January 7, 2014

Commodities Outlook for 2014

Commentary by Senior Market Strategist Robert Balan

"In the years ahead, resource markets will be shaped by the race between emerging-market demand and the resulting need to increase supply[...]."

McKinsey Global Institute, September 2013

2013 was a difficult year for commodities as reflected by the drop of the Diapason Commodities Index® Total Return by 4% over the year. Nonetheless, the performance between commodities sector was mixed. The best performer, the DCI® Energy Total Return Index grew by 6%. On the other side of the spectrum, the DCI® Precious Metals Total Return Index, the worst performer, fell by 29%. The interesting fact about last year is that commodity sectors made their lows sequentially. Energy prices bottomed in April, followed by Base Metals in July, Precious Metals and Agriculture at the end of December. Thus, with commodity prices moving higher, 2014 could be a lot different than last year.

Here are the five major factors which we believe will be the primary determinants of commodity prices for this year:

1. Developments on the supply/demand side — The relevant story in commodities in the short-term has always been on the supply side (and conversely, the primary determinant of commodities' secular price trends is demand). In the commodity universe, there is a definitive move from overinvestment to underinvestment back to overinvestment. This process tends to impart a certain cyclicality in commodity prices, especially in base metals. Amid inelastic supply, demand is growing at a faster pace. The entire base metals complex and energy should also be buoyed by a sharp improvement in US growth, a recovery in the eurozone from recession and strong growth in emerging markets. The global economy is about to enter its first synchronous expansion since 2010.

2. China — Base Metals and Energy will also be underpinned by the Chinese activity, which we expect to pick up, especially in the H1 2014. China has opted to dial down from 10%-12% GDP growth rates to what they expect to be more sustainable 7%-8% growth rates has now been factored into markets, and surprises on growth could be on the upside. The acceleration of the Chinese economy, which started in the second half of 2013, indeed coincided with stronger base metals prices.

3. The Fed's tapering process — The Fed's diminution of securities purchases proved to be less aggressive than what the market had expected, precipitating a risk assets rally late last year. Despite the taper, markets may be underestimating developed economy central banks’ determination to support growth for a much longer time than the markets has initially expected. A quid pro quo for the Fed's taper is a commitment to hold policy rates near zero to as far as 2016, providing ample global systemic liquidity during this period.

4. The performance of the US Dollar — We expect the US Dollar to be relatively weaker during Q1 and part of Q2 2014 due to loose monetary policy. Commodities should benefit from a weaker US Dollar, and gold may get a respite from its recent decline.

5. Relative value — Commodities have underperformed equities significantly in 2013 and now offer significant value relative to other asset classes. Equities and especially US equities have risen sharply these past few months, while the sentiment on commodities remain markedly negative. Looking at the business cycle, commodities have entered the phase when they typically outperform equities.

Contrasting with last year, 2014 appears therefore significantly more attractive on an absolute and relative basis. Commodities are entering a phase of very supportive conditions with a tightening supply/demand balance, the acceleration of Chinese growth, loose monetary policy and a weak US Dollar. The commodity sector has hence the potential to move by 15-20% this year in our opinion.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Clashes in South Sudan have affected crude oil supply

South Sudanese crude oil production has been affected by clashes between different factions as some oil companies shut down operations at several oil fields. Crude oil production which stood at around 250’000 b/d two weeks ago has fallen by 45’000 b/d in the Unity state due to fighting.

The loss is even greater as before the political situation degraded, crude oil production was expected to rise between 50’000 and 100’0000 b/d in the coming months. Indeed, the country was still in the process of restarting its oil production after being halted for several months.

South Sudan produced around 350’000 b/d before shutting down output in January 2012 due to a dispute with Sudan over pipeline fees. An agreement was found in Q2 2013, allowing output to restart gradually amid important tensions between the two countries. The rising political instability in South Sudan is reducing oil supply, forcing Asian refiners to look elsewhere for medium sweet crude oil. This has contributed to the recent growing backwardation in Brent futures.

Metals are retreating but longer-term prospects appear brighter

The base metals sector has strongly rallied at the end of 2013, before retreating January to date. In December, metals posted returns as strong as 8.7% as for zinc, 6.5% as for lead and 4.4% as for copper. The setback in January appears mostly technical – considering the strong December rally – and was also fuelled by the Chinese December PMI declining slightly more than expected. Although short-term downside risks persist, we believe the sector should outperform in the coming months due to improving fundamentals on the demand side. Copper, zinc and lead could be top picks for 2014.

It seems that fears of a hard landing in China have faded away, and investors appear now cautiously optimistic for base metals in 2014. Prices are finally starting to reflect the recovery in China’s metals demand, which started in August 2013 and accelerated in Q4 2013 – driven partly by restocking needs and therefore high imports, especially as for copper and iron ore. Another factor supporting the price recovery is the normalisation of LME inventories: copper stocks have retreated by 46% since June last year, from a high of 666,000 tonnes to 359,075 tonnes as of January 5 2014. Similarly, tin inventories have declined 33% over the same period and zinc by 10%.

This year, we believe zinc could be a strong performer again, following the rapid recovery the metal experienced in the last quarter of 2013. Zinc’s fundamentals should improve this year, supported by strong US and Chinese construction and automotive sectors, which make most of zinc’s demand. On the supply-side, mine production has been declining on lower ore grades and little projects to compensate the loss; while smelters are still enduring very tight margins that should prevent strong investments in new capacity.

