year Holiday were the main drivers behind these strong imports. Moreover, some reports suggested that purchases of crude oil for Strategic Petroleum Reserves (SPR) also contributed to push higher crude oil imports.

The large Huangdao SPR facility, with a storage capacity of 18.9 million barrels recently became operational. If the government plans to fill this facility over 6 months this would add 100’000 b/d of Chinese crude demand. However, while this facility is expected to gradually be filled, the Chinese government could purchase crude oil during a decline in crude oil prices like it did these past years. In turn, this should put a floor on oil prices and could even contribute to a rapid rebound in oil prices.

The Chinese government has started the construction of storage facilities of the third phase of the SPR plan (but the Huangdao facility is still part of the phase II). These facilities are expected to have a capacity of about 230 million barrels and are likely to be completed by 2016. The Chinese government plans to have them fully filled by 2020 at the latest.

Cold weather negatively affected US tight oil production

The US is likely to be again the largest contributor to global oil supply growth this year thanks to the tight oil boom. However, cold temperatures have affected US oil production, leading to a decline in output growth. In North Dakota, crude oil production fell by 55’000 b/d m/m in December due to the cold weather that led to supply disruptions.

Tight oil production is indeed sensitive to the weather as cold temperatures could lead to well freeze-off (the water produced alongside oil freezes) and could affect hydraulic fracturing operations, which use an important amount of water. Moreover, the lack of infrastructure in some areas makes tight oil wells vulnerable to the weather.

Indeed, tight oil production in North Dakota remains vulnerable to snow storm as 75% of oil is moved by trucks from the oil fields to pipelines or rail terminals. Insufficient storage capacity on site implies that when trucks cannot transport the crude oil from the well, production is halted at the field. The bad weather that affected tight oil production contributed to the downward revision by the US government of the US oil production growth forecast by 0.1 million b/d for 2014 and 2015 to +1.0 million b/d y/y in 2014 and +0.8 million b/d y/y in 2015.

Contrasting with conventional crude oil production, the slower pace of hydraulic fracturing or the reduction in drilling has a rapid impact on crude oil production due to the high decline rate of tight oil well, which could reach 69% after the first year. The characteristic of US tight oil indeed require constant drilling to maintain production.

The important snowstorms and the extremely cold weather that hit the US Midwest in January and February this year have hence contributed to slow down drilling and hydraulic fracturing activity. This led to a reduction in crude oil production and contributed to the decline in crude oil inventories in the Midwest. Consequently, this implies that the strong performance of WTI prices was driven by weather-related events, which will not last. The return of normal temperatures could therefore lead to a weaker WTI.

Lead: short term risks but stronger prospects for the spring and summer

Lead has benefited over the past weeks from the harsh winter season in North America. US lead consumption may have in fact increased by nearly 2% y/y in January. The metal is indeed primarily used in the manufacturing of car batteries, whose replacement usage exceeded expectations due to the damage the cold have had on car batteries over the past weeks. As temperatures are normalising, we expect lead demand to retreat in the short term. Also, the beginning of the year is the time when China demand slows down, due to the combined effects of the New Year holiday week and the lowering demand for electric bikes – as sales decrease in the winter. China has indeed remained a net lead exporter so far this year.

Prospects for lead appear brighter for the spring and summer seasons though, when demand for e-bikes is expected to improve. Although Chinese authorities are restraining the use of this transportation method due to security issues, the consensus expects ebikes sales to increase by another 4-5% this year. In addition, the spring season (along with the fall) is also the time when battery makers rebuild their inventories ahead of the summer months (and winter months as far as the fall restocking season is concerned), during which replacement batteries often break.

Furthermore, it seems there is currently a shortage of scrap supply, which usually meets about half of global lead demand. Currently, scrap battery prices in the US are only 7% below their 2012 all-time high. As secondary smelters are running below full capacity, the lead market should see its deficit widening this year, from a balanced market in 2013.

Unsurprisingly, forward curves have flattened and have even recorded a slight backwardation from the April to October contracts. Backwardation should be confirmed soon; but not immediately as short term risks persist.

Gold and silver investment demand on the rise

Despite the retreatment at the end of last week, gold and silver prices still appear on an upward trend and are now respectively up 10.7% and 10% since the beginning of the year (as of February 27, 2014). Over the past six weeks, we have been arguing that precious metals could be set for a rally — and we believe that both metals have further upside potential, especially now that investment demand appears finally on the rise. The depreciation of the US dollar and the retreating long interest rates from the end-2013 high levels have both had a positive impact on the sector.

Indeed, on the Comex, net speculative positions have strongly risen these past weeks. Net gold specs have climbed to 119,685 lots, up 1.5 times their December low levels and doubling the beginning of year levels. This rise in net positions has resulted from both a 25% increase in longs and a mirroring 25% decrease in shorts since the start of the year. Similarly, silver net speculative positions have surged by 75% year to date, with stable longs but tumbling shorts (+42% YTD).

Furthermore, ETFs have recorded net inflows over the past weeks for the two metals. The world’s largest gold ETFs have seen their holdings rise by 0.2% since the start of February. This looks like a small figure but it is actually a considerable improvement from the massive outflows that have been recorded in the past twelve months. Silver ETFs also recorded net inflows of 0.8% in February.

As far as the sentiment is concerned, gold has exited the oversold territory. The consensus is now 57% positive on the yellow metal, the highest level since early November last year; and far above the 29% recorded at the start of the year. Similarly, positive opinions have totalled 47% as for silver, the highest since mid-December 2013.

Chart of the week: Gold prices to benefit from the expected weaker US Dollar

|

Over the past weeks, we have identified several factors that could lead to a rebound in the gold price. The metal's performance since the start of the year - despite the recent setback - has confirmed our view and we still expect the yellow metal price to improve further over the coming months, with higher inflation expectations and a lower USD as background. Historically, an increase in the US dollar has led to a poor performance in the preice of gold, and vice versa. A divergence appeared in the second half of 2013 as the DXY depreciated from a high of 84.580 as of July 9 to end up the year at 80.035, while the US gold price experienced further declines over the same period. This divergence was not expected to last — and so far, the correlation has regained ground since the start of the year. As discussed in our main commentary, we believe the deterioration of the economic activity could eventually lead to a shift in the US Fed's policy towards additional monetary easing, and therefore to downside pressures on the US Dollar, hence supporting the gold price. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com