February 24, 2014

Central bank reaction function at work:

Is China’s PBoC loosening the purse strings?

Commentary by Senior Market Strategist Robert Balan

"When the facts change, I change my mind. What do you do, sir?"

John Maynard Keynes

China's central bank is doing an apparent volte-face on its tight money regime after a domestic growth scare and the EM turmoil. The People’s Bank of China (PBoC) is sounding less and less hawkish and the words “stability” and "to maintain appropriate liquidity" has been well emphasized in its Q4 2013 report. Is this a real shift? The dubiousness was appropriate — only a month or so ago, the PBoC's tight regime was there for everyone to see: It allowed faster appreciation of the CNY since September, it guided reverse repo rates higher in late October and it tolerated devastating spikes in interbank rates in mid-December. So what changed the central bank's regime — from a real tight-wad to a more growth-oriented policy in January?

The subtle shifts that we are seeing now may reflect recent changing economic conditions with slowing growth and subdued inflation in late 2013 and in early 2014. Late last year, growth momentum has slowed steadily, with investment decelerating to a decade low in December, the manufacturing PMIs falling to ~50 in January and inflation surprising to the downside. The change in the economic environment has encouraged to the PBoC to change its policy.

The repo operation on Tuesday 18 February, the first in eight months, set a lot of analysts in a frenzy, claiming that the PBoC is retightening policy. Has the PBoC, indeed, gone hawkish again? No, we do not believe so. Open market operations (OMOs) from the PBoC to withdraw liquidity should be expected at this time of the year given the usual large amount of cash that goes back to the banking system after the Chinese New Year holiday. It happens practically every year. Moreover, the PBoC, contrary to analysts interpretation, refrained from using OMOs earlier in the week, and tolerated the falling rates instead. Tuesday's repo amount was pitifully small, hence the 7-day rate fell again later in the trading day. Obviously, the 7-day repo operations on Tuesday was a bid to keep the repo rates from falling too sharply. As we said, the PBoC evidently desires rates to stay at early February levels — not too tight and not too loose. On the FX side, the PBoC guided the CNY weaker (with some spectacular declines in Q4 2013). There has been a slowdown in monthly FX purchases. The reduced PBoC intervention in large part reflects its desire for a CNY appreciation. The CNY strength was also mirrored by a decline in China FX reserves growth since the stronger CNY trend started in 2011.

The PBoC has hence moved away from a contractionary stance (for the immediate future — the rest of Q1 2014 — at least). We do think that relatively favourable liquidity conditions will continue into March (at least). The PBoC's shift towards a more flexible stance has occurred ahead of the annual National People's Congress (NPC) meeting that will convene on 5 March, when the economic agenda for 2014 will be set and the reform road map will be discussed. The reaction function of the central bank with respect to crucial and very high profile events like this is very predictable. And with the NPC meeting close at hand, the PBoC will not likely (and knowingly) inflict harm on the corpus economicus before the meeting has even started. The reaction of the PBoC to the new economic situation is supportive for the Chinese economy. In turn, this should have a positive impact on commodity demand and especially on the base metals sector.

This is an excerpt of a longer report: Diapason Commodity Themes - Central bank reaction function at work: is the China’s PBoC loosening the purse strings?

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Iranian crude oil exports are unlikely to restart this year

The international sanctions against Iran have led to a decline in Iranian crude oil exports by about 1 million b/d since mid-2010. This forced the Iranian government to shut in output. Recent negotiations may have let the market believe that this oil could come back this year. The interim agreement between Iran and the P5+1 countries in November 2013 in Geneva has been implemented last month (and will last until July 2014) and indeed increased hope that international sanctions against Iran will gradually be lifted throughout the year.

Recent speeches from Hassan Rouhani, the Iranian president, to international companies implied that Iran could soon open to foreign investment. The end of the international sanctions would also mean that Iran could increase its crude oil exports in the second half of the year, which are now constrained at 1 million b/d.

The nuclear negotiation occurred in Vienna in mid-February 2014 were hence closely monitored by the oil industry. These negotiations have set the framework for an final agreement that would be implemented by the middle of the year.

However, the recent declarations from Iran’s Supreme Guide, Ali Khamenei, are leading to growing doubt about a final agreement. Indeed, he said before the Vienna’s negotiation that he was “not optimistic about the negotiations” and that they “will not lead anywhere”. These declarations from the man who has the final say in state affairs are implying that even if a nuclear agreement is close to be reached, Khamenei may oppose and prevent a final agreement.

Moreover, some diplomats and people working in the trading industry have also expressed doubts about an agreement to be reached this year. Ian Taylor, Vitol’s CEO, said this week that he doesn’t expect additional supply from Iran on world markets this year as issues aren’t likely to be solved any time soon. This imply that Iranian crude oil exports aren’t likely to increase in the second half of the year and are hence likely to stay at around 1 million b/d.

China’s apparent copper demand hit a record high in January

Last week, the Chinese commodities trade data surprised markets by showing record high imports of copper, iron ore and coal, ahead of the New Year festivities, which ran from January 31 to February 6. In fact, total copper imports in January surged to 536,000 tonnes, up 22% m/m and 53% y/y. Refined copper imports hit a second highest level on record, at 397,000 tonnes, just slightly below the December 2011 figure.

