December 9, 2013

2014 Outlook: Commodities offer the best relative value

Commentary by Senior Market Strategist Robert Balan

"Commodities tend to zig when the equity markets zag."

Jim Rogers

The improved conditions for the global economy these past few months does not put the market out of risk. On one hand, the US economy is still growing (although it is mainly inventory-driven), Europe is still positive, Japan’s output looks range-bound for now (at moderately high levels), and China is set to grow moderately over the next few quarters. This should lead to the first synchronous expansion of the global economy since 2010. On the other hand, the timing of the Fed tapering process, and still the question whether it will actually happen, still worries the market. Another worry is the remote possibility of China’s tightening of monetary policy.

Moreover, the newest worry in the market is that equity prices have gone so high a pullback may be due soon. Indeed, with such strong U.S. stock returns as we have seen this year, equities may be susceptible to small-scale consolidation before seeing a top early next year (in our opinion). Considering these elements, what is the outlook for the different asset classes?

The USD is likely to rally over the short-term, probably up to the early part of Q1 2014. To us, this adds to the weight of evidence (including our GDP model work) that the US will likely show signs of growth until late in the year. Nonetheless, other evidence also shows that the rapid fiscal consolidation during the early part of the year will start to negatively impact growth as the year ends. Most of the negative impact will likely be felt in H1 2014 however. The US Dollar will decline significantly in the first half of 2014.

Paper assets (equities) should also be very sensitive to any hints of a slowdown. The equity markets have simply risen too fast, given the outlook for growth after all the fiscal consolidation and policy/communication mistakes committed by the Fed earlier in the year. Also, given the overbought conditions from momentum and margin debt metrics, equities may also face an important consolidation during the first half of 2014.

Bond yields will likely fall as well, but it may wait for a break in the equities before a significant decline snowballs. Further declines in the yield should also hurt the US dollar.

Commodities may fare better than equities, if the market break we are projecting comes about. Why? We expect Chinese growth to remain on an uptrend well into H2 2014. Commodities have remained at such low levels for such a long time that the scope of the weakness in growth that we are projecting has already been fully discounted. US dollar weakness and Chinese resilience will redound to an outperformance by commodities. In terms of the business-cycle, this will also more importantly mark the shift to the phase when commodities typically outperform equities.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The tight petroleum products market is not reflected in prices

Petroleum products inventories have fallen significantly around the globe these past few weeks. While a drop in petroleum products inventories is usual during the fall refining maintenance season, the decline experienced since the beginning of September has been more important than usual.

In the US, petroleum products inventories dwindled by 57.5 million barrels between mid-September and mid-November, significantly above the 5-year average (-17.9 million barrels). In Europe, light and medium distillate inventories declined by 6.5 million barrels, compared to a 2.6 million barrels drop on average the previous five years during the same period.

There are two main drivers behind this massive drop in petroleum products inventories. First, European refiners have suffered from low margins, leading to lower than normal activity. The International Energy Agency indeed decreased its forecast of European crude runs for October 2013 from 11.5 million b/d in early August 2013 to 10.6 million b/d in November 2013.

Second, petroleum products demand accelerated, especially in OECD countries. According to the US government, US petroleum products demand growth accelerated significantly in September and October 2013 thanks to stronger demand from the transportation, the petrochemical and the agriculture sector (for corn drying). Western European oil demand has also recently improved. Stronger manufacturing PMIs in the US and in the Eurozone suggest that oil demand could grow further.

Moreover, global oil demand tends to increase seasonally due to stronger heating demand and increased travel in December. This has contributed to significantly reduce the stock-to-use ratio in the US to its lowest level since 2007.

However, crack spreads do not reflect the tightness in the petroleum products market, especially gasoline crack spreads, which remained at a low level. Crack spreads hence need to rise in order to encourage refiners (and especially European refineries) to increase activity in order to respond to the stronger demand.

The Chinese Third Plenum sent positive long terms signals for metals

Base metals’ performance was gloom in November for most metals but tin, which resisted quite well due to its structural deficit. There was no fundamental support to the decline, which accelerated on November 12th, following the Chinese Communist Party’s Third Plenum (that took place from November 9 to 12) as markets were hoping for more infrastructure-related announcements.

However, the Plenum actually provided positive signals for metals in the long term, even though one could argue these reforms will be challenging to implement. Indeed, what dragged base metals prices lower in the past two years were doubts regarding the long term prospects of the sector, and especially regarding China’s demand for metals. Positive signals are therefore welcome, despite the probable slow implementation process.

Firstly, the announced increasing flexibility in the currency system reform could allow an appreciation of the Yuan. This could therefore make imports more affordable and further support the imports of metals.

Secondly, the liberalisation of the rural-urban migration should spur another wave of infrastructure needs and could support metals such as iron ore, steel, copper, aluminium and zinc. The home affordability is a top priority for the government and it is therefore likely that house construction will be boosted in those cities to supply low-income migrants (farmers) with affordable houses.

Thirdly, the environmental concerns could decrease subsidies to some energy-intensive sectors such as the production of steel and aluminium (the latter devouring 6% of the country’s electricity), which could help rebalancing these surplus markets.

Finally, the ease of the one-child policy, even though it should not strongly shake China’s birth rate, shows that the party is concerned with the aging population and could be on path to implement further flexibility to the one-child policy. This is positive for commodities, with potentially more people to feed, heat and house.

