August 12, 2013

Labor force participation revival may scupper a September taper

Commentary by Senior Market Strategist Robert Balan

« Our plans depend on the economic scenario and how it evolves. […] If things are worse, we will do more. If things are better, we will do less.»

Ben Bernanke, at the June 19 2013 Press Conference

The markets could be surprised by a rise in the unemployment rate before year-end

Many economists say that it takes roughly 90,000 - 100,000 jobs a month to keep pace with the underlying growth rate of the labor force – although this number is subject to debate. This means that less rapid job growth would lead to increases in the unemployment rate if more people enter the work force, and vice versa. Add to that the historical observation that it is easier for people to come back or enter the labor force than it is to create jobs – and we might have a situation at hand where the unemployment rate and/or the payroll data reverse their recent trends.

Why is there a new pre-occupation with jobs and the labor force participation? It has something to do with the Fed's intention to taper the amount of monthly QE3 securities purchases. Many economists say the Fed is likely to taper in September; and just as many point to December or early 2014 as the likely calendar event. Our take on the issue is very different from either camp – we believe that the Fed may not taper at all, or if they do taper early (as in September 2013), they may want to subsequently paper over the taper and resume QE3 with even more vigor.

Why so? It may be that the Labor Force Participation Rate (LFPR) will bottom soon and the nominal rate actually increases before the year is over. The LFPR rate of change has turned upwards, and the nominal rate is slowly stabilizing. When this LFPR rate of change rises, depending on the monthly job creation rate, the unemployment rate may actually back up – and as we have noted in the initial paragraphs, the near-term trajectory of the unemployment rate depends critically on what happens to the participation rate.

The impact of the LFPR is not confined to the Unemployment Rate – it also exerts indirect first-principle effects on economic growth and, more directly, on the nonfarm payrolls (NFP) data. Removing the effect of the business cycle on the nonfarm payrolls, we derived an analysis of the NFP vis-à-vis GDP and LFPR. We reached the same conclusions – nonfarm payrolls may be heading lower soon, likely well before the year is over. If this happens, then it may deter the Fed from a tapering process; and if they have already decided to implement the process by the time the unemployment and/or the payroll data reverse direction, then they may have to resume the QE purchases at the same, or even enhanced, pace.

There are many drivers of the LFPR changes but apparently, it depends a lot on the labor market attachment of those that are currently out of the labor force. Using monthly data from the Current Population Survey (CPS) that are matched year over year, Melinda Pitts, from the Atlanta Fed, sees that the marginally attached workers do transition back into the labor force at twice the rate of all individuals who are not in the labor force. These rates are relatively stable over time. She concluded that these trends suggest that we could expect to see higher rates of return to the labor force going forward (and thereby, potentially higher unemployment rate), and forestalling this potential development will likely require a much better showing of jobs numbers than we have seen in the past few months. This is the crux of the problem.

If the recent favourable labor trends do reverse their course as we expect, the most negative impact will fall upon the equity markets. Labor and employment issues have far more significance to the stock markets, and we believe a significant rise in the unemployment rate or fall in the nonfarm payroll will severely depress equity prices. Commodity prices, on the other hand (especially energy and industrial materials), are more exposed to the Chinese growth story and to the macro developments in the developed economies. A rise in the unemployment rate will likely trigger a resumption of the commodity outperformance over equities – a development that was seen in Q2 2013, but temporarily stalled in early Q3. Any commodity performance, and outperformance over equities, originating from a deteriorating US jobs/employment environment – and from an improvement in the Chinese economy – will likely be sustained until year-end or even until Q1 2014.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

US biofuel mandates continue to drive gasoline crack spreads

Volatility in the gasoline market increased after changes to the US biofuel mandate were announced on Tuesday. Gasoline prices had recently outperformed the oil sector due to higher costs for refiners to meet the 2007 Renewable Fuel Standard mandate. Indeed, they need to blend an increasing amount of ethanol or to buy Renewable Identification Numbers (RIN) credits in order to meet the biofuel quotas. However, the decline in gasoline demand these past few years and the limited amount of ethanol which can be blended into gasoline (10%) forced refiners to purchase RIN credits in lieu of using ethanol, pushing RIN credit prices from $0.1 per gallon to $1.4 by mid-July. Growing political pressure to modify the biofuel quotas then triggered a correction in RIN credit prices.

