February 3, 2014

EM woes give commodities a chance to shine versus equities

Commentary by Senior Market Strategist Robert Balan, Metal Analyst Marion Megel, Energy Analyst Alessandro Gelli

"With the growth leadership shifting from emerging markets to the OECD, this is certainly positive for energy overall"

Daniel Belchers, Threadneedle Investments, October 2013

The sharp drop in Emerging Markets currencies has hit the most vulnerable countries with large current account deficit the hardest. Fears of further propagation of these issues — contagion — have increased concerns about other emerging countries. It is no wonder then that MSCI Emerging Markets is underperforming equities in developed countries and even commodities. To some degree, in fact, equities in developed countries are also feeling the heat, at a time when commodities have stayed flat or are even rising in some sectors. In these past two weeks, the Diapason Commodities Index® rose by 0.6% while the S&P 500 index fell by 3.1% and the MSCI Emerging Markets Index dropped by 3.7%. There may be a significant link between the economic development in emerging markets and commodity demand growth, but the stronger correlation is now between commodities and the surging demand growth from developed economies.

It should come as no surprise therefore, that commodities will likely outperform emerging markets further. The latter now has tremendous relative value after having lagged developed market these past three years. On the other hand, there are still important political and economical risks in some large emerging markets countries such as Brazil (with the October 2014's general election), Russia and South Africa. These issues in large EM countries are now, and for some time will continue to be, negative factors for the MSCI Emerging Markets Index.

The impact of the EM turmoil on commodities would be country-dependent and could be specific to some sectors that have close links to EM markets (e.g., base metals). The EM turmoil could negatively affect commodity prices if contagion extends to major importing countries such as China — the turmoil may in fact be supportive for commodity prices if contagion engulfs major commodity exporters. So far, there are no signs of contagion affecting the growth outlook in China, on the other hand, political tensions are rising in some major commodity exporting countries such as Iraq and Venezuela (energy exporters), and in Brazil (iron ore and soybean exporter). Turmoil in these large producers should contribute to the outperformance of commodities over emerging markets equities.

While it's true that most energy demand growth comes from emerging countries, developed economies still comprise a very large share of global energy demand. OECD countries account for example for 50% of global oil demand. Thus far, the recent recovery in oil demand in Europe and in the United States has contributed to the $10 increase in Brent prices since Q2 2013. Moreover, it has an important impact on commodities indices as these tend to be heavily biased towards energy. The energy sector which is linked to the stronger growth in developed countries should do well, and that would mitigate the impact of slower growth in some emerging countries to general commodity prices.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Cold weather and low inventories push US natural gas prices higher

The Arctic weather, which again hit the US, contributed to an important increase in space-heating demand. Natural gas, heating oil and power demand hence reached high levels. This especially affected natural gas which accounts for 70% of total fuel used for space-heating in the US.

The strong space-heating demand therefore led to a significant reduction in US natural gas inventories, which have reached last week 2193 billion cubic feet, down 22% y/y and the lowest level since 2005 for the season. Low inventories while the heating season has not yet ended has made the US gas market vulnerable to lower than normal temperatures.

The latest cold wave which has hit this week the southern part of the US and expected cold weather next week for the northern part of the Midwest amid low inventories have contributed to sharp moves in natural gas prices. The March 2014 NYMEX Henri Hub futures contract indeed rose by 17% in only two days (on 28-29.01.2014) and then declined the following day by 8.3%. Natural gas inventories are likely to decline further following the recent cold wave. Volatility on US natural gas prices is hence expected to remain at an elevated level.

Nonetheless, natural gas production is likely to rebound once temperatures increase. These past few months, production from the Marcellus shale continues to grow at a rapid pace, more than offsetting the decline in shale basins in the southern part of the country. Furthermore, the higher natural gas prices have encouraged some producers to restart drilling for natural gas, especially in the southern part of the Midwest where production has been declining these past few months due to low natural gas prices.

Amid stronger natural gas production, there should be little price support from demand as US coal prices remain at a low level compared with natural gas and this is hence encouraging gas-to-coal switching. Thus, upside potential is limited above $4.5-5.0 per million btu. However, the significant reduction in US natural gas inventories could lead to a higher price structure than last year when prices fluctuated between $3.1 and $4.5 per million btu.

Bad timing for the new crude oil pipeline

Two weeks ago, TransCanada started shipping crude oil through its Gulf Coast pipeline, renamed Marketlink, which is delivering about 300’000 b/d of crude oil from Cushing in Oklahoma to the Houston Area in Texas. The pipeline with a nameplate capacity of 700’000 b/d is expected to transport an average of 520’000 b/d this year. The pipeline was initially designed as the southern leg of the Keystone XL pipeline, which is supposed to link the Alberta in Canada to refineries on the US Gulf Coast.

However, the Obama administration has yet to give its final approval for the project. This encouraged TransCanada to develop first the southern leg of the project as it doesn’t cross the Canadian-US border and hence doesn’t require the White House’s approval. The large price differential between Midwestern crude oil and crude oil on the Gulf Coast, also incited TransCanada to move ahead with this pipeline.

As the pipeline begins to transport crude oil out of the Midwest to the Gulf Coast, WTI prices faced upside pressures against Gulf Coast grades such as the Light Louisiana Sweet. This should also allow a reduction in LLS premium over WTI. It is also adding downside pressure on the Brent-WTI spread as refineries on the Gulf Coast could replace light sweet crude oil imports with domestic crude oil of the same quality. Moreover, the pipeline will replace the more expensive form of transportations such as trucks, barges and trains.

