September 23, 2013

FOMC's non-taper: reality won over the theoreticians

Commentary by Senior Market Strategist Robert Balan

«If inflation-adjusted interest rates decline in a given country, its currency is likely to decline.»

Ray Dalio

So that's how it came about -- the FOMC's decision not to taper was the achievement of rationality over theory; a success of the market over the theoreticians -- and this can be exploited. What is important now is to translate that decision into actionable tactical/strategic moves. The immediate consequence which come to mind is that the Fed will be "gun-shy" for a long while -- for many in the FOMC (which is full of academics), this is probably the first time they have beheld the true power of the market to override ill-conceived theories and sloppy econometric work. This means the Fed will very likely be on hold up to the end of the year, at least. This is practically providing the market with a "free lunch", similar to the episode which we saw in 1999, when the S&P 500 rose from 1190 to 1440 by year-end, as the market understood then that the Fed will be on hold during the period.

Mr. Bernanke's press conference yielded another gold nugget. Chairman Bernanke backed away from the 7.0% unemployment rate as a guidepost for ending the asset purchase program. The only remaining guidance was his suggestion that the plan to end the program by mid-2014 was still on track. But the lack of any clear guidance on the criteria for tapering and the eventual ending of the asset purchase program means there is substantial leeway regarding the path of the asset purchase program — it is now obviously clear that financial market anticipation of tapering might deter the Fed from tapering once more. And here's another. The FOMC said: "The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished, on net, since last fall, but the tightening of financial conditions observed in recent months, if sustained, could slow the pace of improvement in the economy and labor market". So the tightening of financial conditions clearly concerns them, and should be rightly so.

The total bottom line of the non-taper and the ensuing press conference was that the FOMC meant to send an extremely dovish message, not only through the lack of tapering but also with its 2016 forecasts. Even though the Fed’s forecast for the unemployment rate is within its estimated range for full employment and inflation is close to its target, the median federal funds rate is 2.0%, far below its estimate of a 4.0% neutral rate. Chairman Bernanke said a neutral fed funds rate might be reached two or three years after 2016. This was a clear attempt to emphasize the “low for long” message.

This should have a positive impact on risk assets and especially commodities. The taper phenomenon has been internalized by commodities for some time now, and the joyful response of the asset class to the Fed decision was a claw back to the deep sell-off that commodities suffered at the start of the taper-talk. Dollar-denominated commodities also could see a strong uplift move thanks to growing downside pressure on the US dollar, triggered by the Fed’s decision. However, the most significant focus of commodities at the moment is China -- which seems to be leaving the doldrums behind. These are the active considerations we should look at from here. If indeed the US grows until Q4 2013 or even until Q1 2014, then growth in China (which is 2 to 3 quarters behind) will extend well into H2 2014. That is also the reason why we believe a commodities outperformance over equities will likely extend well into next year.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

OPEC spare capacity could decline further in September

Latest reports showed that Saudi Arabia has been pumping 10.2 million b/d of crude oil in August 2013, the highest level since August 1981, when production had been increased to replace the lost Iraqi and Iranian barrels due to the war between the two countries. Between August 1980 (the war started in September 1980) and August 1981, crude oil production fell by 2.4 million b/d. This time, it is the decline in Libyan crude oil production, which fell by 1.2 million b/d between April and August 2013, that triggered this response. Moreover, supply disruptions also occurred elsewhere (Nigeria, Iraq,…).

This contributed to lower OPEC “effective” spare capacity (comprised of Saudi Arabia, Kuwait and the UAE) to 2.2 million b/d, the lowest level since October 2012 and close to the low range of last year (around 2.0 million b/d). It is interesting to note that effective spare capacity recently peaked in April 2013, when Brent price reached the lowest level for the year. Thereafter, the oil market has gradually tightened as reflected by higher prices and the decline in OPEC effective spare capacity. The latter is likely to fall further in September due to ongoing supply disruptions in Libya, Nigeria and Iraq.

On top of the uncertain situation in Libya, Iraq will be an important factor behind stronger production from Gulf countries. Indeed, major work at the southern Iraqi oil port has already pushed down crude oil exports to 2.0 million b/d by mid-September, down 350’000 b/d in August 2013. They could decline further in the coming weeks to around 1.8 million b/d until mid-October when crude oil exports are expected to gradually go back to normal levels.

The OPEC effective spare capacity is likely to rebound after October and increase by the end of the year, due to the rebound in Iraqi crude oil exports, lower seasonal demand for crude oil because of the refining maintenance season and especially due to lower domestic crude oil demand in Gulf countries.

The distillate price outperformance should continue

Distillate prices performed well during the summer compared to other oil products. This was caused by strong demand, while US distillate production was particularly strong during July and August, up by 6.1% y/y. In spite of strong production, US distillate inventories rose by a lower than usual amount and remained close to last year and the 2004-2008 average level, which are significantly below previous years.

The period of the fall maintenance season (September-October) could add more upside pressure on the distillate market. Demand from the US and Europe has recovered thanks to the improved economic situation, offsetting lower demand from large emerging countries such as Brazil and India, due to the lower economic growth. Finally, Chinese diesel demand is expected to accelerate due to stronger industrial activity. Moreover, low refining margins in Europe (driven by weak gasoline prices) should contribute to a more important reduction in refining activity during the fall maintenance season and possibly a weak rebound in crude runs thereafter. Thus, the tight market should lead to a more important than usual decline in distillate inventories, hence adding upside pressure on distillate prices.

