September 16, 2013

Q4 2013—Q1 2014 expectations: a US dollar fall, China’s revival and lower long yield to push commodities higher

Commentary by Senior Market Strategist Robert Balan

«Commodities will be in the hands of the Fed and China.»

Arne Lohmann Rasmussen, Danske Bank

Commodities are among the strongest performing assets this quarter. Fed tapering plans have basically built into the commodity market prices at this point, but it is still having a large impact on equity and bond prices. The positive correlation between commodities and equities has continued to trend lower and has recently fallen into negative territory.

We expect commodities to deliver another strong outperformance in Q4 2013 and Q1 2014, spurred by an expected US dollar collapse and the revival of China’s demand.

1. A falling US dollar

We expect the US Dollar to weaken in the next months, as the Fed should curtail or restrain its task of tapering QE3 securities purchases, as activity data will likely prove to be worse than the Fed staff forecasts for the rest of the year and 2014. In particular, signs of a break in the residential market recovery have emerged, and recent declines in housing starts and home sales will likely translate into further negative pressure on US housing activity. Also, the recovery in employment is now at risk of being reversed as the Labor Force Participation Rate could bottom soon. In addition, personal income growth is likely to stay weak in Q4 2013/Q1 2014, with declining aggregate wages and salaries, lower activity in the housing market.

The emerging markets situation will also likely get more problematical in the short-term, and the likely help that is forthcoming will be a forced collapse of the US Dollar by the US Treasury. It will not be spoken of as a USD devaluation but there are a lot of methods to accomplish this.

Adding further impetus to a US dollar decline could be a sharp fall in US bond yields as the Fed modifies its tapering activities.

2. China is back in the (economic) chase – the time frame for China to take off is at hand

China’s activity grew faster than expected in August. In particular, the jump in IP growth to 10.4%, from July’s 9.7% and June’s 8.9%, was significant. Fixed asset investment growth rose to 20.3% YTD (July: 20.1%), led by infrastructure investment.

China’s latest trade numbers also supported the case of the Chinese revival: exports continued to accelerate – they rose 7.2% y/y in August – suggesting the Chinese economy is slowly getting export leverage from increasing demand from the U.S. and from other important export markets. China is also continuing to stock up on raw materials for its industrial sector, despite the seasonal import correction in August. Imports will likely be supported by healthy demand as industrial activity picks up for the peak export and investment season into Q4 2013.

We believe that market sentiment for the rest of the year will likely be supported by better economic data and reform initiatives to be rolled out at the Third Plenary Session of the 18th CPC Central Committee, to be held in November. We expect China Q4 2013 GDP to be 7.7%-7.8%.

The rapid appreciation of commodity prices will be boosted by the fact that commodities are undervalued, and short positions are at record high for some commodities – short covering will provide a robust initial kick-off for the entire asset class.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The gasoline underperformance may last

Lower geopolitical tensions surrounding Syria have triggered an important decline in oil prices. The ICE Brent October contract price fell by $4.87 dollars in 2 days, following the Russian proposal to place Syrian chemical weapons under international control. However, it was not the worst performer within the oil sector. The price of the NYMEX RBOB Gasoline October contract fell by $4.96 (per barrel) during the same period. But the weakness in gasoline started actually at the end of August, as the price on the front month fell by 7.6% from August 28th high (the 2nd and 3rd maturities fell by 6.6% and 6.1% respectively), while Brent price of the front month fell by 4.6%.

Several factors can explain the significant weakness in the gasoline market. The US driving season ended with the Labor Day holiday (02.09.2013), leading to lower US gasoline demand, which accounts for 40.7% of global gasoline demand. Moreover, the switch to winter gasoline (officially on September 15) is reducing costs for refiners (additives used during winter are cheaper than the one used during summer).

The seasonal weakness was amplified by three factors. First, refining activity in the US remained above normal level. Crude oil input into refineries stood last week at 15.9 million b/d, up by 1.6 million b/d y/y. This contributed to strong gasoline supply while demand was falling seasonally. Moreover this occurred while gasoline inventories in the US and especially on the East Coast remained at a high level for the season. Finally, the US Environmental Protection Agency (EPA) is expected to reduce the 2014 ethanol mandate, which will give more flexibility to refiners.

Gasoline prices have reached low levels due to these factors. While expected lower refining activity (as well as an unfavourable and unexpected EPA’s decision on ethanol) could lead to a temporary gasoline outperformance within the oil sector, fundamental weaknesses could push then gasoline prices lower again.

The situation remains potentially explosive at South African mines

Platinum prices have retreated since the start of September, as risks of supply disruptions in South Africa – which produces 75% of the world’s platinum and where 98% of the PGMs reserves are located – have somehow eased from last month. Strikes have indeed ended in the gold sector, and the PGMs sector has surprisingly been relatively exempted from severe unrests. The country’s production of PGMs actually climbed 4.3% y/y in July this year, following a 19.2% decline in June, according to Statistics South Africa.

However, we believe that the situation in South Africa remains potentially explosive for platinum miners and production. Since mid-July this year, most of the country’s industries has indeed started reviewing miners’ wages; a very sensitive process, in a country where the slightest spark can set alight the entire mining sector. Although wage agreements have been found for most gold miners, negotiations in the platinum industry have not been settled yet, and we expect tensions to spread quickly from gold to platinum mines. The largest platinum producer, Angloplats, has already announced that 3,300 jobs should be cut in a plan to revive profitability, showing that mining companies are struggling to remain profitable.