Palladium remains a top pick among precious metals for 2014

Palladium was the best performer on the precious metals complex in 2013, rising 1.7% over the year, compared with declines of 11.5% for its sister-metal platinum, of 28% for gold and 36% for silver. We believe this trend should continue in 2014 as PGMs could benefit from their industrial profile, being widely used in the automotive industry and having therefore price patterns that are completely different from gold and silver. As investors seem to have capitulated on inflation fears and to be back on a risk-on mode, PGMs could benefit. Also, we continue to see the brightest prospects in palladium, as the metal has still the strongest supply-demand fundamentals.

The leading PGM statistics provider, Johnson Matthey, confirmed a reasonably healthy supply-demand position for platinum and palladium in 2013 and forecasts continuous deficits for both metals in 2014. However, most of platinum’s shortage should result from enduring disruptions and lower investments in South Africa. Recent events suggest that strikes in the largest PMG producing country have become a known-unknown with limited impact on prices; this is why we believe that the platinum price should not benefit that much from its deficit this year, unless extremely violent labour disruptions occur such as those of the summer 2012.

On the other hand, palladium prices should enjoy strong fundamental support. In addition to the South African issues, the uncertainty regarding Russian stockpiles should continue to fuel supply worries. In addition, demand should keep advancing due to the prime use of palladium in gasoline-powered cars, i.e. in the growing Chinese and US automotive industries. Substitution should however hamper palladium industrial use in non-automotive industries such as electronics and dentistry, lowering the positive impact of auto catalysts demand. Investment demand appears positive as Absa has received approval for a South African palladium ETF, following the success of its platinum ETF. The consensus expects that about 150,000 ounces could be purchased via this new investment vehicle.

Despite the positive fundamental picture, we believe that above ground stocks, which are currently plentiful as for platinum and palladium, should limit the extent of price rallies this year.

Biggest Egypt wheat order for years

The year 2014 starts well for wheat exporters as Egypt, the largest importer, unveiled its biggest order since 2010, on January 3. Indeed, the state grain buying agency, the General Authority for Supply Commodities (GASC), revealed orders totalling 535’000 tonnes. The origin selected was from France and Eastern Europe: Romania, Russia and Ukraine. In fact, US hard red winter wheat was the cheapest offered to GASC, but it was excluded due to the extra cost of shipping to Egypt across the Atlantic.

It was GASC's 16th international tender since the removal of former president Mohamed Mursi by the army on July 3 last year in response to nationwide protests against his rule. The purchase was the biggest since at least 2010, topping a 475’000 tonnes order in September 2012, and a 420’000 tonnes purchase of Russian wheat a year before.

On the same day, Algeria purchased between 500’000 and 550’000 tonnes of milling wheat, taking the day's total world orders above 1 million tonnes. Since this news, price of wheat increased by 2% to trade back above $6.00 a bushel in Chicago, outperforming corn and soybeans.

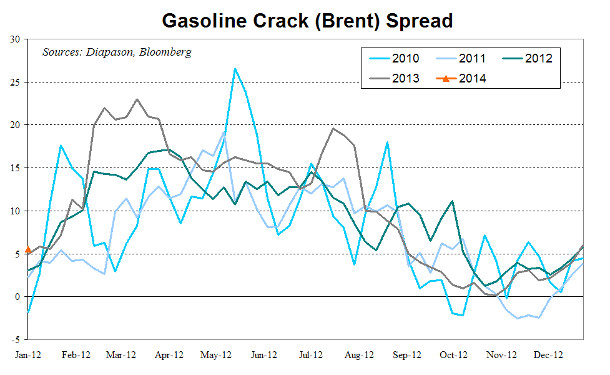

Chart of the week:The gasoline crack spread has room to move higher

|

The NYMEX RBOB Gasoline front month has recently outperformed the oil sector due to limited supply and stronger demand. Indeed, strikes at several refineries in France at the end of December have contributed to reduce the gasoline surplus in Europe, leaving more room for US refineries, which were able to gain market share. However, the key gasoline market that sets global gasoline prices is the US East Coast, which lacks gasoline. Moreover, the gasoline surplus on the US Gulf Coast can only be sent economically to the US East Coast via pipelines. Indeed, the Jones Act, which forces the use of US ships between US ports, is making uneconomic the transfer of gasoline by ship between the Gulf Coast and the East Coast. Moreover, even if the arbitrage between the two regions is open, the limited amount of ships which comply with the Jones Act forces the East Coast to look for other source of gasoline. Europe is the traditional source of foreign gasoline supplies to the US East Coast. But strikes in France have reduced gasoline supply to the US East Coast, forcing the region to import gasoline form more distant regions. At the same time, gasoline demand is growing. Since the beginning of November, US implied gasoline demand estimated by the EIA was up by 370’000 b/d y/y, contributing to a lower than usual build in gasoline inventories for the season. In fact, demand has improved since the summer allowing to reduce the gasoline surplus and bringing inventories to relatively low levels in the US, Europe and Asia. The snow storm, which is currently hitting the US, is likely to have only a temporary impact on US gasoline demand. Stronger demand amid relatively tight supply should support gasoline crack spreads. The latter has room to move higher due to these factors and the ongoing negative sentiment on gasoline, as reflected by the relatively low amount of net long speculative positions on NYMEX RBOB futures. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com