However, the pipeline has started operations in a relatively bad period. Indeed, the refining maintenance season has started on the US Gulf Coast, implying a gradual reduction in crude runs. As less crude oil is required, crude oil inventories are likely to increase a faster than normal pace on the Gulf Coast fuelled by the new pipeline. In turn, this should add downside pressure on WTI prices as less crude oil would be ship to the Gulf Coast, while the refining maintenance season in the Midwest would start. This should lead to an important rise in crude oil inventories at Cushing in February and March this year.

Indonesia’s export ban could push up aluminium production costs

Now that the export ban has been implemented in Indonesia, bauxites ores and concentrates can no longer be shipped abroad (although some high-grade alumina can) – and this will likely pose problems to the Chinese aluminium sector. Aluminium is indeed produced out of alumina, which is itself derived from bauxite.

The production of aluminium has grown rapidly in China over the past years and the country is now self-sufficient in both aluminium and alumina. As China’s soil lacks bauxite resources, this has been possible only because China has been able to import bauxite. The Middle Kingdom is the world’s largest bauxite importer, devouring 30% of global supply; and as much as 70% of imports come from Indonesia.

As for nickel ores, China has been stockpiling massive amounts of bauxite over the past months, anticipating the export ban. Short-term risks are therefore limited. However, on a medium to long term basis, this should lead to an increase in production costs in China. Indonesia indeed provides a low-cost bauxite, meaning that if China were to supply itself from other countries, it would come at a cost. Brazil’s bauxite prices are indeed 70% higher than Indonesia’s. An additional increase in aluminium’s marginal costs should put further pressure on producers to curtail production this year; but we continue to believe that subsidies and high consumers’ premiums will delay supply discipline.

China’s potential farm reforms to have limited impact on grains

Markets have become increasingly concerned in the past year over China potential reforms of its farm policies. In particular, reports that Chinese policy makers could slowdown the strong stockpiling program has brought fears that imports of grains (and other commodities, especially cotton—see our last publication) could tumble in the coming months, hence affecting prices. It is indeed true that grain prices in particular have been strongly supported by Chinese stockpiling policies and imports in the past years.

However, we believe that impact could be limited for grains. Firstly, there is no certainty that this reform will actually take place; and if it does, there is no actual established time frame yet. Also, as we explained in our last publication, farmers’ revenues should decline after having benefitted from high prices for long, if the stockpiling-policy were to be abandoned. In order to encourage production growth, subsidies could be implemented, which could turn out to be complicated and costly compared to the current system of buying excess supply, which has proven to be quite efficient so far.

Furthermore, lower grain prices could also support demand for these products, which could lead to a decline in inventories. This could prove positive for grains, as high stocks seem to be already priced-in. Although China’s farm reforms could have limited impact on grain prices, we continue to see negative prospects in the short term but much better ones in the medium term, with a potential bottom in the first quarter this year.

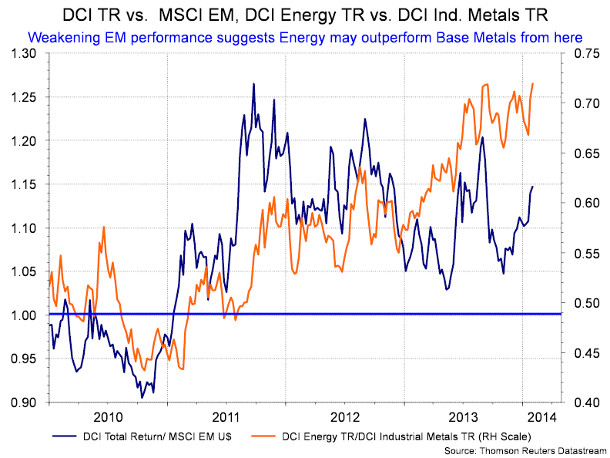

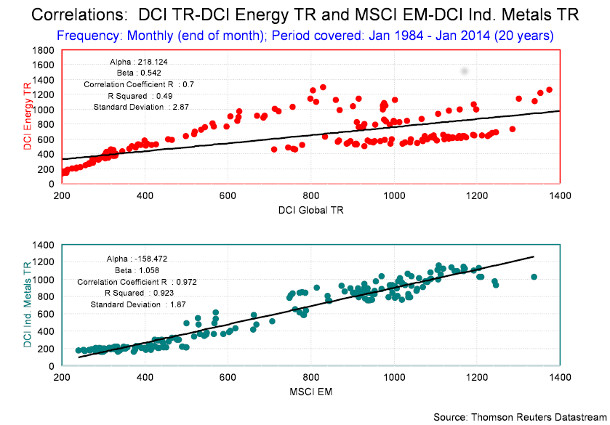

Chart of the week:Energy to outperform base metals driven by EM turmoil

|

The turmoil in the Emerging Markets has given the chance for commodities to outshine the equities from the developing countries, and for some time now, even the equities of the developed countries. How can we benefit from these developments? Aside from the obvious option of diminishing exposure to EM and even developed equities and channelling the investment into an exposure to commodities, there are opportunities in fine-tuning the sectoral exposure in the hard asset class. As the charts will show, the EM issue will tend to benefit the energy sector over the base metal sector, which is correlated to the MSCI EM Index to a very high degree. The other trade of course in this aspect is staying with the Energy sector at the expense of a general exposure to a broader index, like for instance, the Diapason Commodities Index® Total Return. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com