December 2, 2013

A "revival" of the commodity "super-cycle" is at hand? It never was “dead”.

Commentary by Senior Market Strategist Robert Balan

"China overtakes the United States as the largest oil-consuming country and Middle East oil consumption overtakes that of the European Union, both around 2030. The shifting geography of demand is further underlined by India becoming the largest single source of global oil demand growth after 2020."

International Energy Agency, World Energy Outlook 2013, November 2013

There are reasons to believe the commodity "super-cycle” has not died in the first place; the averment of "commodity super-cycle peak" by investment banks over the past 12 months was an unwarranted meme. The conclusion that the commodity super-cycle has peaked deserves to be revisited and re-evaluated — for us, it looked like some elements have been underestimated.

The primary reason for many investment banks' calls for the end of the "commodity super-cycle" 12 months ago has been the poor outlook for the Chinese economy (which was expected to land hard), and the then Hu Jintao government's desire to rebalance the economy. Slower average economic growth rate and a switch to a more consumption-led growth pattern was expected to slow down China’s demand, especially for industrial and infrastructure related commodities in the next few years, if not decades. In addition, the US housing market and industrial production did not look at all robust then, as they have recently. Japan of course was written off completely at that time, and the eurozone, then, was expected to implode under the weight of rising government debts and insolvent banks. It was understandable, therefore, that analysts projected global commodity demand would likely expand much less in the 2010-2020 decade compared to the last one (2000-2009).

Now, it turns out that the pessimistic prognostications two years ago of commodities structural decline will likely be proven wrong. The data so far does not provide support for the pessimistic view. For one, the narrow focus on China has failed to notice the emergence of India and other Asian economies which will make up for diminution of the Chinese commodity demand. Also, despite a modest performance for the global economy, the demand growth rates for most commodities in the rest of 2013-2020 decade look like turning out to be significantly above the average levels of 2000-2009. Our own modelling work also provide support to the theme that US and global growth will likely be significantly stronger in the 2015-2020 period than the average USA and global growth since 2010 to present.

That average commodity demand growth has not diminished suggests very significant ramifications for the asset class in the near-term. With the macroeconomic aftershocks of the Great Recession continuing to recede, commodities are now behaving as different risk exposures again. The near-term demand growth for commodities looks healthy, and with the falling correlations between assets classes (as global risk factors decline), commodities will again take its legitimate place as an asset class. The improving macro environment will also enable the outlook for demand to dictate variations in supply trends in commodities subsectors, which will be influential in differentiating price outcomes in 2014 and for the rest of the decade.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The US storm’s impact on gasoline and natural gas should not last

Winter storms typically led to higher energy demand and usually result into higher prices. However, the storm, which has hit the US East Coast and most part of the Midwest with heavy snow, rain and high winds last week, had a mixed impact on energy demand. Last week, prices within the energy sector saw indeed big divergences in performance. US natural gas futures prices rose sharply while gasoline prices dropped.

The reason is that the storm hit the US at the beginning of the Thanksgiving holiday. The latter is especially important for the transportation sector due to the important amount of travel during this period. Indeed, according to the American Automobile Association, 43.4 million Americans will have travelled 50 miles or more from home during the Thanksgiving holiday. The storm led to important travel disruptions, which contributed to lower oil consumption.

Gasoline demand has been the most affected as about 90% of travellers are planning to travel by automobile and 37% of travellers were expected to depart on Wednesday. This has hence contributed to the underperformance of gasoline within the energy sector. Air travel was also hit but the decline in kerosene demand is mitigated by stronger heating oil demand.

Indeed, the second consequence of the storm on the energy sector has been the rise of space heating demand, leading to the outperformance of space heating fuels. US natural gas, which is the most important space heating fuel, accounting for about 50% of the main space heating fuel used in US households, has therefore outperformed the energy sector, followed by US heating oil. Nonetheless, as the storm has ended, natural gas prices could suffer from the strength in supply, while gasoline prices should benefit from the rebound in demand amid relatively low inventories, especially on the East Coast.

Russian crude oil exports are set to decline further

Recent investment in the downstream sector and the current fiscal regime have boosted refineries profitability in Russia. This contributed to an increase in refining activity, which more than offset the rise in Russian crude oil production. Indeed, between January and October 2013, the latter grew by 130’000 b/d y/y on average according to the Russian government, while Russian crude runs increased by 200’000 b/d y/y on average during the same period.

Moreover, the growing importance of the refining sector has led to more volatile Russian crude oil exports. The refining maintenance seasons in the spring and in the fall are hence having a significant impact on exports. They indeed dwindled by 700’000 b/d from April 2013 to 4.4 million b/d in August 2013 as refining activity increased.

This year, the fall refining maintenance season contributed to an increase in Russian crude oil exports to 4.9 million b/d in September 2013. As refineries are now restarting activity, crude oil exports, which already declined by 200’000 b/d m/m in October 2013, are likely to fall further.

According to the International Energy Agency, crude runs in Former Soviet Union countries are expected to rose by 500’000 b/d over the month in November 2013 to 7.0 million b/d. Russia is likely to account for the bulk of this increase, therefore reducing the amount of crude oil available for exports. At the same time, Russian petroleum products exports (and especially diesel) are likely to increase, albeit by a smaller amount than the decline in crude oil exports due to the stronger demand driven by seasonality and the rebound in economic activity. Last year, Russian petroleum products exports rose by 115’000 b/d between December and September, while crude oil exports fell by 240’000 b/d during the same period.

