December 16, 2013

New Chinese data confirm no hard landing

Commentary by Senior Market Strategist Robert Balan

"China's growth means more opportunities and a bigger market for the rest of the world."

Hu Jintao

China’s economy is again on a roll — the data so far show very strong momentum going into the end of 2013. China is back in the growth chase, as we have long expected that it would by this time. During the past few weeks, the Chinese economy surprised most observers with favourable data.

Credit conditions have finally improved despite the central bank’s continued rhetoric on reining in rapid credit growth. In November, Chinese loan growth stood at +14.2% y/y as well as M2 growth. Moreover, retail sales surprised to the upside, rising 13.7% y/y in November, above consensus. Given the new focus on domestic consumption, and the sharp pick-up in household loans, we expect durable goods retail to continue powering this series through H1 2014.

Industrial activity continued to grow. Industrial output was up by 10.0% y/y in November. We believe that the strong IP growth rebound since July will have more room to go on the upside as the lagged spillover from stronger activity in the US, Europe and Japan finally comes down the pipeline into China's factory floors.

Indeed, stronger external demand was reflected in the recent above-than-expected rise in Chinese exports (+12.7% y/y in November). The export strength in China is likely supported by the recent improvement in global manufacturing activity, as shown by the strong PMI prints in major advanced economies. Looking ahead, we think that this trend will continue as lagged demand from the US and Europe should continue to come in during the next two to three quarters. The pace in exports could top 16% by Q1 2014.

Commodities demand has naturally benefited from the improved economic activity, reflected by stronger imports last month. Iron ore & concentrate imports grew by 18.3% y/y, above the year-to-date average of +11.0% y/y. Copper imports rose by 19.2%, the 2nd strongest growth since March 2012. On the other hand, Chinese crude oil imports rose by only 0.8% y/y, due to negative base effects. The start of new refining is likely to lead to stronger crude oil imports in the coming months.

These latest blow-out data suggests that the second-largest economy in the globe remains upbeat, defying predictions of a more pronounced slowdown, even hard-landing. The consensus of as recent as October was that Chinese activity would fade sharply towards year-end. We did not share that gloomy assessment. For us, given the recent spate of favorable data, China is likely to be en route to keeping the 7.8% Q3 y/y pace as baseline for Q4 2013 GDP, and we project that GDP in H1 2014 would be above 8.0%. In turn, cyclical commodities are likely to benefit from this situation as reflected by the recent strong performance of base metals prices such as copper (+2.8% since December 1, 2013), nickel (+4.3%), zinc (+4.8%), lead (+3.4%) and aluminium (+2.1%).

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

High LNG prices could encourage the use of petroleum in Asia

Colder than normal temperatures and coal-to–gas switching (in order to reduce pollution) have contributed to increase Chinese natural gas demand significantly these past months, reducing already thin natural gas inventories. Shortages have appeared forcing gas companies to ration and suspend supply to some industries as the government tends to favour households.

This has forced the Chinese government to hike the price of imported natural gas by 26% in order to encourage LNG imports. Total pipeline and LNG imports were up by 15.5% in October. Imports of LNG are likely to rise further due the start of new LNG terminals (the Tangshan terminal in Hebei province started commercial operations at the beginning of this week), which will increase China’s capacity to import LNG. Stronger Chinese demand for LNG should add upside pressure on an already tight LNG market in Eastern Asia, as Japan and South Korea have already purchased a more important than usual number of LNG cargoes.

In South Korea, natural gas use by the power sector has increased at a more rapid than usual pace these past few weeks to respond to growing heating demand due to the halt of several nuclear power plants. Indeed, out of 23 nuclear reactors, six are closed including three shut since May in order to replace cables supplied with forged documents. The other three reactors are either performing maintenance work or being upgraded. This led to a rise in LNG imports of about 20% y/y in October. Between January and October, South Korean LNG imports were up by 13% y/y.

In the coming weeks, stronger seasonal heating demand is likely to boost Asian demand for LNG cargoes higher as well as prices. Asian spot LNG prices indeed climbed to $18.9 per million Btu two weeks ago. This is the equivalent of $106 dollars a barrel of oil. As LNG prices are moving closer to oil prices, petroleum products are becoming more attractive as they could be used as a substitute for gas in power generation, leading to stronger diesel demand.

The Brent-WTI spread is set to narrow further

The Brent-WTI spread recently fell from $19 per barrel two weeks ago to about $11. This sharp decline was caused by the decline in crude oil inventories in the Midwest and especially at Cushing, Oklahoma, the delivery point of NYMEX WTI futures.

Two weeks ago, inventories there dwindled for the first time since the beginning of October 2013. Moreover, TransCanada’s announcement that its 700’000 b/d Gulf Coast pipeline will come on stream in mid-January 2014 added further downside pressure on the Brent-WTI spread.

Indeed, the pipeline will allow the transportation of a larger amount of crude oil at a lower prices, encouraging refineries on the Gulf Coast to use Midwestern crude oil at the expense of imported crude oil linked to Brent prices.

Crude oil inventories in the Midwest are likely to decline further in the coming weeks as refining activity should rise further, crude oil continues to be transferred out of the Midwest, the Gulf Coast pipeline is being filled with crude oil and as a snow storm, which has hit the Midwest last week, could lead to supply disruptions in North Dakota.

Indeed, tight oil production in this area remains vulnerable to snow storm as 75% of oil is moved by truck. The lack of storage capacity on site implies that when trucks cannot transport the crude oil from the well to pipeline network, production is halted at the field. This already occurred in April 2011 when a snow storm led to a decline in crude oil production by 10’000 b/d over the month. Thus, lower crude oil inventories in the Midwest should add more downside pressure on the Brent-WTI spread. The spread could move to $5 by mid-January.