Gold investment demand declining again

Gold’s performance was lacklustre in the past weeks. The US economic data was pro-tapering, offsetting Janet Yellen’s supportive stance on the Fed’s QE program. The metal was mostly affected by an increase in long-term real interest rates. The 10-year Treasury rate rose from 2.53% at the end of October to a range between 2.79% to 2.88% in the first week of December. Furthermore, the US dollar is holding firm, also affecting gold prices, which enjoy a strong inverse relationship with the USD. The DXY rebounded at the end of October from 79.2 to 81.3 in the first week of October and has only slightly and slowly retreated since then, to 80.2 at the beginning of this month. This decline was clearly too slow to allow improvements in the gold price.

Given the lack of clear direction, investment demand declined again, especially at the end of the month. On the Comex, net long speculative positions collapsed to 48,500 lots (futures and options), the lowest level since July this year. Long positions dropped from 167,500 lots at the end of October to 151,200 during the week of November 19, while short positions nearly tripled over the same period, from 39,000 lots to 103,000.

Furthermore, the rate of outflows from the world’s gold ETFs has accelerated again since late-November, at a pace of circa 0.7%-1% per week (7-day percentage change), following a period a decelerating outflows (of circa 0.3%-0.5% 7-day change on average), from October 23 to November 20.

As far as the sentiment is concerned, it fell, unsurprisingly, from 61% of bullish opinion in the week ending October 25th to 46% in the week ending November 29 (latest data available). The sentiment is still hovering in normalised territory (as opposed to the 25%-35% of bullish opinions observed before the summer, when gold was oversold) but is moving towards bearishness.

Analysing components of the corn demand

Every three months, the US Department of Agriculture (USDA) publishes its highly watched Quarterly Stock report. The next one is scheduled on the second week of January and will measure stocks as December 1, 2013. For this time of the year, the difficulty consists to evaluate the corn consumption as production is already well estimated. The main components of the demand are feeding, exports and ethanol.

The USDA publishes each week, the quantity of corn inspected for export. Since September 1, date of the previous report, 322 million bushels have been exported. Moreover, the US Energy Information Administration (EIA) provides also, each week, estimates of ethanol production. An average of 885’000 barrel per day of ethanol were produced since September 1, so we can deduce that 1.2 billion bushels were consumed for ethanol. As a consequence, analysts can easily forecast the demand for exports and for producing ethanol. In total about 1.5 billions bushels have been used for both. At the opposite, data regarding feeding are not collected on a timely basis leading therefore to a large difference between the number published by the USDA and analysts’ estimates.

Indeed, the feeding part is difficult to forecast as it vary considerably from year to year. Feeding depends mainly from the livestock production. The estimate is based on an estimate of the number of animals fed by species, weighted by the amount of grain required per animal in each species. Moreover, grains used by breeders will maximise protein intake and minimise its cost relative to other grains. Therefore, corn prices often reach its daily limit on the publication day of the Quarterly Stock report as analysts wrongly estimate USDA number for feeding.

Chart of the week: US crude oil imports to decline at a faster pace

|

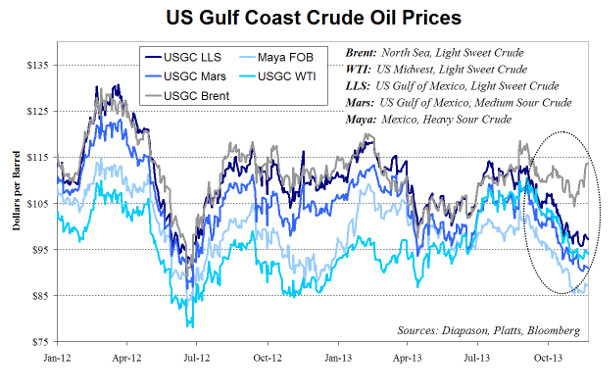

Last week, the OPEC members organized in Vienna their bi-annual meeting. The production target of 30 million b/d was unchanged as most participants are pleased with the current level of prices. However, not all OPEC exported barrels are benefiting from this price level. Indeed, OPEC crude oil exports to the US Gulf Coast, which averaged 2.3 million b/d between January and September 2013 (66% of overall OPEC crude oil exports to the US, 62% of total crude oil imports on the US Gulf Coast and about 9% of total OPEC crude oil exports), are now feeling the impact of the tight oil boom in the US in the form of lower income. OPEC Gulf producers linked their crude oil exports to the US Gulf Coast with the Argus Sour Crude Index, which is an index of medium sour crude oils produced in the Gulf of Mexico such as Mars crude oil. Venezuelan crude oil exports to the US use the Mexican oil benchmark Maya due to their similar quality (heavy sour). These benchmarks have closely followed Brent crude oil prices until the beginning of September 2013, when the US oil glut moved from the Midwest to the US Gulf Coast, adding significant downside pressure on regional crude oil prices such as Mars or Maya crude (see chart above). This implies that Saudi Arabia is now exporting crude oil to the US Gulf Coast at a value of about $91 per barrel (using Mars crude oil price), while it is selling the same crude oil in Asia at a value of around $108 per barrel (using Oman crude oil price, the main benchmark for Asia). The tight oil boom has hence indeed led to an important loss of income for foreign exporters of crude oil to the US Gulf Coast, which is the key refining hub in the US, accounting for 51% of overall US refining capacity. This should discourage crude oil exports to the US Gulf Coast, leading to a more rapid decline in US crude oil imports, which already dwindled by 940’000 b/d y/y on average between January and September 2013. At the same time this should ease the oil glut that appeared on the US Gulf Coast and then lead to a narrower Brent-WTI spread. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com