January 27, 2014

Weaker US Dollar ahead: a Boon for Commodities

Commentary by Senior Market Strategist Robert Balan

"The Japanese Central Bank intervenes in currency markets to keep the yen cheap and to create an advantage for its industry. Why doesn't our government do the same for us?"

Tom LaSorda, former Chrysler Group CEO, 2006

The macro-economic environment is becoming more favourable to commodities. Loose monetary policy from the main Central Banks is indeed having a positive impact on the commodity sector. One critical issue for global monetary policy is whether or not the US Federal Reserve can manage to convince markets that rate hikes are still a distant threat, despite the tapering process which was initiated last month. Furthermore, the continuing benevolence of the other developed economy central banks in attempting to foster growth should moderate the price impact on risk assets of a progressive tapering trend.

Take the Bank of Japan, for instance. We believe the BoJ will carry out another easing to counteract the anticipated deleterious, short-term impact of the VAT hikes which will take effect in April, and to impart further momentum on the Abenomics initiative. In the Eurozone, falling inflation, slow progress on bank reform and slowing growth will be the focus for investment risk in 2014. But we believe that the ECB will respond to the threats to the recovery robustly.

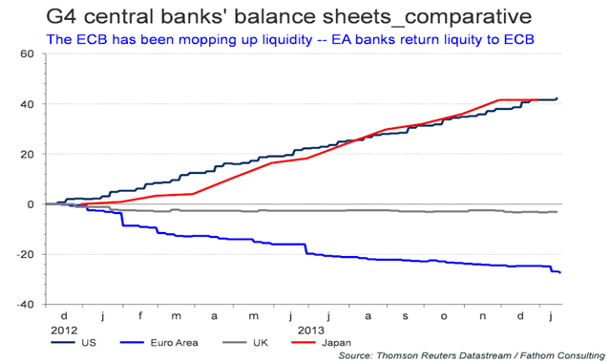

Given these constraints on central bank policy makers, the most important forward indicators to watch on the risk-on and risk- off outlook are EUR/USD and USD/JPY. The almost-universal conclusion in foreign exchange in 2014 is that the US Dollar will reign supreme — especially against the EUR. However, despite positive macro-fundamentals for the US Dollar, the reduction in the ECB balance sheet, while the US Fed’s balance sheet continues to expand is adding growing upside pressure on the EUR/USD (See Chart of the week). Moreover, the Japanese monetary policy, which is probably the most aggressive worldwide, is likely to remain loose while the Fed is expected to only gradually increase tapering, adding upside pressure on the USD/JPY as the increase in money supply in Japan is larger than the current Fed’s monthly injections of liquidity.

Additionally, Janet Yellen is taking over the chairmanship of the Fed with Stanley Fisher, another "dove" like Yellen, that will also assume the vice-chairmanship mantle — making two "doves" at the head of the Fed. This is likely to reduce the risk of a Fed’s reduction in liquidity following supportive economic data. On the other hand, there is a chance that disappointing growth, which we expect in early H1, may cause the Fed under the Yellen leadership to quickly reconsider the taper. Even the hint of stopping the taper should weaken the US Dollar (as we expect) in H1 2014. While it could affect significantly the EUR/USD, the downside pressure on the USD/JPY is likely to be extremely limited due to large increase in Japanese money supply relative to the US. The stronger EUR/USD and USD/JPY would then have a positive impact on commodities.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Iranian crude oil exports to remain flat at least until mid-2014

The agreement signed between Iran and the P5+1 countries in Geneva last November came into power last week and may have led people to believe that Iran could increase its crude oil exports. However, this will have only a marginal impact on the oil market.

Indeed, the agreement only prevented further reduction in Iranian crude oil exports as it left unchanged the Iranian crude oil imports quotas imposed by the United-States to some Asian countries. The combined amount is about 1 million b/d.

The implementation of the agreement would nonetheless facilitate Iranian crude oil exports through a reduction in transportation costs as the sanctions on shipping companies will be removed and due to the decline in insurance costs as European insurance companies would be allowed to insure Iranian crude oil exports. These reductions in costs would allow the Iranian regime to decrease the discount on its crude oil, which was required to attract buyers.

Thus, Iran will be able to see a rise in its oil income without increasing its crude oil exports. For the United-States, it enabled to relieve some sanctions on Iran without allowing the regime of Tehran to increase its crude oil exports.

Thus, until the end of the agreement which should occur by the middle of the year, Iranian crude oil exports are likely to remain flat at around 1 million b/d, down from 2.4 million b/d in 2010. Moreover, even if an agreement is found this year allowing Iran to increase its crude oil exports, Iranian crude oil exports are unlikely to rebound rapidly. Contrasting with the light crude oil found in Libya, Iran possesses heavy/medium grades which are more difficult to extract. Moreover, the Iranian government is lacking resources to maintain in good conditions the idle oilfields. Thus, even if the country is allowed to increase its crude oil exports it could take several months to see a rise in Iranian oil production.

