August 19, 2013

Is there a precious metals revival?

Commentary by Senior Market Strategist Robert Balan

« Over the long run, the price of gold approximates the total amount of money in circulation divided by the size of the gold stock. If the market price of gold moves a long way from this level, it may indicate a buying or selling opportunity.»

Ray Dalio

Gold normalizes its correlation with fundamental drivers, inflation expectations

As financial markets come to terms with the possibility that the Fed will probably begin the process of monetary normalization with a tapering of the asset-purchase program in September, investors seem to have overcome their fear of the taper worm. For instance, US equity market volatility and European volatility have fallen since the end of June. At odds with their usual safe haven characteristic, gold and precious metals are rising again together with the gradual improvement in market sentiment and strong performance of risk (in particular, equities) during the quarter to date. These recoveries, so far, are small by comparison with the preceding price declines, but they are large enough to put these assets near the top of the quarter-to-date performance tables. So what's going on? What has triggered the precious metal outperformance?

We can see a few reasons which will account for it. A weaker dollar has likely contributed to the recovery of precious metal prices, but the greenback has declined only modestly so far, and the fall probably is not enough to explain all the surge in gold and silver prices. One explanation is that asset prices are normalizing their correlations with inherent, fundamental drivers, and this is happening for both gold and US dollar valuations. It was clear that Gold (and arguably, the US Dollar as well) had overshot its fair valuation in recent months relative to its fundamental drivers, and so the process of adjustment is now taking place.

Perhaps another plausible explanation of sorts may lie in a more realistic appraisal of the risk of higher inflation and inflation expectations. Indeed, after the Fed suggested the tapering in late May 2013, inflation expectations (counter-intuitively) started to rise, closely followed by an appreciation in gold prices. Stronger growth in the US also contributed to reduce disinflation’s concerns. In fact, we are seeing a classic relationship between gold and inflation expectations. If this assessment is correct, it suggests that the current rebound in gold and silver prices could be significant but may not continue further without another catalyst.

Although we expect core inflation to creep up in the few months to come (perhaps until year-end) — supporting inflation expectations at historically normal levels relative to the very weak levels of June — there is little in our forecast of US growth or of the world economic environment to push long-term inflation expectations above historical norms in the immediate future. We may have to wait for late-2015 before we can obtain those ideal conditions for further gold outperformance.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Iraqi crude oil exports should decline further

Iraqi crude oil exports continued to disappoint in July as they stood at only 2.3 million b/d, close to the previous month level and down 200’000 b/d y/y. Since April 2013, Iraqi crude oil exports are down by 300’000 b/d, due to several attacks against the Kirkuk-Ceyhan pipeline in the northern part of the country. In the first seven months of this year, Iraq exported 29% less crude oil from Kirkuk than scheduled in shipping plans. Moreover, bad weather and technical issues affected crude oil exports from the southern oil terminal of Basra. Recent attacks against the northern pipeline should keep Kirkuk crude oil exports at a low level in the coming weeks. Lower Iraqi crude oil exports usually lead to a halt of crude oil output of about the same amount due to the lack of storage capacity.

These issues have prompted the government to invest in infrastructure. The government is planning to build a third offshore terminal and perform maintenance work on existing infrastructure. Works at the Basra oil terminal in September are expected to lead to a drop of 500’000 b/d in Iraqi crude oil exports during the month. Even with a rebound in crude oil exports thereafter, these works could lead to a full year decline in Iraqi crude oil exports by around 70’000 b/d. This would mark a pause of the rapid growth in Iraqi crude oil exports, which rose by about 260’000 b/d y/y in 2011 and in 2012.

The decline in Iraqi crude oil exports this year would be another major setback for OPEC, which saw crude oil production fell in Iran due to international sanctions, in Nigeria due to oil theft and in Libya due to protest, and forced Saudi Arabia, OPEC’s largest oil producer and the only holder of large spare producing capacity, to boost output to offset the decline in the rest of the cartel. According to the IEA, Saudi Arabia produced 9.8 million b/d of crude oil in July, up 150’000 b/d from June and the highest level since October 2012, thus reducing its spare capacity.

Stronger OECD oil demand is offsetting weaker demand in non-OECD countries

Supply concerns are not the only drivers of oil prices. The strength in oil demand is also adding upside pressure on oil prices, despite being underestimated by some agencies. Last week, the International Energy Agency (IEA) lowered its estimates for global oil demand growth in 2013 and 2014, due to the lower GDP growth forecasted by the IMF. Global oil demand growth was cut by 30’000 b/d for 2013 and by 100’000 b/d for 2014.

However, the IEA may underestimate the improvement in the economic activity in OECD countries as suggested by the latest manufacturing surveys. European economies appear in a better shape, while oil demand is rebounding in the US. We expect OECD oil demand to decline by around 300’000 b/d y/y this year, significantly below last year’s decline of about 600’000 b/d. OECD Europe is expected to see the largest decline with a loss of about 300’000 b/d y/y in 2013 (it averaged around -340’000 b/d y/y between January and May 2013 and is improving), lower than the drop of 600’000 b/d y/y in 2012. This is due to improved economic conditions, confirmed by recent GDP data for Germany and France. Japanese oil demand should decline by around 100’000 b/d y/y as growth-oriented policy is being mitigated by lower oil use by the power sector due to the restart of nuclear power plants, expected in the coming months.