Furthermore, the combined effects of tensions over wages in the coal sector, and an unofficial strike from some electricity workers, have added the risks of power outages in the country, further endangering the energy-intensive mining industry.

In addition, this is not just the mining sector that is subject to protests, suggesting that the many industries in the country could explode, providing a fertile ground for violence and production stoppages. The entire country’s “strike season” is ongoing, with the automotive, and transport sectors still on strike, while the construction workers just ended their 3-week strike on Friday, September 13.

Gold could still have some upside potential

Although gold prices have a bit retreated this week from last week’s improved levels, we still believe that gold has still some upside potential for the coming months. Most commentators have pointed the conflict in Syria as the main driver for gold prices in the very recent weeks, and it is true that global geopolitical tensions first supported the gold price – tensions in the Middle East have historically been positive for gold – before accompanying it towards lower levels as tensions were easing. However, gold’s expected better performance should, in the coming months, find its roots in fundamentally stronger drivers, i.e. in the monetary environment and currency movements.

Firstly, the risks of the US fed tapering its QE program are probably already priced in the gold market, given that the Fed’s tightening announcement, along with the rising real interest rates, largely drove the mid-April collapse that saw the gold spot price tumbling the most in thirty years. Therefore, if the tapering were to materialise, it should not come as a surprise and should have little impact on gold prices. On the other hand, an eventual delay to tapering or a tapering below consensus could really give a boost to the precious metal.

Secondly, it appears that the massive bullish consensus over the US dollar has weakened recently and that more investors are expecting the world reserve currency to head downward in the coming months. The consensus surveys show that the positive sentiment percentage over the USD Index fell to 48%, the lowest level since February this year, and compared with levels above 65% for most of the time between March and August.

Unsurprisingly, China’s aluminium production cuts fail to materialize

Aluminium has underperformed base metals in the past weeks, again. Year to date, the light metal is now the second worst performer, down 15% y/y. The reasons to aluminium’s price disaster have remained the same for the past three years: the large global surplus and the total lack of supply discipline from producers, in China and in the rest of the world. This year should be no exception, despite unified calls for production cuts at the start of the year, with Chinese smelters in particular announcing curtailments of up to 1 million tonnes.

We were (rightly) sceptical at that time, due to the past history of increasing capacity across the country. It seems our doubts have come true, despite the continuing tight margins delivered by aluminium smelters, with about 20% of domestic producers currently reporting zero or negative margins. But these 1 million tonne-curtailments have been more than offset by raising capacity in the Western provinces, where incremental production remains profitable. The continuing subsidies to the sector have also encouraged production. Therefore, from January to July this year, China’s aluminium production has risen by 11%; and more specifically, the average daily production during the month of June hit an all-time record at 61,400 tonnes per day.

In the rest of the world, producers have continued to enjoy relatively strong premiums that support their margins, explaining why production cuts have also failed to materialise in non-Chinese countries. In fact, aluminium production in the world ex–China has remained stable y/y in the past three months and has just decreased by 0.5% y/y year to date. The ongoing discussions to modify the LME warehousing rules, if they were to be implemented, could actually be aluminium’s silver lining, as they could drive physical premiums downward (rather than LME prices), affecting producers’ margins, and imposing supply discipline, finally.

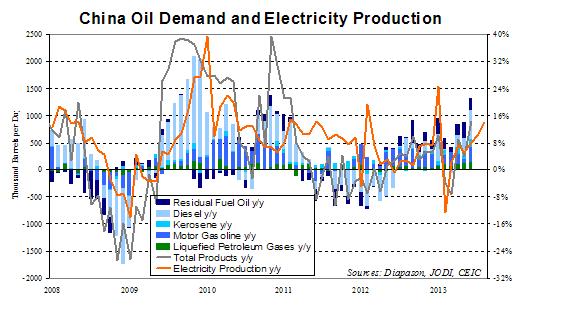

Chart of the week: Chinese oil demand could accelerate further by year-end

|

Recent trade and manufacturing numbers suggest a stronger than expected Chinese economic growth. The electricity production data were particularly strong. Power production rose by 14.0% y/y in August 2013, the strongest growth since March 2011 (when removing the New Year’s impact on the data). Moreover, the strong monthly gain followed another high monthly increase in power production in July 2013. Incremental power production over two months rose to its highest level ever, suggesting an acceleration of the economic activity (and also a hot summer), which is boosting oil demand. Diapason expects the Chinese economic activity to accelerate in the second part of 2013. This should contribute to a growth in oil demand by around 450’000 b/d y/y. The prevision is close to the US Energy Information Administration’s forecast of +420’000 b/d y/y, while the International Energy Agency sees it at +360’000 b/d y/y. Moreover, concerns over oil demand growth relating to the transition of the Chinese economic growth towards domestic consumption at the expense of exports and investment are not overdone. First, the move towards domestic consumption implies an increase in the purchasing power, which should lead to an expansion in the passenger car fleet. In 2010, China had 46 passenger cars per 1000 capita (217 in Beijing compared with 24 in the Guizhou region), close to Namibia’s level but significantly weaker than South Korea with 276 cars per 1000 capita and than the European Union with 474 cars per 1000 capita. The increase in the passenger car fleet will translate into stronger gasoline demand growth. On the other hand, diesel demand growth is expected to remain strong in inland provinces, which still require huge investment and infrastructure to catch up with the coastal regions. In 2011, oil demand per capita in Shanghai was close to the one in Spain (around 10 barrels per capita), while in least developed regions it is closer than in India. Thus, it is not surprising that despite lower economic growth last year and in the first part of 2013, Chinese oil demand has continued to grow strongly.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com