Like last year, the heating oil crack spread, now at around $18 per barrel, could hence move towards $21 by mid-October, when heating oil crack spreads tend to peak. However, there is more value within petroleum products. Heating oil prices could outperform gasoline prices much further. Indeed, while the heating oil-gasoline spread, now at around $15 per barrel, appears expensive relative to historical levels. However, it remains in line with the previous years if a high sulphur discount of $5 per barrel is added as the NYMEX Heating Oil futures contract moved to ultra-low sulphur specifications in April 2013, making the product more valuable. The heating oil premium over gasoline could move above $20 per barrel by mid-October.

Platinum to benefit from Fed’s non-taper

Prior to the Fed’s announcement that the pace of the asset purchase program would be left untouched, platinum was experiencing a slowdown, especially relative to its peer-metal palladium. Indeed, the situation in South Africa appeared to have appeased – putting some pressure on platinum prices – and on the other hand, recent statistics were confirming palladium’s strong fundamentals as China’s automotive sales were much higher than expected in August and Russia’s palladium exports to Switzerland were back to very low levels in July. Moreover, the two metals have not moved in tandem in the past months as it looks like investors are spread-trading, holding a long position in one PGM and a short position in the other.

The Fed’s decision, completely against the consensus, should benefit platinum slightly more than palladium – although both metals have good prospects. Platinum is generally perceived as a “more precious” metal than palladium, being used in jewellery, unlike palladium, almost exclusively used in the car industry. Also, platinum has traditionally more been considered as store value, along with gold and silver. The prolongation of the QE3 program, by putting some downward pressure to the dollar and to interest rates, and by potentially raising inflation expectations, should provide a favourable environment for precious metals .

In addition, the US dollar, if it were to keep falling as we expect it will , would fall against other currencies, especially those of mining countries, and against the South African Rand in particular. A rise in the Rand would put some additional pressure on platinum miners’ production costs. On average, between 80% and 85% of producers’ costs are denominated in Rand, while their production (PGMs) is sold in US dollars. This means that producers must exchange their dollar sales into Rand in order to pay for the costs; so a rise in the Rand can significantly increase the cost pressure of the industry, shrinking margins and forcing producers to curtail production; supporting platinum.

The cocoa market moves into deficit for the first time since 2009

Since March 2013, cocoa prices have increased by 25% to reach a one year high of $2’600 per metric tonne. This rise is due to both a rebound in global grindings demand and fears about adverse weather in West Africa. After a collapse in 2009, followed by a slow growth the next two years, global cocoa grindings are finally on a recovery path.

The largest rebound was observable in Asia, where grindings increased by 10% over the last two years. As economies expand, demand for cocoa and chocolate products rise. According to chocolate manufacturers, chocolate demand should grow by 5% in the coming years and demand for cocoa powder products should increase by 7%.

Following the consumption rise in emerging countries, the pick up reached American and European countries. North American grindings jumped by 12% to 126’044 metric tonnes, the biggest rise in three years. American cocoa processors are running close to full capacity, well ahead of the traditional Halloween and Christmas peak. This rebound reflects the steady US economic recovery. Moreover, chocolate makers used most of their stocks built last year when demand was weak to process beans and meet the rising foreign demand.

The same situation is noticeable in Europe where Q2 2013 cocoa grind were up by 6% year on year to 310’408 metric tonnes. Production suffered from a prolonged dry weather in West Africa during July. Cooler temperatures in August were not sufficient to repair the harming growth of flowers and pods. Ivory Coast and Ghana, the tow largest producers, were impacted by these weather issues. At the opposite, Indonesian production suffered from rainy weather that makes ageing trees, most of which were planted in the 1980s, vulnerable to disease.

To conclude, according to the International Cocoa Organisation (ICCO), the market should be in a deficit this season for the first time since 2009, supporting therefore high prices.

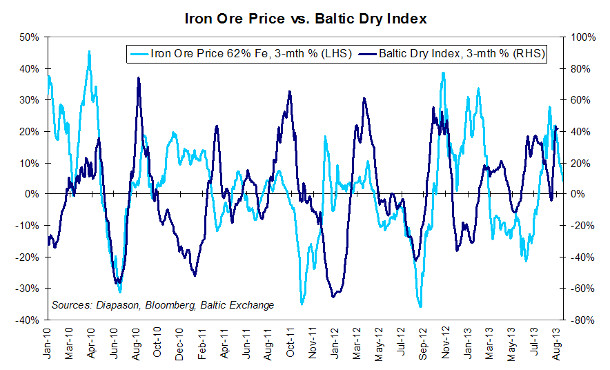

Chart of the week: The stronger iron ore market confirms China’s revival

|

Iron ore prices have much improved over the summer – despite the recent slight decrease – and remain now above $130/tonne, finally slightly above the marginal cost of production, estimated at approximately $120/tonne. Iron ore prices illustrate perfectly the Chinese economic rebound, driven by stronger underlying demand in the Middle Kingdom, and by the steel and iron ore stocking cycles. These past weeks have witnessed an increased demand for ferrous metals in China. Steel production is on the rise, which a very positive factor for iron ore, especially because incremental steel production is being consumed, and not stockpiled. Indeed, steel inventories are heading downwards, and are now at their lowest level since February 2013. This means steel production is driven by a real underlying demand, drawing a healthy picture for both iron ore and steel markets. Because demand for iron ore (steel production) is expected to improve further, China is also rebuilding its iron ore inventories, explaining why iron ore imports have been somehow spectacular in the past months (despite the recent slight import decrease). As China’s iron ore inventories remain at historically low levels (in spite of the rebuilding activity, they remain close to their lowest level since the end of 2011), more imports will be needed in the coming months. Demand for steel and iron ore has been boosted by China’s infrastructure plans, which focus greatly on railways – a very important steel end-using industry. The plan should boost railway fixed assets investment by 90% in H2 hoh. Another strong indicator is the recent surge in the Baltic Dry Index, which has surged to its highest level since the end of 2011, suggesting that trade participants expect China to remain very active in the seaborne market in the near future.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com