September 2, 2013

Collapsing correlations: everything now relates to risk-on

Commentary by Senior Market Strategist Robert Balan

« Each market is behaving logically based on its own determinants, and as the nature of those determinants changes, what we call correlation changes”»

Ray Dalio

The recent sell-off in equity markets and the debacle in emerging markets financial asset prices have not been replicated in commodities. A positive development for a change, commodity prices have been very stable in the current market environment where sentiment is being dominated by expectations regarding the start of QE tapering and negative news flow from emerging markets. Moreover, the Syrian issue has undercut equities to the tune of almost 3% so far, but has driven the prices of crude oil and products higher; and many commodities came along for the ride. Not only have commodities been stable, they are actually among the strongest performing assets this quarter, with average gains of about 6%, contrasting with losses in equity markets of 2-3%. This contrasts with these past years when correlation between commodity prices and equities was high.

While it may be premature to say that the long period of positive commodity correlations with equities is now over, the latest move is part of a consistent trend of diminishing positive correlations in place since late last year, suggesting that commodities can still provide investors with diversification. It does not also hurt that for the time being, commodities are also a source of precious beta, when equities and bonds are underperforming. We believe that with activity having stabilized in China, stronger beta and diversification benefits will continue to underpin commodities for the rest of the year, perhaps even into Q1 2014.

Previously, commodities were perceived as a derivative of risk-on, risk-off sentiment through much of 2011 and all of 2012. But commodity markets have been less shackled by macro drivers this year. While economic data, liquidity and monetary policy continue to influence commodity prices, those factors have ceased to be the dominant driver, which is in stark contrast to the way commodities traded hewing the line of the European debt crisis (which in retrospect, does not make sense).

It is not only commodities breaking off from old, well-established relationships. The lock-step relationships that developed over a period of years are beginning to weaken or reverse. In June, global stocks and bonds deviated from their typical inverse dance and sold-off together, causing outsized losses to many investors—a similar situation may be unfolding again this month. Moreover, the U.S. dollar and Treasuries have decoupled since May, ending their "risk-on" relationship, while the Japanese Yen has lost its strong correlation to other developed currencies and equities; emerging market equities, which were trending with U.S. equities, have experienced a massive divergence this year. Finally, copper's correlation to equities has fallen substantially over the past year.

It is clear that the vanishing correlations is actually a product of a new correlation with “risk on” — everything now seems just simply relates to risk-on. This shift in turn can be traced to an adjustment of expectations regarding certain “truisms” in recent quarters that are now subject to revaluation, such as the Chinese hard landing, US growth and unemployment. The primary beneficiaries of the recent flux in correlations are the commodity sectors. Commodity price performance is now better, and while large investors’ sentiment towards commodities remains weak, commodities will likely play a similar outperforming role as that seen in H2 2010 and H1 2011.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Brent backwardation could narrow in September

The recent outperformance of Brent prices was characterized by the sharp steepening of the Brent’s forward curve. The front month contracts started to outperform significantly more distant maturities since mid-August. The triggers of the Brent’s wider backwardation were the supply disruptions in Libya and in Nigeria, exceptionally low Russian crude oil exports and maintenance work at offshore platforms in the North Sea. These factors tightened significantly oil supply for European refiners amid strong global refining activity. The latter tends to peak in July-August due to the strong seasonal petroleum products demand during the summer. Lower Iraqi crude oil exports through the Kirkuk-Ceyhan pipeline and growing political instability in Egypt also increased concerns about crude oil supply in the Mediterranean area.

The latest upside move of the Brent’s backwardation was caused by the increasing likelihood of an US military intervention in Syria. Moreover, the outperformance occurred on the front month as the oil market is seasonally tighter during the summer. Thus, the rise in backwardation is a combination of stronger geopolitical risks and a tighter supply/demand balance. While Brent’s backwardation could remain at a high level in the coming two weeks, it should start to gradually weaken by mid-September as unseasonal supportive factors would be mitigated by seasonal factors, with downside impact on prices.

On the other hand, the WTI backwardation has fallen by a large amount since the beginning of August, after having reached unsustainably high levels. The narrower Brent-WTI spread has reduced incentives to move crude oil out of the Midwest and has, on the other hand, encouraged crude oil to be shipped to the Midwest, decreased refining margins and pushed for further drilling activity. This increased expectations of stronger supply and lower demand in the Midwest, adding downside pressure on WTI’s backwardation.

Syrian tensions push oil prices higher

Uncertainty. This word is enough to summarize the impact of a foreign military intervention against Syria. Indeed, the alleged chemical attacks last week may trigger a western military intervention in Syria, which could destabilize the already fragile region. Indeed, while Syria is not itself an important oil producer, it is located near important ones. A Western attack on Syria would hence trigger an important rise in geopolitical risks in the region.

Indeed, the conflict could easily spill over to neighbouring countries as Western countries’ allies such as Turkey, Israel and Gulf countries could become the target of Syria and its allies. This was reflected in the sharp drop of regional stock markets on Tuesday. The reaction of Iran and Russia over a foreign military intervention in Syria is also a major concern for the oil market. Indeed, the Middle East remains a key region in the oil market, accounting for 46% of global crude oil trade. Thus, any increase in geopolitical uncertainty in the region tends to generate upside pressure on oil prices. Moreover, if an attack on Syria would occur in the coming days, this would have a more important impact than it would during the spring or in autumn due to the tight seasonal oil demand/supply balance during the summer.

