September 9, 2013

The solution to Emerging Markets' predicament: a falling US Dollar

Commentary by Senior Market Strategist Robert Balan

«But because we in the United States finance our current account deficit by borrowing in our own currency, we can move to a more competitive dollar without the adverse effects that followed currency declines in other countries.»

Martin Feldstein

The EM situation will likely get more problematical in the short-term. The sharp fall in EM assets (equities, FX, bonds) came amid rising yields on U.S. Treasuries (and consequent large US Dollar appreciation), and as investors also assume that the Fed will initiate a tapering of the QE3's monthly purchases of government securities this month. Capital has been fleeing EM assets in some degree since January but the rout has accelerated after Mr. Ben Bernanke spoke of the Fed's plan to taper or moderate their monthly purchases of Treasuries and mortgage-backed securities.

The EM's predicament is, of course, more dire than the implications of the rise in US long yields and the US currency. The EM are collectively beset by high debt levels, financial system problems, current- and trade account deficits and structural deficiencies. Debt levels in emerging markets have risen significantly — credit growth has been especially strong in Asia. There has also been rapid growth in debt securities issued by emerging market borrowers, in both local and foreign currencies. More worryingly, consumer credit has grown strongly in many Asian countries and also in Latin America. This would have been not much of a problem by itself — what is alarming is the higher borrowing by lower-income households, which adds vulnerability when interest rates start to rise.

So the link of the EM's predicament to the Fed's rate policy is obvious -- the Fed, after all, sets the cadence for developed economies' monetary regimes — and by implication, the globe's. Any de facto tightening by the US central bank therefore impinges on the ability to service EM debt. This is also happening when the EM currencies are collapsing, which adds to the travails of servicing foreign-currency denominated debt. The weak local currencies also add impediments to domestic consumption, as imports of raw materials and finished goods become more expensive.

How will the Fed handle this situation? The US central bank actually can not do much (aside from stopping all this talk about tapering) — the Fed is constrained as they could not deviate from the policy that they have mapped for the short-rates. But the likely help that is forthcoming will be a forced decline of the US Dollar (which is overvalued anyway from many measures) by the US Treasury. It will not be spoken of as a USD devaluation, but there are a lot of methods to implement this intervention.

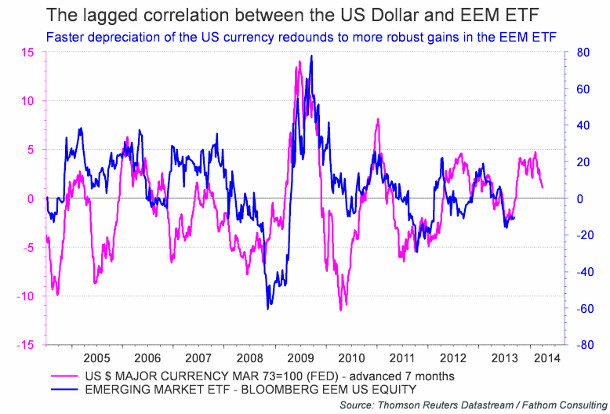

This currency-based solution is not far-fetched. One of the problems of the EM at this point is the rapid devaluation of their currency vs the US Dollar. A direct intervention to lower the value of the US currency will obviously quickly address this issue. The other benefit is the direct, but lagged, effect of the US currency levels to EM asset prices.

EM assets are not the only one which will benefit from a weaker US dollar. Indeed, the latter could add strong upside pressure to dollar-denominated commodities, amid improved fundamentals thanks to the improved economic condition in China (as suggested by the latest manufacturing PMI) and supply disruptions in the oil market and for some base metals.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Supply disruptions are the real culprit behind higher oil prices

Rising tensions in the Middle East helped the rise in Brent prices from $105 per barrel at the beginning of the August to around $115. However, actual supply disruptions were the main reasons behind this rise.

Indeed, the combined crude oil supply disruptions from Nigeria, Libya and Iraq reached around 1.8 million b/d in August 2013. International sanctions against Iran add about 1.0 million b/d of supply cuts (Iranian crude oil production fell from 3.7 million b/d in May 2011 to 2.7 million b/d in July 2013). The situation in Libya is particularly worrisome as crude oil production fell in August to around 250’000 b/d down, from 1.4 million b/d in April 2013, as the political situation is deteriorating. Indeed, while some ports on the eastern side of the country have reopened, an armed group forced the halt of a major pipeline on its western side, leading to lower crude oil exports.

In Nigeria, crude oil production remained around 1.9 million b/d, 400’000 b/d below the level reached in August 2012 due to technical issues and oil theft, which are damaging the oil infrastructure. The situation in Libya and in Nigeria (as well as in Iran) is unlikely to improve in the short run as the underlying factors which are affecting crude oil production are likely to persist.

Moreover, Iraqi crude oil exports, which rebounded in August and reached 2.6 million b/d (+255’000 b/d m/m and +14’000 b/d y/y), are expected to decline by around 250’000 b/d in September due to work at Basra’s oil port. This should lead to a significantly lower growth in exports than last year. Indeed, between January and August 2013, Iraqi crude oil exports were up in average by only 95’000 b/d y/y, compared to an increase of 255’000 b/d y/y in average in 2012. Supply disruptions from these countries are unlikely to improve in September and should hence continue to keep the global oil supply tight.