In addition, domestic copper inventories have not risen in such proportions, while production is estimated to have remained near record high last month, taking China’s apparent demand of refined copper (calculated as production + net imports – change in inventories) to an all-time record high.

The data contrasted with disappointing PMI indicators and worries over emerging markets’ metals demand. However, one major risk has arisen on the copper market: the depreciation of the CNY. As the upside case on copper has mostly been driven by the high restocking needs and hence expected large import volumes; further decreases in the CNY could hurt imports and drag copper prices downwards. The CNY may be the major indicator to monitor in the coming weeks.

Silver too could rally over the coming months

Gold and silver prices have both performed remarkably well since the start of the year, respectively by +9.5% and +11.9% as of February 20, 2014 — offsetting the declines recorded during December 2013, when gold fell below the $1,200/oz barrier and silver below $19.5/oz. It is worth noticing that during the December price slump, gold’s closing price set a new low, while silver did not, illustrating silver’s resistance compared to gold.

In the past weeks, we have been arguing that gold could be set for a rally over the next quarter or two, lifted by macro economic factors (inflation expectations may have bottomed, USD could depreciate) and also helped by the still depressed sentiment. We believe that silver could also participate in this price rally. Silver has long been the ugly duckling of the precious metals sector and many investors have shied away from the devil’s metal’s volatility. However, the past weeks have seen a strong outperformance of silver over gold, boosted by the breaking of its own resistance level.

Sentiment over silver is indeed very low too, at only 31% positive opinions, not far from the 22% low hit in June 2013. Also, silver net speculative positions remain relatively low, with short positions having continuously increased since mid-January this year; offering room for short covering activity in the coming weeks. Short positions are indeed only 10% below the all-time high record set in December last year. Another positive factor is that investment demand is holding firm, especially when compared to the continuing outflows from gold ETFs.

Investors are turning more positive on agricultural commodities

According to data published by the Commodity Futures Trading Commission (CFTC), managed money, a proxy for investors, raised by more than 116’000 contracts its net long positions in futures and options in the main 13 US traded agricultural commodities. The rise took the aggregate net long above 500’000 contracts for only the second time in the last 14 months.

For corn, investors turned positive for the first time since June 2013 with a net long positions in Chicago futures and options of 34’340 contracts. In less than 4 months, managed money have bought nearly 215’000 contracts. For wheat, investors have only a net short position in Chicago futures and options of 43’225 contracts. Last month, managed money had a net short position of 73’088 contracts, which represented the biggest bet on price falls since records began in 2006.

These changes were encouraged by cold weather in the US which has hampered crop supplies leading to a surprisingly large downgrade to estimates for US supplies. Indeed, in the last monthly report, published on the 10th of February, the US Department of Agriculture (USDA) cut its estimate for US corn stocks at the end of the season 2013-14 by 150 million bushels to 1.48 billion bushels, a far bigger downgrade than investors had forecasted. Moreover, the USDA also revised lower its wheat ending stocks estimate by 50 million bushels to 558 million bushels.

Regarding others agricultural commodities, hedge funds extended to 14’728 contracts their net long position in Arabica coffee, for which Brazilian production estimates have been sharply curtailed because of the lack of rainfall. That represented the most bullish positioning in Arabica coffee futures and options, traded in New York, since September 2011

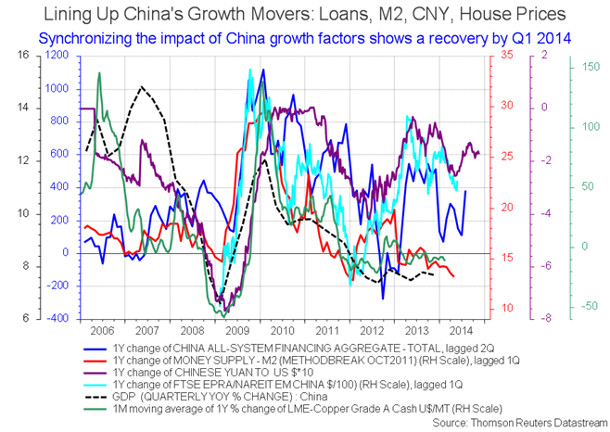

Chart of the week: China’s growth movers are becoming more positive

|

Growth in China has been growing on a sideways trend, despite positive contributions coming from loan issuance, rising house prices, a rising currency which maybe of scant help on the export side, but of definite help on the domestic consumption side. The only weak spot so far has been the falling trend in M2 money supply. These growth factors are anywhere from 1 quarter to 3 quarters ahead of the GDP evolution, which makes sense from the point of view that there is no such thing as an “efficient economy” — where all the facts that contribute to growth can all be distilled in a snapshot of the GDP in any single moment. As we have learned again and again, changes in the contributors to growth lead the changes in GDP, but only after a certain lag. In China’s case, for the factors highlighted on the chart, a concerted upwards trend comes in, or immediately after, Q1 2014, then growth progressively gets stronger towards the second half of the year. This should come as a relief for copper prices, which we juxtaposed, along with those factors. The yearly changes in copper prices have so far matched the trajectory of China’s GDP (flattish); however, but a more positive outlook for Chinese growth should come as a boon for the red metal, and other commodities that feed the growth of the Asian dragon. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com