January 13, 2014

Stop fearing commodities: value is there

Commentary by Senior Market Strategist Robert Balan

"If anybody laughs at your idea, view it as a sign of potential success!"

Jim Rogers

After two years of unclear direction, the sentiment on commodity prices has fallen to its lowest level in 4 years. This contrasts with elevated optimism on the equity market. Worries of hard landing in China, so far unrealised, and exaggerated beliefs that the supply side of the equation has increased, were the main reasons behind the lagging performance of commodities relative. However, the former now poses in our view the strongest potential outperformance over all other asset classes in 2014.

In 2013, the S&P 500 grew by 30%, while the Diapason Commodities Index® Total Return fell by 4%. Last year marked the end of the strong correlation between equities and commodities, which started in 2008, at the nadir of the Great Recession. The correlation between the S&P 500 and the DCI® Total return has now dropped to -0.6, while it stood on average at +0.8 between 2008 and 2012. This can be viewed as the end of the peculiar mono-dimensional risk-on/risk-off behaviour generated by fear of a global economic collapse. Looking closely at the possible reasons behind the divergence, we found positive outcomes for commodity prices.

Indeed, the strong rally of the equity market implies an improving global economy, which according to the business cycle asset rotation model should benefit commodities soon. The divergence between equities and commodities would also then imply that asset classes have returned into a normalised business cycle, which was interrupted after the financial crisis in 2008. Demand for the most cyclical commodities are inherently linked to global economy and, if the later is indeed growing at a more rapid pace, prices for industrial metals and energy products will have to accelerate as inventories are gradually shrinking. Inelastic commodity supply indeed typically fails to meet an acceleration in demand growth. Commodity prices should hence catch up rapidly with equities.

On top of that, the positive sentiment on commodities has gradually declined these past 2 years and has now reached its lowest level since 2009. The strong performance of the equity market last year has convinced many market participants to move out of commodities and to return into equities, leading to a growingly contrasting sentiment between the two asset classes. A Merrill Lynch survey made in December 2013 found that about 30% of the 450 surveyed fund managers thought that a hard landing in China and a collapse in commodity prices are the biggest tail risk, while only 2% believe that inflation could be a major risk. Thus, this is not surprising to see extremely low long managed money positions on commodities. At this stage a less risky strategy would mean a contrarian approach to increase exposure to the least appreciated market, i.e. commodities. To conclude, commodities could in our opinion provide significant return for investors with lower risk.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Extremely cold temperatures in the US had a mixed impact on energy markets

Extremely cold temperatures that hit the Midwest and the East Coast had a mixed impact on energy markets. On one hand, demand for heating rose sharply. Natural gas and heating oil demand indeed surged. According to Bentek Energy, US daily natural gas demand reached 125.7 billion cubic feet (Bcf) last Monday, a record high level, compared with an average consumption of 71.2 Bcf per day in 2013. This pushed spot natural gas prices to extremely high levels. Last Tuesday, spot natural gas prices in New York soared to $90 per million Btu, up from $13 per million Btu last Friday, due to limited infrastructure capacity.

While spare-heating demand rose to significant levels, fuel demand by the transportation sector dropped sharply. Indeed, the cold wave led to the cancellation of 6000 flights, reducing significantly kerosene use. Moreover, gasoline demand has declined due to the lower use of personal vehicles. The slow down in the economic activity induced by the freezing temperatures also affected the use of oil by the industrial sector. Lower petroleum products consumption has been partially mitigated by lower refining activity in the Midwest which was caused by the extremely cold weather.

Moreover, the latter could also affect oil and gas production, as wells in the southern part of the Midwest are not designed for cold temperatures which are leading to well freeze-off and make hydraulic fracturing operations more difficult.

Thus, due to strong demand and possible supply disruptions, natural gas prices are likely to benefit the most from the current conditions. Nonetheless, futures prices have not moved sharply due to expectations of warm temperatures next week. The expected strong reduction in natural gas inventories could however allow futures natural gas prices to stay above $4.0 in the coming weeks. The impact on oil prices is mixed. Heating oil prices should benefit from stronger demand and slower refining activity, while the decline in gasoline demand is likely to be more important than the reduction in gasoline supply, leading to the temporary outperformance of heating oil prices over gasoline ones.

Oil supply concerns heat up

Last year, the oil market faced important unplanned production outages, which forced Saudi Arabia to boost its crude oil output in August 2013 to the highest level since 1981. This year could be different.

In the first days of January, a major oilfield was restarted in the western part of Libya. Crude oil production in Libya is hence expected to gradually rise from around 250’000 b/d to around 600’000 b/d. This would be the highest level since July 2013, when strikes and armed groups blocked oil fields and ports in most parts of the country. Moreover, the completion of the 400’000 b/d Kurdistan-Turkey crude pipeline could soon lead to a rebound in Kurdish crude oil exports, which were constrained due to a dispute with the central government in Baghdad. Finally, the start of the 180’000 b/d Roncador offshore oil field in Brazil reduced even more worries about crude oil supply. These factors contributed to a $5 decline in the price of Brent crude oil at the beginning of the year.

