August 5, 2013

Diverging PMIs affect the relative performance of commodity sectors

Commentary by Senior Market Strategist Robert Balan

« The wise man is he who knows the relative value of things.»

William Inge

Global manufacturing confidence series posted a third consecutive increase in July, as global manufacturing confidence improved on stronger US and surprise manufacturing lift in China -- Japan fell, however. The improvement came on account of stronger-than expected US manufacturing ISM, as well as another improvement in the euro area and UK manufacturing confidence. In Japan, manufacturing confidence slipped in July, following six straight months of gains.

The official Chinese manufacturing confidence improved slightly — another positive surprise. However, the Chinese HSBC-Markit PMI, which follows more closely small companies than the official Chinese PMI, fell to the lowest level since August 2012. The important divergence between these two PMIs was due to the June 2013 liquidity crunch (“Shibor shock”), which particularly affected small and medium Chinese companies, while large and state-owned companies were broadly unaffected. Elsewhere, emerging markets continue to show weakness: July manufacturing PMIs fell in Brazil, Mexico, Russia, Turkey, India, Indonesia, Korea and Taiwan. We therefore continue to highlight risks to global growth from weaker EM growth, while advanced countries show encouraging signs of gradual expansion in activity that so far seems able to continue driving global GDP.

The divergence in manufacturing data have important implications for commodity demand, and consequently on commodity sector relative price gains. In 2012, OECD countries accounted for about 44% of global energy consumption and for slightly more than 50% of global oil consumption. While its share of global energy and oil demand is declining, these countries still have an important impact on the energy market. On the other hand, the economic activity in OECD countries have a lower impact on metals prices due to their lower share in metals usage. Demand for base metals is indeed driven by emerging economies and especially China, which accounted in 2012 for 44% of world refined metals demand, according to the World Bank (up from 42% in 2011).

We are seeing the divergence of PMIs between developed and emerging countries play out in the commodity markets, as crude oil and its derivative products outperform base metals (and all other commodity sectors for that matter) in the past few weeks. With a recovery in sight in the eurozone, an acceleration of the US growth and with Japan set to grow further on prospective fiscal innovations, energy prices will likely continue to outpace other commodity sectors in the near-term. On the contrary, base metals would require a rebound in the Chinese economic activity. The implementation of the recently announced “mini-stimulus” should help small and medium Chinese companies and mitigate the impact of the liquidity crunch. This could have a positive impact on base metals demand especially after the end of the summer when the economic activity tends to increase seasonally. The energy sector could hence outperform the base metals sector in the short run. The latter could then take the lead at the end of the summer when energy demand seasonally weakens and stronger Chinese economic activity boost metals demand.

The strong US manufacturing PMI also contributed to the underperformance of the precious metals sector, driven by weaker investment demand for gold. Stronger positive expectations on the US dollar indeed reduced incentives to hold gold. Nonetheless, these expectations are likely to be proven wrong as central banks and especially the Fed are likely to keep a dovish stand. Thus, while the precious metals sector could underperform the energy and base metals sector in the near term, clearer indications by the Fed on the fact that tapering will not occur in September, should give a boost to gold prices and contribute to a stronger absolute performance of the precious metals sector.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

US natural gas prices suffered from weak fundamentals

Last week, US natural gas prices fell below $3.4 per million Btu for the first time since February 2013. They are now down by about $1.0 per million Btu from April’s high. Mild temperatures expected for the Midwest and the US East Coast triggered the price decline as it reduced expectations of the use of air conditioning and therefore power consumption. The latter is indeed, the most important driver of natural gas demand during the summer as it accounts for about 50% during the summer, while it accounts for less than 25% during the winter.

However, milder temperatures were only the trigger for the recent price fall. Fundamentals for US natural gas remained weak. Indeed, demand from the power sector declined these past months. But it was not the temperatures, which caused this weakness. According to Bentek Energy, US natural gas demand was down last week by 5.4% y/y, driven by weak demand from the power sector (-12.2% y/y).