On Tuesday, the US government announced that the amount of renewable fuel required to be use in 2014 (initially 18.15 billion gallons up from 16.55 gallons in 2013) will be revised lower. Moreover, refiners will have an additional four months to meet their 2013 biofuel quota (up to June 30, 2014). The announcement triggered a sharp decline in gasoline prices. Distillate prices also declined as biofuel is also used in diesel albeit on a significantly lower scale.

Gasoline crack spreads, which were inflated by the RIN credit prices and reached $20 per barrel in mid-July, could decline further. Nonetheless, the stronger than expected US driving season might prevent a sharp drop in gasoline crack spreads. They are likely to decline from about $15 per barrel currently to around $10 by the end of August. Volatility on gasoline prices could come back in September when details of the Environmental Protection Agency’s proposed 2014 quotas will be announced.

The tightness in the oil market is likely to persist in August

Brent prices rose from around $101 at the end of June to close to $110 per barrel in early August, making oil one of the best performer among commodities during this period. As previously discussed, a combination of seasonal tightness in demand and unexpected supply disruptions contributed to add upside pressure on prices.

Indeed, the summer driving season is pushing oil demand for transportation higher. The power sector is also contributing to stronger oil demand during the summer, when power usage seasonally peaks due to the lack of alternative in the Middle East and other Asian countries. These seasonal demand factors are stronger than usual due to the better than expected demand in the US and in Europe and warm temperatures in eastern Asia.

On the supply side, crude oil production in the North Sea tends to decline during the summer maintenance season at offshore oilfields, while Russian crude oil exports are falling due to stronger refining activity. They reached 4.5 million b/d in July, down 600’000 b/d from April level. Stronger domestic and foreign demand also forces Saudi Arabia to increase its production, thus reducing its spare capacity. Moreover, unexpected supply disruptions in Africa and the Middle East more than offset the growth in North American oil production. In July, the most important supply disruptions occurred in Libya where crude oil exports fell to 300’000 b/d two weeks ago from around 1.2 million b/d, due to protests at oil exports terminals. This was the largest disruptions in Libyan oil exports since the civil war. In Iraq, crude oil exports reached 2.3 million b/d in July, flat m/m and down 200’000 b/d y/y, due to ongoing attacks against the Kirkuk-Ceyhan pipeline.

While crude oil production could rebound fairly rapidly in Libya, downside risk on global crude oil production ex-North America remains elevated. Additionally, stronger than normal seasonal factors should also contribute to a tight oil market in August.

Restricting US banks from managing physical commodities should not solve the metals warehouses issue

In last week’s Commodities Insight Weekly newsletter, we argued that the proposed changes to the LME warehousing rules should only moderately impact the metals storing system. At the same time the LME is trying to address this problem of metals availability to consumers, the Federal Reserve and the US Senate have both expressed reserves regarding the authorisation for US banks to trade and store physical commodities.

Metal consumers have taken the lead in the complaints to the Senate, especially in a hearing on July 23rd, 2013, arguing that most of the warehouses concerned by the cash and carry deals were subsidiaries of large US banks, notably Goldman Sachs and JP Morgan.

We believe that such restrictions on US Banks’ ability to trade physical commodities, if they were to be implemented, should not help solving the issues of metals’ tight availability. On the contrary, this will likely shift the business to global physical trading companies such as Glencore, Trafigura, etc (which are already fully involved in the warehousing business and in the cash and carry trades) and to non-US banks. Last week already, an article from the Financial Times stated that Cargill was interested in expanding its energy business, as a result of the US banks’ disposal of commodity desks. Considering that the physical trading and storing of commodities remains a lucrative business, we do not expect that the storing system will return to what it was in the 1990’s, i.e. a number of small independent operators. Another risk here is that prohibiting or restricting US banks from dealing with physical commodities could increase the opacity of the storing system, as it would go under the radar of US regulators.