On the other hand, US oil demand is expected to grow this year for the first time since 2010, when oil demand increased by around 500’000 b/d y/y. Indeed, US oil demand grew by 120’000 b/d y/y in the first half of 2013 and should increase by around the same amount in the second half. However, the IEA expects US oil demand to grow by around 60’000 b/d y/y, half of the growth recorded in the first half of 2013. The IEA is hence likely to revise higher OECD oil demand growth for 2013 and especially US growth, which is largely underestimated.

Copper supply concerns continue to add up

Copper prices have enjoyed a strong rally in the past weeks, along with all other base metals, after China released supportive trade figures earlier this month. The supply-side of the global copper market has also been supportive in the past weeks, as supply threats and concerns have continued to pile up, paving the way for a tight market for the coming months. The past weeks have not witnessed actual heavy supply disruptions such as the ones that occurred during the spring of this year (the massive landslide at Bingham Canyon in the US and the tunnel collapse that killed 28 workers at Grasberg in Indonesia) but several threats to global supply, especially in Chile, have emerged. Firstly, Chile’s presidential frontrunner Michelle Bachelet, announced she would review the country’s mining code to eventually raise royalties if she were to be elected. This would add further pressure to the soaring production costs in the country, which have soared by 40 to 50% on average last year.

Secondly, Codelco, Chile’s state-owned producing company, and the world’s top copper producer, has been running out of cash for its operations and investments, as the government promised less capital than expected. Despite a bond-issue and the plan to secure financing from banks, the company announced it was short of $1.8bn; an issue that could delay several investment projects. Thirdly, workers at Escondida, the world’s largest copper mine, went on a 24-hour long surprise-strike on August 14, 2013. Although this strike was of short duration and is not expected to strongly affect the mine’s production, this was clearly the sign that labour relationships are getting increasingly tense as labour contracts are being renegotiated.

In other parts of the globe, supply threats have also arisen: Freeport McMoran announced it would have to cut production from next year at the world’s second largest copper mine, Grasberg in Indonesia, if the government does not alter its plan to restrict exports of minerals and metals that do not reach a certain purity grade (99% in the case of copper). On top of all these, the decision of Rio Tinto to cut 1,700 jobs in Mongolia after a dispute with the government, which halted the expansion of Oyu Tolgoi, reveals how tense the relationships between the company and the government are, regarding the mine that is set to become one of the world’s largest source of copper.

All these come in addition to the shortage in scrap supply, which is expected to decrease by 10 to 20% this year – or 350,000 to 700,000 tonnes. The global copper market is expected to remain tight, especially given the revival of Chinese imports; and production this year will probably fall below beginning-of-year expectations.

China is set to become the world’s largest wheat importer this year

According to the last World Agricultural Supply and Demand Estimates report, China will become the largest wheat importer this year. Indeed, last week, the U.S. Department of Agriculture (USDA) revised higher its Chinese imports estimate by 1 million metric tonnes (Mt) for the season 2013-14. If forecasts are realised, China will need to buy 9.5 Mt on the international market to meet its domestic demand.

In the last two month, the USDA has increased Chinese consumption by 5.5 Mt to reach a record of 126.5 Mt. Therefore, with a production unchanged at 121 Mt, imports estimate has jumped from 3.5 Mt in June to 9.5 Mt in August. Since the beginning of the season, China has already purchased more than 3 Mt from the US and has also bought wheat from France and Australia. Egypt, who used to be the largest buyer is relegated to the second rank with 9 Mt.

Moreover, a few analysts expect China’s wheat harvest to fall this year. Industry sources suggest that there are quantity and quality issues with the 2013-14 Chinese wheat crop due to wet conditions during the early part of the harvest. The US Department of Agriculture's Beijing bureau is only forecasting a 118 Mt harvest, which is 3 Mt below the official forecast. Therefore, there is still a chance to see China’s wheat imports revised higher again.

China is hence turning into a more important player in the international grains market. China is already the world’s top importer of base metals and is about to become the largest importer of crude oil. Within the grains market, China is already the biggest buyer of internationally traded soybean and is one of the most important importer of corn. By becoming the top wheat importer, China’s influence on commodity markets is increasing further.

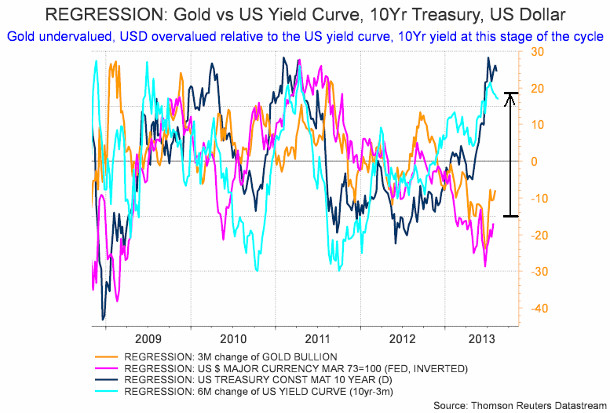

Chart of the week: Gold is undervalued relative to long bond yields and the yield curve

|

The recent weakness in the US Dollar contributed to the recovery in gold and silver prices. However, this was not sufficient to account for the sharp uptake in precious metals so far. What we are seeing is a reconnection of these assets with fundamental drivers. Indeed, a rise in long bonds yields and a steeper yield curve typically add upside pressure on gold prices, through a weaker US Dollar and higher inflation expectations. After overshooting until late May 2013 due the sharp drop in inflation expectations, gold prices are hence now catching up with these factors. The chart below shows that despite the recent rally, gold prices remain severely undervalued (and the US Dollar extremely overvalued) relative to the position of the yield curve and the long bond yield at this stage of the financial cycle. Gold prices could therefore move towards $1500 - $1550 in the coming weeks.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com