The latter was caused by gas-to-coal switching as low coal prices relative to natural gas encouraged power plants to switch back to coal, contrasting with last year when natural gas prices fell below coal prices and encouraged natural gas use by the power sector at the expense of coal. The spread between natural gas and coal prices need to narrow to see a rebound in demand for natural gas from the power sector.

Moreover, US dry natural gas production continues to grow. According to Bentek Energy, last week it was up by 3.1% y/y. The development of the Eagle Ford Shale and the Marcellus Shale in Pennsylvania contributed to stronger supply.

The growth in natural gas production in these two areas more than offset the decline in other places and is likely to persist. Producers in the Marcellus shale are close to consumers on the East Coast and benefit from high prices, while associated natural gas production in the Eagle Ford Shale will continue to grow as high oil prices encourage drilling activity.

Proposed changes to LME warehousing rules to moderately impact the metals storing system

The past weeks have witnessed a flurry of regulatory debates and political movements regarding the efficiency of the physical commodity markets and, more specifically, the issue of metals warehousing and the involvement of banks in the physical trading and storing of commodities.

The debate became vivid last year as aluminium consumers became vocal, complaining about the 9 month-queues required to get delivery of aluminium in Detroit, US, and Vlissingen, Netherlands after traders had stored significant volumes of the grey metal for financial deals, making aluminium unavailable to real consumers and pushing premiums upwards. The situation has remained unchanged since then. Traders have indeed widely used the cash and carry arbitrage on the aluminium market, benefitting from the contango on the forward curve. The process is to simultaneously buy the metal on the spot market and to sell a future contract at a higher price (contango), taking the spread between the two contracts as a profit. Following aluminium, similar deal structures have been formed on the zinc and then copper market, creating subsequently months-long queues as well.

Addressing these issues, the LME – which has therefore been accused of failing to its role of market “of last resort” – published proposed changes to the operating of warehousing on July 1st, 2013, with a 3-month consultation period up to September, 30. In particular, the LME suggested that a warehouse operator, in a location having a load-out queue exceeding 100 calendar days, would be required to load out 1,500 tonnes per day of metal more than was delivered in. This is therefore a reinforcement of the current minimum load out rates, which vary according the volume of metal held in a particular warehouse location, between 1,500 tonnes per day per operator for a volume up to 300,000 tonnes to 3,000tpd for a volume in excess of 900,000 tonnes.

Concretely, these proposed changes are not expected to have a drastic impact on the physical metals storing system. Firstly, we expect that these will lead to a growth in inventory levels in warehouses where queues currently do not exist, i.e. will prompt operators to move material from Detroit, Vlissingen, Antwerp, New Orleans and Johor to the other warehouses forming the global, vast LME warehousing network.

Secondly, there has been little discussion about another regulation issue: the load-out rates do not specifically target (with the exception of nickel and tin) metals by their nature, but only in general. In other words, an operator with a minimum load-out rate of 3,000tpd can choose if it will deliver aluminium or copper or zinc; or a mix of all the metals it holds, for instance. Therefore, we expect that copper and zinc in particular will remain stuck behind aluminium in the order of delivery, which should be the first metal to be loaded out given the high degree of scrutiny on this metal.

Thirdly, LME warehouses represent only a minor share of the global storing facilities, so new financial deals could be concluded in non-LME warehouses, especially since the contango is set to remain attractive, in particular for aluminium and zinc. This should increase the opacity of the system.

Also, the proposed changes should impact premiums mostly, as the physical market is set to ease – at least in the short term. However, the expected impact on prices should be minor as the inventory levels appear already priced.

Supply issues in Brazil could lead to a lower sugar surplus

Since mid-July 2012 sugar prices have been falling on fears of the forecast claiming a huge surplus in the 2013/2014 season as well as an increased output from Brazil.