Pressure on wheat rises as Egypt is rebuilding its stocks

Early July, Egypt had less than two months' supply of imported wheat left in its stocks, according to Bassem Ouda, the former President Mursi's minister of supplies. This represented only 500,000 metric tonnes of imported wheat. Two and a half years of political turmoil have caused a deep economic crisis in Egypt, draining foreign currency reserves and making it difficult to maintain imports of food and fuel. According to the U.S. Department of Agriculture, Egypt has to buy 9 million metric tonnes of wheat on the international market for the season 2013-14, making it the world’s largest importer.

However, since February, Egypt had halted its purchases of wheat, its longest absence from the market in years, until the eve of Mursi's overthrow, when the state grain buying agency, the General Authority for Supply Commodities (GASC), bought wheat under Ouda's instruction. Since then, Egypt bought more than one million metric tonnes of wheat via five tender, representing 12% of its importation needs. Each time, the origin selected was from Eastern Europe. Half have been bought from Romania, 35% from Ukraine and 15% from Russia.

Limitations on crop storage, logistical issues and a history of grain export controls in the former Soviet Union, typically encourage the region to fight hard for trade early in the marketing year. Moreover, all these countries have the advantage to be located on the Black Sea, limiting therefore the cost of shipping. In average, wheat was bought at USD 263.9 per metric tonne representing a cost of USD 285 million. Since Mursi was toppled, the United Arab Emirates, Saudi Arabia and Kuwait have promised $12 billion in cash, loans and fuel in order to help the country to fulfil its financial obligations. With these promises and high political instability, the new government is hence likely to purchase more wheat. The government indeed wants to avoid wheat shortages, which could lead to more social unrest. Those purchases will add upside pressure on wheat prices.

Chart of the week: Egypt’s political instability adds upside pressure on oil prices;

|

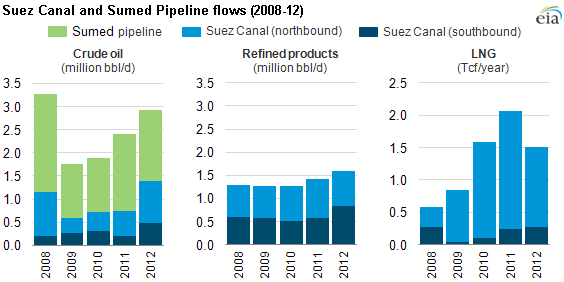

The growing political instability in Egypt has contributed to higher oil prices in June and early July and remains an important factor in the oil market. Indeed, Egypt controls the Suez Canal and the SUMED pipeline which are important transit points between the Middle East and Europe. In 2012, about 3 million b/d of crude oil transited through Egypt, accounting for 7% of total seaborne traded oil. The increase in oil flows in 2012 was caused by the return of the Libyan crude oil on international oil markets. Moreover, in 2012, 13% of LNG traded worldwide transited through the Suez Canal (it was 18% in 2011). LNG flows through the Suez Canal fell in 2012 due to lower Qatari LNG exports to the US and Europe and reduced LNG exports from Yemen due to attacks on the oil and gas infrastructure. The halt of these two transit points would have a larger impact than in previous years on the European oil market due to the growing dependence of European refiners to extra-European crude oil supply. This is due to declining oil production in the North Sea, lower Russian crude oil exports to Europe – as they are being redirected to Asia – and Libyan crude oil exports which remain volatile. The closure of transit points in Egypt would force oil tankers to navigate around Africa, increasing both costs and shipping time. This would add 15 days of transit to Europe and 8-10 days to the US. Moreover, the halt of the Suez Canal and SUMED pipeline would also have a significant impact on oil prices if it occurred during the summer when the oil market is seasonally tight. A deterioration of the already unstable political situation could hence push oil prices higher. |

|

Source: EIA |

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com