The tight light sweet crude oil market could lead to refinery closures

Important supply disruptions in Libya and in Nigeria have contributed to tighten the light sweet crude oil market significantly these past months. Indeed, the combined light sweet crude oil production from Nigeria and Libya accounts for about a quarter of global light sweet crude oil production. Moreover, the maintenance season at offshore oilfields in the North Sea and the seasonal peak in refining activity have contributed to a tighter crude oil market, especially for such quality. This light sweet crude oil supply crunch impacts mainly European refiners. Indeed, US refiners are awash with light sweet crude oil from tight oil formations, while most Asian refineries are designed to use mainly medium/heavy crude oil.

Thus, the light sweet crude oil premium has risen especially in the Mediterranean Sea, where refineries struggle to replace Libyan crude oil. Moreover, weak Nigerian crude oil exports have also mitigated the impact of the reduced US imports of light sweet crude oil (which came mainly from Nigeria). The light sweet crude oil market is especially important for Brent price as the latter is a light sweet crude. Moreover, the light sweet crude oil market is less flexible than the heavy crude market as the lion’s share of OPEC spare capacity is composed of heavy sour crude which cannot easily replace light sweet crude, especially for simple European refineries. Thus, supply disruptions of light sweet crude oil tend to have a more important impact on Brent prices than supply cuts of heavy sour crude oil.

While the light sweet crude oil premium could decline in the coming weeks due to the start of the refining maintenance season, the European downstream sector is likely to see another phase of consolidation such as the one we saw after 2008 and 2011, which were both characterised by a tight light sweet crude oil market. The closure of some European refineries should hence be expected by the end of the year and could have a positive impact on crack spreads. Indeed, following a phase of consolidation, crack spreads tend to increase as the oil market is adjusting to the new configuration of the refining market.

Zinc outperforms, standing out from aluminium and nickel

Zinc has been in surplus since 2007, and has therefore long been associated with nickel and aluminium as a fundamentally weak base metal. In May this year – when zinc prices strongly underperformed – we argued that this situation could reverse as zinc’s fundamentals were expected to tighten in the second half. It seems this view has started to materialise and has been somehow priced, as zinc has been one of the best performer in the past month and is now also the second best performer year-to-date, along with lead.

The demand side has been robust, as the two main zinc-using sectors (where most of the galvanised steel is used), the automotive and construction industries, have been strong in China, and, to a lesser extent, in the US. Therefore, the production of galvanised steel is up 12% since the start of the year in China, in line with the growth in the domestic car production.

The supply side is also expected to be supportive. Although China has increased its production of refined zinc in the first half of the year, it is likely that output will decelerate during the rest of the year. Firstly, Chinese smelters are still reporting extremely tight margins, as perfectly illustrated by the financial results of the country’s second-largest zinc smelter, Huludao Zinc, which reported its third consecutive year of losses in 2012. We expect that the current tight margins will force producers to reduce output. In addition, several regions in China and in Inner Mongolia are planning maintenance in the coming months. All this should slow down production in the near future, and the low output levels of 2012 should provide little buffer to consumers.

Another positive sign for zinc is the decrease in LME inventories. Although the absolute numbers remain at historically high levels, they have returned to normal levels in terms of days of consumption.

Egypt keeps rebuilding its wheat stocks

Egypt’s General Authority for Supply Commodities (GASC), continues to be closely monitored by commodity traders due to the importance of Egypt in the wheat market. Egypt was indeed the largest importer of wheat last year but was forced to scale down imports in the first half of the year due to political instability and the lack of foreign currency. Between February and June, Egypt had halted its purchases of wheat, its longest nonappearance in the market in years. Therefore, in early July, Egypt had less than two months' supply of imported wheat left in its stocks, which represented only 500,000 metric tonnes, while the country fell into chaos for several days after the military coup.

As the political stability as gradually returned and because the military regime wanted to reduce social unrest, the GASC started to purchase wheat as the need for imported wheat are extremely important. According to the U.S. Department of Agriculture, Egypt has to buy 9 million metric tonnes of wheat on the international market for the season 2013-14, making it the world’s second largest importer after China. In July, the GASC bought more than one million metric tonnes of wheat via five tenders. Moreover, last week, it bought 890,000 metric tonnes of wheat, via four tenders. In total, this represents nearly 2 million metric tonnes or more than 20% of its importation needs. Each time, the origin selected was from Eastern Europe. 41% have been bought from Romania, 31% from Ukraine and only 28% from Russia, which used to be the main counterparty.

For these purchases, Egypt has to pay nearly USD 500 million. Fortunately, the United Arab Emirates, Saudi Arabia and Kuwait have promised USD 12 billion in cash, loans and fuel in order to help the country to fulfil its financial obligations.

Chart of the week: Emerging markets driven by the US Dollar

|

In the chart below, we show that the US Dollar exerts a tremendous influence of EM asset prices. Although, the die has been cast for an MSCI Emerging Markets ETF (EEM ETF) appreciation over the next months due to previous slowdown in the US currency's rate of ascent, a forceful push-down in the greenback's value, will impart a robust push-up on EM assets (the EEM EFT as a proxy). |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com