However, after falling to 15.53 cents two weeks ago, a three-year low, since the beginning of the week the ICE sugar futures price blasted off to reach 16.92 cents a pound and tested the technical resistance level of 16.55. Suspecting a reversal in trend, investors substantially reduced their short positions. In raw sugar futures and options, speculators reduced their net short position by 20,667 contracts to 78,606 contracts.

Brazil being the biggest sugar producer and exporter, accounting for 22% of total world production in 2012/2013 season with 38.3m tonnes, the delay in harvesting prompted by the rains in Brazil’s central-south region was the main triggering event of this recent price rally. This adverse weather has caused concerns about the loss of sucrose in the cane, which can lead to a decrease in sugar output and accordingly to a tightening supply.

Furthermore frost formed last week in some sugar cane-, corn-, wheat-and coffee-growing regions of Brazil’s states of Parana, Mato Grosso do Sul and Santa Catarina. The frost can damage the plant during the flowering period leading to sinking yields, like we have seen in 2010/2011 season, and in the worst case can even provoke a need for replanting. Taking into account analysts’ forecasts of the cold weather extension, investors remain cautious.

The previous USDA’s forecast for the current 2013/2014 season in Brazil reached 40.4m tonnes of sugar output but given the deleterious weather it is currently being reviewed. As demand for sugar is expected to grow at a rapid pace this year, like last year, the surplus in the sugar market appears less important than initially expected, adding upside pressure on sugar prices.

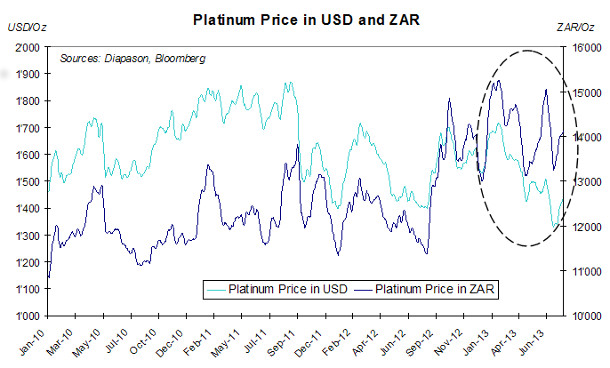

Chart of the week: Weakening Rand provides only a temporary relief for PGMs

|

Amid the severe supply issues PGM producers are currently facing, including elevated risks of labour tensions and threats of energy outages, the weakening of the South African Rand has provided some relief to miners’ margins. South Africa indeed produces 75% of mined platinum every year. On average, between 80% and 85% of producers’ costs are denominated in Rand, while their production (PGMs) is sold in US dollars. This means that producers must exchange their dollar sales into Rand in order to pay for the costs; so a fall in the Rand can significantly reduce the cost pressure of the industry. This is what has been happening in the past months, as the Rand has fallen by 17% since the start of the year. In other words, while the platinum price has fallen by 6% since the beginning of the year in dollar terms; it has increased by 8% in Rand terms. In regards to the PGMs cost curve, this is clearly a big help for producers. The average basket price for PGMs currently amounts to 11,000 Rand/oz approximately, above the average production cost (cash cost and sustaining Capex) of 9,500 Rand/oz, leaving just a couple of mines out of the money, given current FX rates. However, this relief is set to be only temporary. Indeed, there are two reasons explaining the weakening of the Rand: firstly, South Africa’s domestic issues (strikes and other labour issues) have had a major impact on the Rand’s devaluation. So in order to maintain the current FX rates, the domestic labour situation will have to worsen, or at least, not to improve — and this could prove particularly negative for PGM producers. Anglo Platinum for instance, expects its costs to rise by 10-12% this year. Secondly, the dollar could be at an inflexion point and could quickly weaken if, as we expect, US economic data fall below expectations and if, consequently, the US Fed delays the tapering of its QE program. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com