Soaring premiums are bad news for aluminium

Aluminium premiums have soared since the start of the New Year to multi-year highs: in US, they have jumped from c$0.11/lb to nearly c$0.2/lb; in Europe from $230 to $275 and in Asia from $190 to $205. The rise in premiums suggests that the physical aluminium market remains constrained. Premiums are indeed the amount paid by consumers to secure delivery of the metal. The higher the premium, the most difficult it is for consumers to get their hands on the metal.

Given that inventories are enormous and set a new record high this month at nearly 5.5 million tonnes on the LME, and given that the market should remain in surplus this year, these high premiums can only be explained again by cash and carry activities. As the market is in a wide contango (Dec. 2015 prices are 12% above cash prices, vs. 3.5% as for zinc, 2% as for nickel for instance), traders can buy on the spot market and simultaneously sell a futures contract, taking the spread between the two to cover inventory costs and even to generate profits in some cases.

Therefore, aluminium remains tied up in inventories, pushing up premiums. This is actually bad news for the light metal as these premiums have allowed aluminium producers to improve their margins in the past two years and have therefore discouraged long-waited production cuts. History should repeat itself this year as we see no better discipline in global aluminium output.

Copper backwardation could persist

Copper’s forward curve has shifted from contango to backwardation since December 2013, following massive withdrawals from the London Metal Exchange’s warehouses. LME stocks have declined by nearly 13% through December last year and by another 9% since the start of the year, to fall below 340,000 tonnes, half the June 2013 levels. Inventories are also now at the lowest level since January 2013.

Although the backwardation is relatively new, following months of contango, and is therefore still fragile, we believe is could persist for some weeks. Looking at the past seven years, we can notice that the copper market tends to shift from contango to backwardation with LME inventories falling below 400,000 tonnes (similar to our current situation); then tends to confirm its backwardation with inventories standing below 300,000 tonnes (at this point, contango situations become scarce); and is systematically in backwardation with LME inventories standing below 150,000 tonnes (no contango has been noticed with such inventory levels).

Considering the current inventories and the extremely high level of cancelled warrants (warrants that could be withdrawn from warehouses), we expect inventories to keep declining in the coming weeks, hence supporting the backwardation. In fact, cancelled warrants amount to about 200,000 tonnes, or 60% of total inventories.

Support for cotton prices despite the end of the Chinese stockpiling

The Chinese government has announced last Sunday that the cotton stockpiling programme will be replaced by direct subsidies for farmers. This shift was widely anticipated as after several years the stockpiling programme failed to encourage an increase in cotton planting and at the same time it pushed domestic cotton prices above international markets, leading to stronger than needed imports.

The change in system in China may lead to a reduction in Chinese cotton imports. However, the decline is not likely to be significant due to the more important expected deficit, as production is forecasted to decline.

Indeed, the end of the stockpiling programme have increased concerns for Chinese farmers that subsidies won’t be sufficient, leading to a reduction in expected planting to 5.2 million hectares this season, down from 5.3 million hectares in the 2012-13 season. Planting has declined these past few years despite the stockpiling programme. Combined with the expected decline in yield, the lower planting is likely to result into a decrease in cotton output to 33 million bales, down 5.7% y/y.

The growing deficit in the Chinese market is likely to absorb part of the large inventories and will prevent the country to become an important drag on international cotton prices this year. Moreover, the global cotton market has gradually tightened these past few years and should reach in the 2013-14 season the smaller surplus since the 2010-11 season. Global demand is set to grow by 3.1 million bales (+2.9% y/y), a slightly slower growth than last season. Demand growth is driven by incremental demand from India, which is likely to account for almost 40% of global cotton demand growth this season. On the other hand, global cotton supply is expected to drop by 5.3 million bales (-4.3% y/y), driven by a major drop in cotton production in the US, which should account for almost 80% of the decline in global cotton output this season.

Chart of the week: Central Banks’ Balance Sheet signals stronger EUR/USD

|

As the chart below shows, central bank balance sheets changes in the past year have been mostly favouring EUR and the GDP — which explains why these two currencies have been relatively strong during that period. The ECB balance sheet has been decreasing at a fast clip as eurozone banks deleveraged to repair capital charges for asset impairments and to meet regulatory changes. The variation in central bank balance sheets also explains why the JPY has been relatively weak, as Japan embarked on a massive stimulus and will likely stay on course until the Abe government has attained its growth and inflation rate goals and ceases the massive stimulus program. It may seem counter-intuitive, but stronger USD/JPY and EUR/USD are the best forward indicators of a risk-on environment. When USD/JPY and EUR/USD weakens, then a risk-off environment is not far behind. The counter-intuitive part is that both USD/JPY and EUR/USD can strengthen at the same time when market enthusiasm is rampant, and vice versa. Contrary to what some analysts believe, the Fed's taper process is important to watch but not in the purview of currency relative valuation — it is important by itself as a window to the Fed's thought processes regarding the formulation of monetary policy. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com