September 30, 2013

Emerging Markets are back...

Commentary by Senior Market Strategist Robert Balan

«Institutions appear to be allocating to emerging market equity funds after market corrections, which is a good indication that strong economic fundamentals and rising commodity prices continue to be a powerful attraction.»

Brad Durham

In early summer this year, Emerging Markets (EM) rates were riding high, as the confluence of prospects of further liquidity from central banks and investors hunger for yields drove EM bonds higher than local fundamentals warranted at that time. However, EM portfolio flows reacted drastically to the prospective Fed tapering, as US rates climbed at a record pace. The ‘sudden stop’ of capital flows led to sharp valuation adjustments in EM assets. The devastating impact of surging US rates was also exacerbated by EM fundamentals which turned for the worse. EM growth disappointed as concerns remain about hard-landing scenarios in China. This was happening in a backdrop of advanced economies showing increasing signs of recovery. Headlines of flaring domestic tensions in several significant EM countries (Brazil, Turkey, Egypt, South Africa) also added to the sentiment shift against EM assets. At first, the portfolio outflows in March-April were led by retail rather than institutional investors; nonetheless, the flow reversal accelerated its intensity -- outflows in June-August exceeded the accumulative inflows in the first five months of 2013.

Cyclical activity eventually improved in China, commodity prices recovered, and PMI's across the globe stabilized and then actually gain ground -- the better news flow started to have some remedial effects. So even before the Fed's surprise no-taper on 18 September, EM equity performance had improved and portfolio flows into EM equity had already turned positive again. Given the widespread EM underweight and the overly long USD positioning by markets, this triggered an immediate relief rally, in particular in assets that had been deemed most exposed to tapering and, thus, had widely sold off during the summer (e.g., the USD vs. the currency of current-account deficit countries).

The improvement continues to this day. In the week leading to 25 September, EM dedicated equity funds saw USD 1.87bn (or 0.2% of AUM) of inflows, marking the third consecutive week of inflows. Inflows to GEM equity funds have been accelerating, as investor sentiment is turning positive again, as China hard landing concerns faded. Export-oriented major EM economies paced the recovery, as they are likely to benefit from a cyclical rebound in global manufacturing.

Consequently the acceleration of EM economic growth is contributing to a rebound in commodity demand growth as EM are indeed the most important contributors to commodities demand growth. For example, between 2008 and 2012, non-OECD oil demand rose by 6.2 million b/d, more than offsetting the decline in OECD oil demand (-2.5 million b/d). Moreover, this is occurring while the economic recovery in advanced countries is leading to improved commodity demand. The return to strong economic growth in EM should hence triggered higher commodity prices, as they are the barometer of EM’s economic health. Commodity markets continue to be the emerging market play.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

European oil demand is gradually recovering

The poor economic situation in Europe have had an important impact on the regional oil demand. Indeed, between 2008 and 2012, oil demand fell by 1.8 million b/d in the European Union, mitigating the growth in Chinese oil demand of 2.3 million b/d during the same period.

Last year’s decline in European oil demand (-600’000 b/d y/y), also mitigated the gain made in non-OECD countries (-1.4 million b/d y/y). However, this year, the gradual economic recovery in Europe, as suggested by the latest data, is contributing to a lower decline in oil demand growth. According to JODI, gasoline consumption by major and medium sized European countries fell by 125’000 b/d y/y in 2012, while it was declining by 105’000 b/d y/y in average between January and July 2013.

It is interesting to note that in 2012, gasoline oil demand growth declined until September 2012 before starting to rebound, which has continued until recently. Gasoline demand growth fell from –55’000 b/d y/y in January 2012 to –200’000 b/d y/y in September 2012 and then rebounded to +25’000 b/d y/y in July 2013, which was the first positive growth in European gasoline demand since August 2009.

