February 10, 2014

Improving conditions for commodities: Money velocity is back!

Commentary by Senior Market Strategist Robert Balan, Metal Analyst Marion Megel, Energy Analyst Alessandro Gelli

"...there has never been a situation of excess broad money (created by the banking system) which has not been followed by increasing inflation, and […] the increase in inflation occurs after several years lags."

Samuel Reynard, Swiss National Bank, “Assessing Potential Inflation Consequences of QE after Financial Crises.”

The US Fed is expected to continue to taper in the coming months based on improved economic data. This could result into lower inflation expectations by the market as it demonstrates some form of control the Fed has over the monetary system. However, by ignoring monetary aggregates, the US Fed has put itself in a dangerous situation. According to recent research from Samuel Reynard, Economic Advisor at the Swiss National Bank, the increase in money supply is always followed by a rise in inflation but this is occurring with a lag.

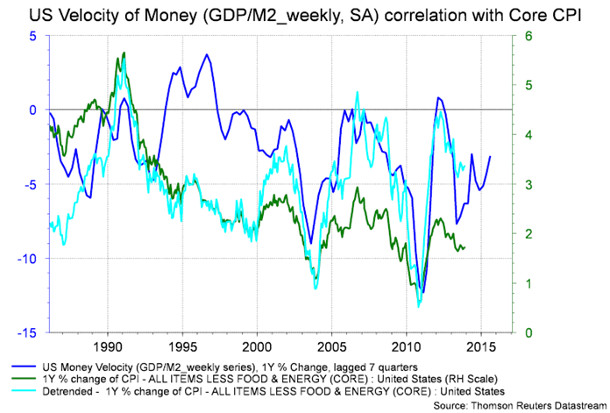

The lags are probably giving a false sense of comfort for the markets about central banks’ capability to act against the possible future rise in inflation. The central banks were behind the curve in the 1970s, and there is a nagging fear that the confidence of the central to act in a timely manner may be misplaced again this time. According to Reynard, “...inflation increases are persistent and occur even after money levels are subsequently reduced with restrictive monetary policy trying to fight the increase in inflation”. And the reason inflation has not yet accelerated is because inflation lags behind the changes in money velocity by two to three years. As the chart of the week shows, we have seen a significant turn-around in M2 money velocity in late 2012 — we are at the right time this year for inflation to rise.

The recent change in money velocity is hence hinting that the period of low inflation is almost over. In fact, according to our modelling work, US core CPI growth is close to its trough. The subsequent acceleration of the core CPI is likely to add upside pressure on inflation expectations. At this time, the role of commodities as hedge against inflation is likely to gain to traction among investors. And as previously discussed, commodities tend to perform well in an inflationary environment.

During the first phase of the last acceleration of the US core CPI growth from late 2010 to mid-2011, the Diapason Commodities Index® rose by almost 20%. Among the commodity sectors, the best performer was the precious metals sector which increased by 38%. The energy and base metals sector also performed well and were up by respectively 19% and 9%. Moreover, despite the recent commodities outperformance these past few weeks, this asset class remains relatively cheap and underappreciated by investors. It still has significant relative value against other asset classes and especially against US equities.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Energy subsidies mitigate the impact of the sharp EM currencies drop

Some worries could arise concerning the recent sharp decline in EM currencies and its impact on oil demand. In local currency, Brent prices made new record highs in Brazil, and South Africa and are close to record high in India and Mexico. The rapid rise in oil price is supposed to have a negative impact on oil demand from these countries as while mild move in oil prices have little impact on oil demand, significant rise in oil prices could lead to demand destruction as we have seen in early 2008.

However, the impact on oil demand from large emerging countries will be limited as some of these countries still have important energy subsidies. Brazil, India, Russia and Indonesia and other non-OECD countries have implemented subsidies on oil products for different reasons: in order to fight against inflation, to gain popular support, to share the oil income for the oil exporting countries, to increase the domestic industry’s competitiveness. These subsidies allowed to insulate domestic oil demand from the rise in international oil prices these past years and are hence now mitigating the impact of the sharp drop in EM currencies.

Furthermore, not all large emerging countries have been affected by these sharp moves in currency. The Brent price in Chinese Yuan and in has for example only slightly increased, having therefore a limited impact on Chinese retail oil prices, which remained under the government’s control.

Moreover, despite the growing subsidy burden for government, incoming elections are likely to discourage government to remove subsidies in the short run. In Indonesia, parliamentary elections will be held in April 2014 and the presidential election in July 2014. In India, the parliamentary elections will be held in May 2014. In Brazil, the general election will occur in October 2014. On the other hand, there is a growing risk of energy subsidy cut following these elections. Global oil demand growth is therefore unlikely to be significantly affected in the short term by these sharp declines in EM currencies.