Nonetheless, the market may have overreacted. Indeed, while the situation improved in the western part of Libya, armed groups in the eastern part of the country are claiming for the autonomy of the region and have tried unsuccessfully to sell local crude oil in an attempt to bypass the central government. About 1.0 million b/d of idle crude oil producing capacity is located on the eastern part of Libya and is unlikely to be restarted in the short run. Moreover, the political situation in Iraq has deteriorated significantly these past days, with growing concerns that the Syrian civil war has spilled over Iraq. This should discourage needed foreign investment in the oil industry and could lead in turn to another year of disappointing oil supply growth. Finally, the situation in South Sudan remains uncertain. Crude oil output from South Sudan fell to about 200’000 b/d due to clashes and is not any longer expected to rise any time soon to pre-January 2012 levels (at 350’000 b/d) when the country halted production and exports due to a dispute with Sudan about pipeline fees.

Thus, the combined supply risk from these three countries, amid high refining activity, should be sufficient to lead to a rebound in international crude oil prices. Since the beginning of last week, Brent’s backwardation already started to rise driven by these concerns.

Gold currently in a fragile situation but prospects should improve

Gold suffered greatly in December but rebounded in January, benefitting in the New Year from index rebalancing, short covering strategies and from a rebound in physical demand in China (SGE volumes hit a 6-month high). Gold’s situation still appears fragile at the moment, given the rebound in interest rates: US 10-year Treasuries rose to 3% for the first time since the summer 2011. On top of that, the US Dollar has also appreciated: the DXY rose from 80.000 on December 30 to 81.005 on January 9. Given these non-supportive trends, gold holdings of the world’s ETFs have tumbled by 4.7% since the beginning of December, with weekly outflows as high as 1.5%-1.7% from December 17 to 23, the fastest outflow pace since July this year.

Despite the fragile current state of gold, we see good prospects for the metal in the coming months – although we do not expect gold to be a top performer in H1 2014. In particular, we anticipate a depreciation of the US dollar, which should strongly support gold prices. In addition, the reaffirmation by the Fed that the interest rates will be kept near zero in the foreseeable future should also bring further support to gold. Being optimistic on gold is not consensual, so if our view were to materialise, it could really bring some strong support to the metal.

Downside risk on cotton due to the changing Chinese stock policy

During the year 2014, the price of cotton will likely fluctuate according to the evolution of the Chinese stock policy, a development which may occur in H2 2014.

China owns 65% of the world’s cotton inventory. Since 2011, China’s government has been buying most of the domestic crop at above-market prices, in order to financially support its farmers. China will possess more than 12 million tonnes at the end of the season, which are equivalent to 150% of its domestic consumption. This type of action is seen as strategically important for both its food supply and its political stability. The main cotton producing area, Xinjiang, is inhabited by large ethnic minorities.

However, this strategy is more controversial due to its high costs. According to Reuters, $33 billion so far have been spend, based on estimate payments over the last two years. Moreover, the scheme has severely penalised domestic mills and the textile industry in general, who have seen profitability slashed due to high internal prices. Because of the complex quota system, they have a limited access to overseas markets and are forced to buy at high prices from the national reserves.

Therefore, it looks like China will abandon its strategy to stockpile cotton in favour of direct subsidies and or loans/crop insurance to farmers. The new policy would allow domestic prices to fall close to the international price, leading to a recovery of margins in the Chinese textile industry.

This evolution will result automatically in a decrease in inventories, which can add a downside risk to the international price of cotton. This risk will depend on when China want to sell its reserves, at which rhythm and the quantity they want to keep in storage for the future. Obviously, China wants to avoid a scenario of record prices, like in 2010-2011, when mills had to pay more than $2/lb to secure cotton from abroad just to carry on spinning, as their own domestic stock was at multi-year low.

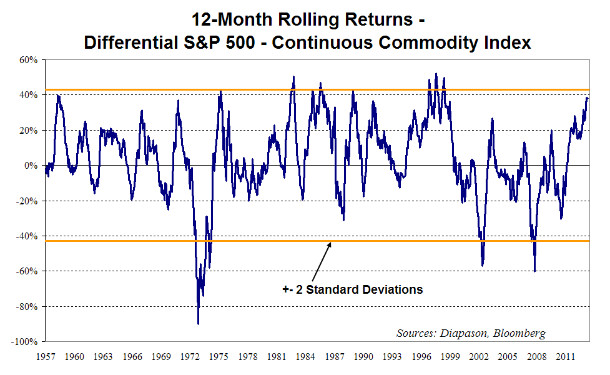

Chart of the week: Third and last consecutive year of equities outperformance?

|

The commodity sector underperformed equities for the third consecutive year. This was the longest outperformance since the start of the commodity bull market in 2001. Moreover, the S&P 500 outperformed the Commodity Continuous Index by 26%, 1.2 standard deviations above the differential in returns between 1957 and 2013. This contributed to decrease the positive sentiment on commodities. However, as exposed in the main commentary, commodities offer now significant value and may outperform equities for the first time since 2010. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com