Johnson Matthey provides supportive view for palladium

The 2013 Johnson Matthey Interim report forecasts significant deficits in the platinum and palladium markets for the year 2013, and provides very a supportive view for the palladium market, which is set to be pushed further into deficit next year.

The leading company in PGMs statistics estimates that the platinum market will exhibit a 605,000-tonne deficit this year, mostly due to a strong offtake by ETF investors. Investment demand is indeed expected rise from 455Koz in 2012 to 765Koz in 2013, contributing the most to the 6% rise in total demand. On the other hand, the global supplies of platinum are set to increase by just 2% over the year with marginal improvements in the South African production and higher output from Zimbabwe. For next year however, the situation does not appear that bright. Although Johnson Matthey forecasts another year of deficit in 2014 (driven by tightened emission standards and Chinese jewellery demand), investment demand is not expected to be as strong as this year, and the deficit may not be sufficient to support prices, given the large above-ground stocks and the decreasing influence of the South African disruptions on prices. The latter indeed appear to have become known unknown given the investors’ lassitude regarding this subject in the past weeks.

The view on palladium looks much better, confirming our view that the metal has brighter long term fundamentals. The deficit is expected to be of 740,000 tonnes this year, driven by a 4% increase in demand from the autocatalyst industry. Next year, primary supply should fall in the absence of Russian stock sales, while this should be partly offset by an increase in secondary supply. The company forecasts very strong investment demand. South Africa’s Absa Capital has received regulatory approval for its palladium ETF, and following the huge success of the platinum one, Johnson Matthey anticipates that this will lead to a much higher investment demand. This ETF comes as a response to investors, who have showed strong interest in the metal that remains structurally in deficit.

The difficulty to estimate US wheat supplies before winter

According to the last USDA Crop progress report published on the 26th of November, 62% of the winter wheat was rated in “good” or “excellent” conditions, almost unchanged since last week but 10 percentage points higher than the five previous year average. Even if the beginning of the winter wheat season starts in good conditions, 93% of the winter wheat has already emerged according to the same report, it will be difficult to anticipate the harvest quantity for different reasons.

Firstly, as each year, the USDA will stop its weekly Crop progress report during winter as crops start their dormancy period. As a consequence, the USDA can not measure the quality of the crops. Therefore, analysts won’t have any official data regarding the condition of the winter wheat.

Secondly, the USDA will publish its first WASDE report for the season 2014-15 in May 2014 or one month before the beginning of the winter wheat harvest, leaving a short timeframe for analysts to compare their own estimates with the USDA’s forecasts. For example, last year, in November, only 33% of the winter wheat was rated in “good” or “excellent” conditions. It was the lowest level since this data started to be reported, 10 years ago. At the end, the wheat harvest was estimated at 2’130 million bushels, the average level of the 5 previous years.

Winter is one of the riskiest period for wheat production, as frost can decimate crops if ears are not developed enough. Therefore, all forecasts made before this period should be used with caution. Once winter is over, analysts can re-start their quality studies and generate more precise forecasts. So, the good start of the season 2014-15 is not sufficient to predict an abundant harvest.

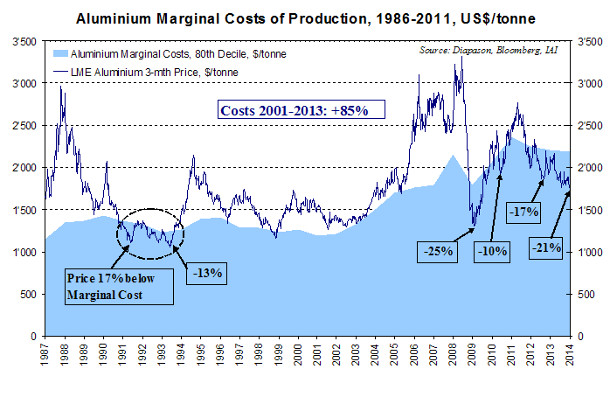

Chart of the week: Downside risks appear limited for aluminium

|

Aluminium prices fell last week to a four-year low, at 1755 $/tonne as of November 29, mirroring the metal’s poor performance of the past decade. Aluminium has been the ugly duckling of the LME complex since the start of the super-cycle in 2002, and is expected to lag behind other base metals next year. In fact, the light metal has just increased by 50% in the past decade, while other metal prices have been multiplied, by as much as 6 times for tin, +5 for copper or +4 for lead. The aluminium market has been characterized by a lack of supply discipline since 2009, both from Chinese and non-Chinese producers. While Chinese producers enjoy various subsidies, including on energy prices, there is little room for curtailments. In the rest of the world, producers have benefited from strong consumer’s premiums (what consumers pay on top of the LME price to secure their purchase), discouraging production cuts. These high premiums have been driven by the piling up of aluminium inventories in LME warehouses over the past three years, which have made aluminium relatively unavailable to consumers as the metal was tied up in financial deals (cash and carry positions given the sustained contango). Earlier this year, the LME showed its willingness to tackle this issue, and a drop in premium was expected, which could have prompted non-Chinese producers to finally adjust their production levels. This did not materialise as premiums in Europe and in the US have only slightly retreated over the summer and have, for some, rebounded since then. In spite of the grim fundamental picture, downside risks appear limited for aluminium, given the price-cost relationship. Price have fallen 21% below the marginal cost of production, for only the second time since the 1980’s — and the first time was in early 2009 during the general commodity price collapse. We have noticed in the 30-year history that the price tends to rebound quickly following such unsustainable margins. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com