Finally, the decline in Saudi spare producing capacity to 2.4 million b/d in July 2013, the lowest level since November 2012, also implies that price volatility will be higher than in the previous months, as it makes the oil market less flexible to respond to supply disruptions.

However, the premium on oil prices is not likely to last for more than a couple of weeks as high oil prices would in turn have a negative impact on oil demand in the medium term, especially in OECD countries which do not subsidies prices on petroleum products and as a temporary supply disruption in the Middle East would be followed by a release of strategic petroleum reserves.

Sentiment continues to improve over precious metals

Precious metals have strongly rallied in the past weeks: since early July, gold soared 13%, silver 26%, platinum 9% and platinum 11%. This rally was caused by several factors, including a weaker dollar, renewed inflation expectations and the fact that investors seem to have overcome their fear of the QE tapering. In addition, the recent escalation of tensions in Syria has also somehow supported precious metals prices, although to a lesser extent, reaffirming precious metals’ safe haven status.

The latest market indicators confirm the gradual — but firm — improvement in the market sentiment over gold and in investment demand. Non-commercial positions on the Comex have improved a lot in the past weeks; a clear signal that investors’ appetite has revived. In fact, net speculative long positions on futures and options are back to their highest level since the end of April as for gold; since March as for Platinum and Palladium; and since February as for Silver.

In addition — and perhaps an even more meaningful indicator — total holdings at the world’s gold ETFs have risen last week, for the first time since the mid-April sell-off that saw gold suffering its strongest percentage fall in 30 years in a single day. Gold ETF holdings are now back to their early-August levels. Also, silver ETF holdings were even more impressive, hitting a record high last week, and rising 2.3% since the beginning of August.

PGMs have also performed very well recently, but drivers are probably quite different from gold’s and silver’s. Prices rose amid renewed concerns about possible supply issues as mining wage quarrels have begun in South Africa, which also prompted an even-stronger interest from investors.

A decline in corn and soybean crop quality

For the last two weeks, corn and soybean crop quality has declined sharply. Indeed according to the last USDA Crop Progress report, only 59% of corn is rated “good” or “excellent”, which is 5 percentage points less than 15 days ago. For soybean, the drop is larger with only 58% in “good” or “excellent” condition, down from 64% two weeks earlier. The fall, which generally occurs during summer, was stronger than expected. During August, dry and warm conditions in central and western Midwest have stressed corn and soybean crops.

For that reason, forecasts made last week by Pro Farmer during their annual crop tour was largely below USDA estimates. Pro Farmer projected a U.S. 2013 corn production at 13.46 billion bushels, based on a yield of 154.1 bushels per acre versus a USDA production estimate of 13.76 billion bushels and a yield of 154.4 bushels per acre. On soybeans, Pro Farmer forecast U.S. production at 3.158 billion bushels, with an average yield of 41.8 bushels per acre versus USDA production estimate of 3.255 billion bushels with a yield of 42.6 bushel per acre.

According to MDA Weather Services, dry weather and very warm temperatures this week will maintain moisture stress. That could prove particularly deleterious to soybean, which is more sensitive to weather at this time of year, during the pod-setting and pod-filling periods. Therefore, soybean and corn prices have increased recently by 20% and 12%, respectively.

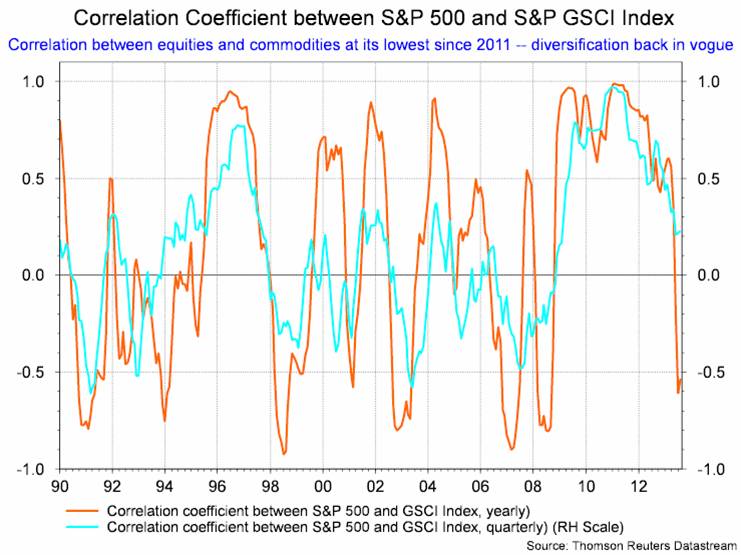

Chart of the week: Equity-Commodity correlation drops to 5-year low

|

The positive correlation between commodities and equities has continued to trend lower and has recently fallen into negative territory. While it may be premature to say that the long period of positive commodity correlations with equities is now over, the latest move is part of a consistent trend of diminishing positive correlations in place since late last year, suggesting that commodities can still provide investors with diversification. It does not hurt either that for the time being, commodities are also a source of precious beta, when equities and bonds are underperforming. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com