European diesel oil demand also continued to improve with an increase of 10’000 b/d y/y in July 2013. This growth in July is a better reflection of the increased economic activity than the growth recorded in April and in May 2013, as diesel demand rose during this period due to cold temperatures. During the summer, European diesel demand is indeed less influenced by the weather than during the winter. Thus, the increase in European diesel demand in July suggests an improvement of the economic situation.

The recovery of European oil demand growth should contribute to a tighter global oil supply/demand balance, contrasting with these past few years, when Europe tended to ease the oil market, due to its strong decline in oil demand.

Despite the improvement of the regional oil demand, European refineries continue to struggle. The surplus of European gasoline is becoming more difficult to export due to the increased US competition, while the continent remains in deficit of diesel, requiring imports.

China’s copper apparent demand near record high

Copper prices appear to have stabilised this week near the level of $7,200 a tonne, supported by the confirmation of China’s economic revival. China’s consumption of copper may have accelerated in the past weeks, as suggested by the sustained high imports, strong production volumes, lowering inventories and high consumers premiums. As a result, China’s apparent demand (production + net imports) was at the second and third highest levels ever respectively in June and July 2013. In August, despite the seasonal lull, apparent demand was just slightly below July levels (so at the fourth highest level ever) and up 12% y/y.

The decline in domestic copper inventories (SHFE and bonded warehouses) in the past three months confirms that China’s apparent demand has probably been driven by a real underlying usage; and not by the stocking cycles. Indeed, total inventories are currently estimated at about 550,000 tonnes, a slight increase from July levels—probably because of the seasonal slowdown in August— but still near the lowest levels since the beginning of 2012. Production of electric cables has also been rising, and was at the highest since May this year in August 2013, up 5% y/y, confirming the real usage.

We expect the trend to continue in September, as current inventories still appear too low to meet domestic demand; which should force China to maintain the high pace of imports. The consumers’ premiums, which have remained near record high at $200/tonne through September, also confirm that the copper market is tight in the Middle Kingdom, as opposed to Europe, where the situation has recently eased. Another indicator suggesting that imports could remain elevated is the SHFE—LME price arbitrage (incl. VAT, import duties) which is now back into positive territory, favouring the imports of copper over the domestic buying.

GFMS provides positive outlook on gold

On September 12, 2013 (i.e. before the Fed’s decision not to taper), the highly-regarded consultancy firm GMFS released a three-month positive outlook on the gold price, anticipating—just like Diapason—the Fed’s non-taper decision. GFMS expects that, once this decision for no-cut in the asset purchase program is fully understood by the markets, gold should exhibit some solid rally in the fourth quarter of the year, towards $1,450/ounce.

GFMS’ forecast is in line with Diapason’s expectations, as we could see the gold price around $1,500/oz later in the year, despite the price decline in the days following the Fed’s meeting. This decrease was driven by the confusion that emerged after contradictory comments from Fed’s officials over the existence and timing of tapering. In addition, gold producers have accelerated their hedging, notably in Australia and in South Africa, adding some downward pressure on gold prices.

However, gold has still some upward potential in our opinion. Since the latest FOMC, real interest rates have headed downwards. The 10-Year real interest rate is now at its lowest level since the start of August this year, hence cancelling the significant rise rates experienced during August and September. Also, the continuation of the massive asset purchase program should pull the US dollar further downwards, after having fallen from 1.334 dollars per euro to 1.355 immediately after the B. Bernanke’s decision. The lowering of the USD should also be encouraged as one effective way to provide some relief the emerging economies, which have been suffering from the sharp fall in EM assets, amid rising yields on US Treasuries and a large USD appreciation. The combined effects of declining interest rates and a falling US dollar usually provide very good grounding for a gold rally.

Agriculture commodities currently driven by fundamentals

On the 18th of September, the US Federal Reserve surprised investors by saying it would maintain its bond purchases at $85 billion a month. The Committee decided to continue purchasing additional agency mortgage-backed securities and longer-term Treasury securities. Reacting to the news, agriculture commodity prices rose on Wednesday and Thursday by 1.2%, on average. This rise is slightly inferior to the average of all commodities, on which prices increased by 1.9%, on average.