EM currency depreciation: not a major risk for most metals

Last week, we discussed the fact that the current emerging markets’ turmoil should not pose major threats to the commodity recovery process and that, amid the crisis, energy should outperform base metals. It is true that the EM tumult should lead to a negative sentiment and to a risk aversion that could affect LME metals. In fact, over the past two weeks, nickel, which is considered as the risk-on metal par excellence has suffered the most. As far as fundamentals are concerned however, it all comes down to China for metals demand – not to Turkey or Argentina.

However, the current emerging markets' drama could pose one risk on commodities' fundamentals in a different dimension: if the depreciation of the EM currencies becomes significant, it would significantly pad the local commodity producers' margins and could encourage more production. Take South Africa, for instance. On average, between 80% and 85% of PGMs producers’ costs are denominated in Rand, while their production (PGMs) is sold in US dollars. This means that producers must exchange their dollar sales into Rand in order to pay for the costs; so a fall in the Rand can significantly reduce the cost pressure of the industry. However, this risk should not affect all metals uniformly. In fact, it should only affect a few metals. Indeed, the metals’ prices are structured around the marginal cost of production of the refined metal, not of the mined production. Therefore, it is the refiner, not the miner, who has the most influence on the end-price. So miners could find some relief in the currency depreciations, operating mostly in Latin America and South Africa. However, for most base metals (copper, nickel, zinc, aluminium), marginal refiners are located in China, where the Yuan has not depreciated that much. Therefore, the EM tumult should help miners without affecting base metal prices to a significant extent.

Gold depressed sentiment set to help push gold prices higher

Gold price outperformed in January, up 3.1% over the month. We have identified several factors that could lead to an extended rally in the gold price over the quarter. The macro-economic environment is favourable to gold prices, as we expect inflation to come back in the picture, global monetary policies from the main Central Banks to remain loose and the US dollar to depreciate in the short term.

The recent microeconomic trends of gold are also paving the way for a good performance of gold in the first quarter. Looking at the market sentiment and the Comex positioning, we are still wondering where all the gold bulls have gone. Net speculative positions on the Comex remain at the second lowest level since September 2008 and short positions are about twice as high as the 2001-2012 average. The market is now 37% positive on the yellow metal; a slight improvement from the 32%-level reported during the second week of January 2014. But this also a very poor level when compared to the period than run from the end of August to mid-December 2013, when the market’s bullish opinions hovered between 44% and 63%. As gold has entered a bear market, it has become difficult to establish new boundaries in market sentiment for the “oversold” and “overbought” territories. During the uptrend in gold prices, the metal was usually considered oversold when bullish views fell below the 50%-level. Since gold has entered a consolidation phase since September 2011, this 50%-threshold no longer holds. It seems that like in the period from 1991 to 2011, these frontiers could stand around 35% and 60% — which could therefore set the current market sentiment into the oversold region. We believe this over-pessimism is not sustainable and could help macroeconomic drivers (inflation, US dollar) to push the gold price near the $1,400/oz frontier over the next quarter.

The pace of soybean consumption is greater than expected

Between September 1, 2013, beginning of the marketing season and December 31,2013, the US have consumed 591.3 million bushels of soybean according to data published by the National Oilseed Processors Association (NOPA). It represents the second largest start since data are published in 1998. Only in 2007, consumption was larger with 597 million bushels crushed.

For the complete marketing season, the US Department of Agriculture (USDA) forecasts the US soybean consumption at 1’700 million bushels, meaning that 35% have already been consumed, a record since the season 2003. Regarding the net export sales, the US have sold 21.4 million tonnes since the beginning of the season, according to the USDA. If we add the sales made before September 1, for the season 2013-14, we obtain a total of 42.7 million tonnes, which is larger than the export estimate of 40.7 million tonnes. Therefore, either the USDA will revised higher its export forecast, or the US will have to cancel some sales already contracted. The market continues to expect cancellations by China, but none have been confirmed. If we look at the soybean export inspections, 1’115 million bushels of soybean have been shipped since the beginning of the season. It is 17% more than last year. With an export estimate up by only 13% since last year, we can conclude that the pace of shipments is higher than in 2012-13.Therefore, we can conclude that both the domestic consumption and the exports are greater than previously expected. It means that there is a large probability to see in the coming months, the USDA to revise lower the ending stocks forecast, which is already at a very low level of 150 million bushels. It is the main reason why soybean prices have outperformed corn prices and wheat prices by 7.4% and 11.9%, respectively since the beginning of the market season.

Chart of the week: Rising money velocity will set the pace for higher inflation

|

Although the massive monetary stimuli by the US Fed these past few years have not yet cascaded into the money supply aggregate (the impact was confined mostly on the M0, the Monetary Base), some of it is already leaking into the M2 and M1 aggregates (which are considered the true measure of the level of money in the system). The benign inflation behaviour is also abetted by the long lags between the onset of new money and the concomitant inflationary push caused by the rising money aggregates. That situation looks to be coming to an end soon. The rate of change in M2 two years ago is about to impact core CPI. We expect inflation to rebound soon and to rise at a rapid pace. Commodity prices are likely to be the main beneficiaries of this new environment. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com