Tin affected by recovering Indonesian exports despite tight fundamentals

Tin prices have dropped 1.3% since the start of December (as of Dec. 12, 2013), underperforming the rest of the LME base metals, which have risen between 1.7% and 4.2% over the same period. Tin is however fundamentally the strongest of base metals, having outperformed the sector since the beginning of the year.

Prices have primarily been affected by a recovery in Indonesian tin exports, which rebounded by 28% m/m in October this year, after months of collapsing figures. In fact, year to date total tin exports remain 13% below last year’s levels. The Indonesian government has indeed made mandatory for all tin exporters to trade on the Indonesia Commodity and Derivatives Exchange, resulting in plunging exports as producers and consumers were not all registered on the exchange and needed time to meet all registration requirements. Also, illegal miners could not register to the exchange as well. Finally, producers reported several logistical issues especially with physical delivery. Now, the situation appears to have improved as exports are rising again.

However, tin’s prospects remain bright. The market is set to remain in deficit; and it is likely that the measures taken against illegal mining will affect global supply, considering that could represent between a fifth and a fourth of the country’s tin production. Also, the government should introduce a ban on unprocessed ore exports next month. Although tin is not really concerned as most of the exports are in the form of the refined metal, this will again stress the government’s attempt to control the metals market (nickel and tin mostly). In the past, bans have already been implemented or organised by producers to push up tin prices.

Wheat prices suffer from a record harvest and a negative sentiment

On the 10th of December, the US Department of Agriculture (USDA) published its monthly report, the World Agricultural Supply and Demand Estimates (WASDE). According to this report, the wheat harvest is forecasted at 711 million tonnes, 5 million tonnes higher than the last estimate made in November. If the projection is realised, it will represent a record harvest.

The increase comes mainly from Canada and Australia. Indeed, according to Statistics Canada, the official body for this country, the harvest may reach 37.5 million tonnes, up from a September outlook of 33 million tonnes and up by 38% since last season. In Australia, ABARES, the governmental agency, estimates the wheat harvest at 26.2 million tonnes, a 17% increase since last year. Therefore, USDA revised higher both forecasts, to match official data.

At the end of November, according to the CFTC, managed money, a proxy for investors, raised their net short position on wheat by more than 10’000 contracts to 66’041 lots, the biggest bet on price falls since records began in 2006. These data were collected at the end of November, meaning that the net short position could even be larger due to the USDA report. Moreover, an analysis made by Census reinforces this negative attitude. The study shows that less than 40% of analysts are bullish on wheat.

On crop development, the planting season in the US started well. Even if it is difficult to make forecasts for wheat before winter, as it is one of the riskiest periods, situation looks near ideal, with a snow cover protecting winter crops from frost. And if we look at seasonality, wheat tends to underperform corn and soybean during the first quarter of the year.

Therefore, the probability to see a rebound in wheat prices in the short term is limited. It can only happen if investors cut massively their short position to take their benefits before the end of the year.

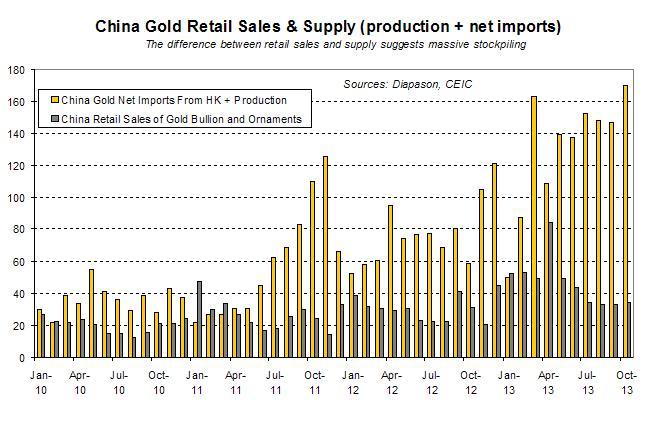

Chart of the week: China’s gold imports keep soaring on stockpiling activity

|

Gold’s performance has remained lacklustre over the past weeks, on declining investment demand. On the Comex, net long speculative positions fell to their lowest level since July this year; hedge funds’ bearish bets reached a 7.5-year high; and outflows from the world’s gold ETFs accelerated to the pace of 1% per week, compared with 0.5% in mid-November 2013. On the physical side, the disconnection between India’s and China’s demand for the yellow metal widened. The consensus now believes that India’s gold imports will collapse by 70% in the final quarter this year, due to the combined effects of rising import duties and high domestic prices. On the other hand, China’s gold imports from Hong Kong (proxy for total imports, which remain undisclosed) have continued to soar: in October, net imports totalled 129.9 tonnes, just slightly below the record high of 130 tonnes hit in March this year. October was also the sixth consecutive month that net imports exceeded 100 tonnes, a level that had never been reached before March 2013. These high import levels appear to be driven by stockpiling strategies. True, retailers need to rebuild their inventories ahead of the Chinese New Year. However, there seems to be much more under these imports levels. Over the past six months, the gap between retail sales in China and supply (measured as net imports from HK + production) has drastically widened. Although these numbers can not cover the entire gold trade in China (as consumption may be different from official retail sales and as the country imports its gold from other country than HK), the suspicion is that China is heavily building gold reserves, benefitting from the lower gold prices (especially since imports have started to surge since prices have consolidated since Q4 2012). China has the world’s biggest stockpiles of FX reserves, but rarely discloses its gold holdings (last statement was made in April 2009 at 1,054 tonnes). Beijing is probably looking to diversify its reserves away from the US dollar.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com