Indeed, these effects are more positive for industrial commodities as continued stimulus in the US is positive for demand. In the case of agricultural commodities, the benefits are short-term and tend to come from the weakening of the US dollar. A weaker dollar often leads to higher import demand. As the US are a net importer of soft commodities, prices of sugar and coffee, for example, have over performed prices of grains including corn, wheat and soybeans.

However, at this time of the year, agriculture commodities are more influenced by their respective fundamentals, especially weather forecasts, rather than macro factors. US harvest for corn and soybeans started last week. After a month of dry weather, leading to a yield decline, weather has been more favourable recently.

For soft commodities, sugar harvest has been disrupted by a rainy weather in Brazil. At the opposite, these rains are beneficial for coffee crop as they should promote flowering.

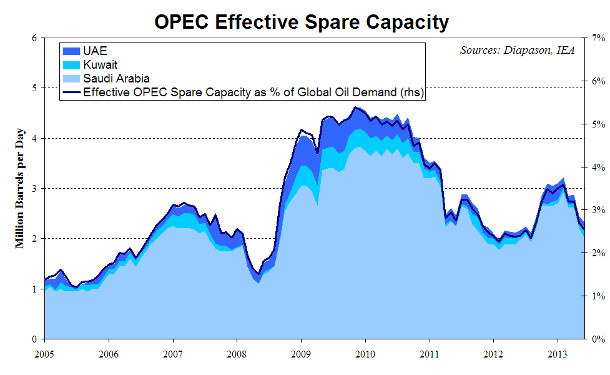

Chart of the week: OPEC spare capacity could rebound in October

|

Supply disruptions contributed to stronger oil prices in July and August 2013 and kept prices at a relatively high level in September 2013, contributing to bring OPEC spare capacity to low levels. OPEC’s effective spare capacity (Saudi Arabia, Kuwait, and the UAE) fell in August 2013 to 2.2 million b/d, the lowest level since October 2013. However, supply disruptions are likely to be gradually solved amid weaker seasonal crude oil demand due to the refining maintenance season. Indeed, crude oil supply is expected to increase from several places. South Sudanese crude oil production reached last week 240’000 b/d, the highest level since it resumed crude oil exports in March after an agreement was found between Sudan and South Sudan. Crude oil production could increase further in the coming weeks and could reach 250’000 b/d by the end of the year. The agreement between the two countries also reduced political tensions. Iraqi crude oil exports are expected to rebound sharply by mid-October. In September 2013, crude oil exports were constrained by work on the Basra oil port, which caused a decline of about 500’000 b/d. Iraqi crude oil exports from the southern part of the country could hence bounce back to around 2.3 million b/d. Brazilian crude oil production, which has disappointed since the beginning of the year, is likely to increase as maintenance operations at offshore oilfields are more than offset by the start of new fields. The major 140’000 b/d Papa-Terra field is expected to see its first oil in October, while production continues to ramp up at the 120’000 b/d Sapinhoa Pilot and the 120’000 b/d Lula NE Pilot fields. Moreover, two other major oilfields, with both a capacity of 180’000 b/d, will come on stream in December (the Parque das Baleias field and the Roncador module III field). This comes on top of the start of the Kashagan field in Kazakhstan with an initial production capacity of 180’000 b/d. The field, which was considered as the largest discovery in 30 years in 2000 will then gradually ramp up to 370’000 b/d. In Libya, some ports have restarted activity, allowing an increase in crude oil production, which had fallen to 250’000 b/d in August 2013. These increases in supply will more than offset supply disruptions in Nigeria (Shell recently closed a 150’000 b/d pipeline due to oil theft). The increase in crude oil supply amid weaker seasonal crude oil demand should thus lead to a rebound in OPEC ‘s spare capacity in October. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com